PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408446

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408446

Africa Satellite Imagery Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

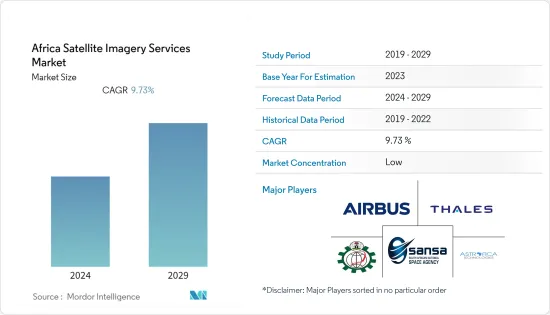

The Africa satellite imagery services market size is estimated at USD 0.04 billion in the last year and is expected to reach USD 0.07 billion by the year of the forecast period, registering a CAGR of 9.73%.

Key Highlights

- There has been a growing demand in the space sector in Africa in the past few years, led by the increasing investments by the country's government to bolster the space sector. Further, the expanding presence of global market vendors, the emergence of local satellite imagery services market vendors, and the growing launches of satellites to gather high-quality and high-resolution satellite images in the region are driving the satellite imagery services market.

- To address Africa's socio-economic challenges, incentivize private investments and promote innovative and sustainable projects. Establishing the African Space Agency and Combining space activities into Africa's Sustainability Development Plan will help coordinate measures and provide a framework for the industry's development. In addition, designing new services, apps, and geo-information solutions can address various issues, such as infrastructure monitoring and climate change.

- Collaborative innovation in big data, IoT, multimedia, apps, analytics, imagery, artificial intelligence, advanced communications, networks, blockchain, and crowdsourcing can rev the development of space-related technologies in Africa. Education and expertise ensure the industry has the skills and talent to succeed. If implemented effectively, these actions will position Africa as a crucial player in the space industry and contribute to its socio-economic growth.

- Despite the market growth, satellite imagery data investment and processing costs are high, particularly for high-resolution and specialized datasets. This can prevent small and medium-sized enterprises (SMEs) and specific industries from accessing and using satellite imagery services.

- Further, COVID-19 significantly impacted the African satellite imagery market. During the pre-pandemic stages, the market's supply chain slowed significantly, leading to the discontinuity of services. However, post-pandemic, the market is expected to witness substantial growth with technological advancements in satellites and satellite images, an increase in satellite launches, and the integration of advanced technologies.

Africa Satellite Imagery Services Market Trends

Natural Resource Management to Hold a Significant Market Share

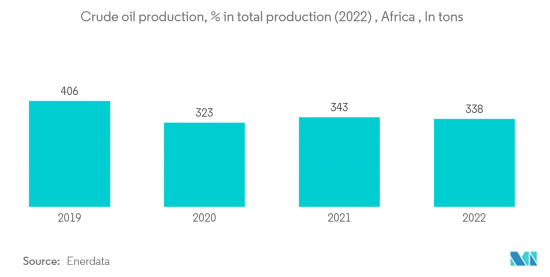

- The African countries are renowned for their abundant natural assets, including vast forests, agricultural lands, mineral deposits, and marine resources. Satellite imagery services play an essential role in efficiently and sustainably managing these resources, making them a significant driver in the market.

- Satellite imagery is crucial in mineral exploration, helping identify potential mining sites and conducting remote surveys. It assists in assessing environmental impacts, monitoring mining operations, and ensuring compliance with mining regulations.

- Further, in August 2023, Commercial satellite imagery made available through ESA's Third Party Missions program guides an ambitious community-focused initiative to regrow natural grasslands in Sub-Saharan Africa. Led by the non-profit foundation Justdiggit, this impressive project is revitalizing native ecosystems, boosting prosperity - and contributing to global climate action. Very high-resolution imagery gathered over a project site near the settlement of Rombo, Kenya, in Spring 2023 revealed substantial regrowth following a period of rainfall.

- Further, using satellite imagery services in natural resource management offers many opportunities for improving efficiency and sustainability. As satellite technology advancements and the ability to process and analyze the extensive amounts of satellite data generated by these systems improves, the potential for satellite imagery services to revolutionize how the country manages its natural resources will only continue to grow. Thus positively indicating the growth in demand for satellite imagery services in the coming years.

- The region's dependence on its natural resources for economic growth and sustainable development drives the demand for satellite imagery services to manage and preserve these valuable assets effectively. As African countries prioritize environmental conservation, resource efficiency, and disaster resilience, the need for satellite imagery services in Natural Resource Management is expected to remain a significant driver in the market.

Government Initiatives and Investments to Support the Market Growth

- The government of African countries has taken aggressive measures to develop its space industry, recognizing the immense potential of space technology and Earth observation capabilities. These initiatives have placed the region as a prominent player in the global satellite imagery services market, driving advancements in data analytics, satellite technology, and remote sensing applications.

- GeoAction Africa is a ground-breaking initiative by the World Geospatial Industry Council (WGIC) in collaboration with AGFUND, the Arab Gulf Development Programme. Its mission is to harness the power of geospatial technology to address the urgent challenges of climate change in Africa. Using advanced mapping techniques, satellite imagery, and remote sensing data, Geoaction is working towards creating a resilient and sustainable future for the continent. GeoAction Africa facilitates the research, documentation, and insights on the available commercial resources of geospatial data, services, tools, and solutions to help support African countries actively implement their national adaptation plans (NAPs).

- The government actively fosters partnerships and collaborations with international space agencies and private companies to expand its access to advanced satellite technology and data sources. These collaborations provide the UAE with valuable insights, knowledge exchange, and access to global space resources.

- Scientific and technological prowess is growing on the African continent in several fields of study and space-related research. This is evident by the number of space programs launched by different nations on the continent and a continental space agency under development. Despite their limited capabilities, technology development, such as miniaturization, has made it more affordable for emerging space nations to enter the space race.

- Africa is not commonly associated with space capabilities. Such a perception is misconstrued. The African Union is about to launch its continental space program, with several African countries already having space programs and some others being in the process of establishing such programs.

Africa Satellite Imagery Services Industry Overview

The African satellite imagery services market is characterized by moderate consolidation, with a limited number of major market vendors holding significant market shares. Market players in the region are actively engaging in partnership and acquisition activities to expand their market presence. Notable market vendors operating in the Africa satellite imagery services market include Airbus, Thales, L3Harris Corporation Inc., and Maxar Technologies, among others.

In April 2023, the nation of Kenya achieved a milestone by successfully launching its inaugural earth observation satellite into orbit. The Taifa-1 satellite from Africa was launched into space aboard SpaceX's Falcon 9 rocket. According to a joint statement issued by the Kenyan Defense Ministry and Kenya Space Agency, the primary purpose of the satellite is to provide valuable earth observation data that can be utilized in critical areas such as food security, agriculture, and environmental management. This achievement marks a pivotal moment in Kenya's scientific innovation journey, particularly in the context of addressing food security challenges. This accomplishment is of great significance, given that Kenya is currently grappling with its most severe drought in decades, coupled with five consecutive seasons of insufficient rainfall.

In October 2021, Satellogic, a prominent player in sub-meter resolution satellite imagery collection, announced a strategic collaboration with GeoTerraImage, the premier geospatial solutions provider in southern Africa. This partnership aims to leverage low-latency hyperspectral data and Satellogic's high-resolution multispectral satellite data for large-scale agribusiness management. The goal is to contribute to the continent's efforts in developing innovative food systems and enhancing food security solutions. This collaboration holds great promise for advancing agricultural practices and bolstering food security across the African continent.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Strategic Government Initiatives and Substantial Investments to Drive the Market Growth

- 5.1.2 Adoption of Big Data and Imagery Analytics

- 5.2 Market Restraints

- 5.2.1 Accessibility and Affordability might restrain the Market Growth

- 5.2.2 High-resolution Images Offered by Other Imaging Technologie

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Imagery Analytics

- 6.1.2 Video Analytics

- 6.2 By Deployment Mode

- 6.2.1 On Premise

- 6.2.2 Cloud

- 6.3 By Organization Size

- 6.3.1 SMEs

- 6.3.2 Large Enterprises

- 6.4 By Vericals

- 6.4.1 Insurance

- 6.4.2 Agriculture

- 6.4.3 Defense and Security

- 6.4.4 Environmental Monitoring

- 6.4.5 Engineeting & Construction

- 6.4.6 Government

- 6.4.7 Others

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Airbus

- 7.1.2 Thales

- 7.1.3 NASRDA (National Space Research and Development Agency)

- 7.1.4 SANSA (South African National Space Agency)

- 7.1.5 Astrofica

- 7.1.6 Ethiopian Space Science and Technology Institute (ESSTI)

- 7.1.7 Kenya Space Agency(KSA)

- 7.1.8 GeoApps Plus

- 7.1.9 GeoTerraImage

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS