PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408479

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408479

Australia Data Center Cooling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2030

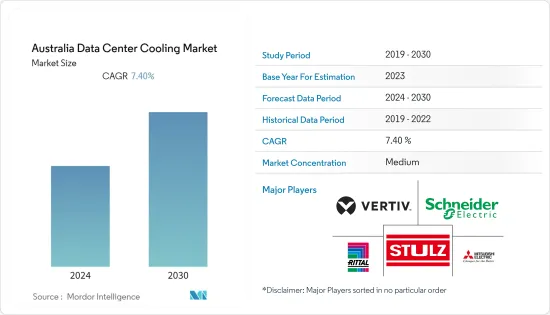

The Australia data center cooling market reached a value of USD 454.5 million in the previous year, and it is further projected to register a CAGR of 7.4% during the forecast period.

Key Highlights

- The increasing demand for cloud computing among SMEs, government regulations for local data security, and growing investment by domestic players are some of the major factors driving the demand for data centers in the country.

- The upcoming IT load capacity of the Australian data center market is expected to reach more than 3,000 MW by 2029. The country's construction of raised floor area is expected to increase above 11.4 million sq. ft by 2029.

- The country's total number of racks to be installed is expected to reach above 5,70,000 units by 2029. Melbourne, Perth, and Sydney are expected to house the maximum number of racks by 2029. Average annual temperatures observed in Australia from 1901 to 2021. In 2021, the average annual temperature observed in Australia reached 22.06 degrees Celsius. Depending upon climatic conditions, the DC cooling is processed in the DC facilities.

- There are close to 23 submarine cable systems connecting Australia, and many are under construction.

Australia Data Center Cooling Market Trends

Liquid-based Cooling is the Fastest Growing Segment

- Technological advances have made liquid cooling easier to maintain, more scalable, and more affordable, reducing data center liquid consumption by more than 15% in tropical climates and by 80% in greener areas. The energy used for liquid cooling can be recycled to heat buildings and water, and advanced artificial refrigerants can effectively reduce the carbon footprint of air conditioners.

- In March 2023, GreenSquareDC's WA1 hyperscale data center in Perth, Western Australia, will be Australia's only AI-ready data center capable of meeting the anticipated rapid deployment of LLM (Large Language Model)-based AI, making it the only Economical and sustainable. Designed to be AI-enabled and highly sustainable, GreenSquareDC's 96MW WA1 data center provides "ultimate flexibility" for customers to operate in air-cooled, chip-direct, or immersion-cooled environments.

- Liquid cooling takes advantage of the superior heat transfer properties of water or other liquids to support efficient and cost-effective cooling of high-density racks, up to 3000 times more effective than using air. Long proven in mainframe and gaming applications, liquid cooling is increasingly being used to protect rack servers in data centers across the region.

Direct liquid cooling solutions (DLC) can achieve partial power usage effectiveness (PUE) ranging from 1.02 to 1.03, surpassing the performance of even the most efficient air cooling systems by a margin of just a few percentage points. However, it's important to note that PUE does not account for a significant portion of the energy savings attributed to DLC.

- In traditional server setups, fans are utilized to dissipate heat, drawing power from the rack. As such, the control of these fans is typically factored into the IT power consumption section of the PUE calculation. These fans are considered part of the data center's overall payload, which encompasses all energy-consuming components and equipment within the facility.

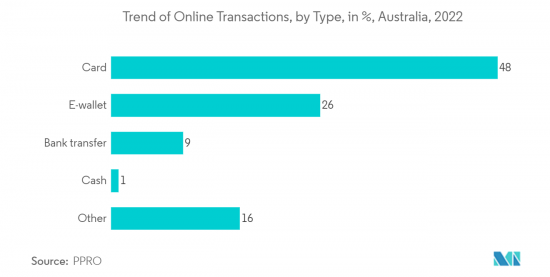

- Further, Australia is the eleventh largest market for e-commerce, with a revenue of USD 31.3 billion in 2021, placing it ahead of Russia and after Canada. With the expansion of e-commerce facilities and the increasing prevalence of digital payments, the market is expected to grow. In May 2021, Melbourne-based Little Birdie, an e-commerce startup, received an investment of AUD 30 million (USD 21.9 million) from the Commonwealth Bank of Australia in prelaunch funding to integrate its shopping content, including exclusive offers, into its consumer banking app, which reaches 11 million retail customers across Australia.

IT & Telecommunication is the Largest Segment

- The increasing adoption of advanced technologies such as artificial intelligence, cloud computing, big data, and the Internet of Things primarily drives ICT spending in Australian data analytics; rising widespread use of AI and automation and big data in various consumer industries is likely to have a significant impact on the Australian ICT market during the forecast period.

- In Australia, government initiatives such as the Australia Government Information Management Office (AGIMO) are leading the way in optimizing data center resources with the introduction of the Australia Government Data Centre Strategy 2010-2025. The strategy represents a transition from using government-run data centers to third-party, multi-tenant data centers.

- The need for public cloud services in Australia continued to grow in 2019, with 42% of businesses in the country reporting the use of cloud computing compared to 31% in 2015-16. Market vendors are rolling out enhanced product offerings curated for IT industry end users, which is also driving growth in this segment.

- Moreover, the Australian government's continued focus on the digital transformation of private and public services will positively drive market growth. Therefore, mobility, cloud computing, data and analytics, and digital storage will see high adoption rates over the next few years. All these factors will create growth opportunities and support the growth of the ICT market in this country.

- Additionally, the total number of Internet users in Australia is increasing. According to Hootsuite, the total percentage of active Internet users in Australia's population was about 91% in 2022, compared to about 89% in 2021. market during the forecast period.

Australia Data Center Cooling Industry Overview

The Australia data center cooling market is moderately competitive and has gained a competitive edge in recent years. Several major players, including Stulz GmbH, Schneider Electric SE, Vertiv Group Corp., Rittal GmbH & Co. KG, and Mitsubishi Electric Hydronics & IT Cooling Systems SpA, currently dominate the market.

In March 2023, STULZ, a Hamburg-based company specializing in mission-critical air conditioning, announced a significant advancement in its industry-leading CyberAir 3PRO DX series. Some units in this series are now compatible with the low-global-warming-potential (GWP) refrigerant R513A. This breakthrough development underscores the company's ongoing commitment to providing the most sustainable air conditioning systems for data centers. Furthermore, STULZ has expanded its product portfolio to incorporate R513A refrigerant in more of its offerings, reinforcing its dedication to eco-friendly solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Dynamics

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Volume of Digital Data

- 4.2.2 Emergence of Green Data Centers

- 4.3 Market Restraints

- 4.3.1 Costs, Adaptability Requirements, and Power Outages

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of COVID-19 Impact

5 MARKET SEGMENTATION

- 5.1 Cooling Technology

- 5.1.1 Air-based Cooling

- 5.1.2 Liquid-based Cooling

- 5.1.3 Evaporative Cooling

- 5.2 End-User

- 5.2.1 IT & Telecommunication

- 5.2.2 BFSI

- 5.2.3 Government

- 5.2.4 Media & Entertainment

- 5.2.5 Other End-Users

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Vertiv Group Corp.

- 6.1.2 Stulz GmbH

- 6.1.3 Schneider Electric SE

- 6.1.4 Rittal GmbH & Co. KG

- 6.1.5 Mitsubishi Australia Pty Limited

- 6.1.6 Asetek AS

- 6.1.7 Daikin Australia Pty Limited

- 6.1.8 Johnson Controls Inc.

- 6.1.9 Alfa Laval Corporate AB

- 6.1.10 Trane Technologies International Limited

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS