PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408487

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408487

Remote Integration Solutions - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

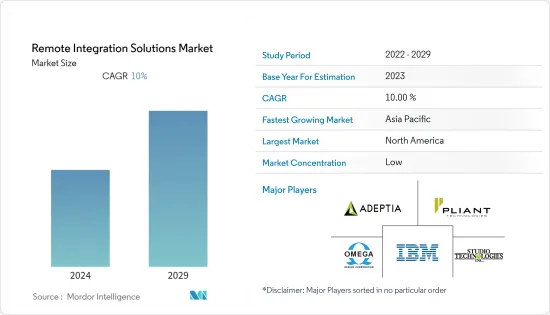

The remote integration solutions market is expected to register a CAGR of 10% during the forecast period.

Key Highlights

- The need to transform, analyze, monitor, and interpret all this data has become a preference to facilitate business processes as there is an exponential increase in the volume of data across enterprises. Additionally, due to the introduction of additional software, there is increasing complexity within the IT infrastructure.

- Hence, companies are incorporating enterprise application integration (EAI) systems to establish a cost-effective solution to change heterogeneous applications into a normal, recognizable platform to prevent this sophistication. Thus, companies combine media to link numerous enterprise systems with the web and wireless applications to facilitate the process. Hence, such characteristics are expected to drive the growth of remote integration solutions during the forecast period.

- There is a growing adoption of remote integration solutions for analytics and big data services as it helps to incorporate distributed IT systems with back-end techniques to examine the data in a centralized IT environment. Further, it helps interpret large volumes of data generated by companies, thereby delivering them with business insights.

- One of the critical issues in executing large-scale IT projects for remote integration solutions is experiencing technical faults and holds during integration. The primary reason for these technical faults and uncertainties is the intricacies involved in the scale of the organizational structure in large enterprises.

- Consequently, these technical glitches impede the efficiency of system implementation within large organizations, subsequently impacting their overall business performance. The measurement of key performance indicators (KPIs) has assumed paramount importance, making any delays a significant impediment to smooth business operations. Therefore, these factors are expected to pose challenges to the growth of remote integration solutions throughout the forecast period.

- During the COVID-19 pandemic, the global remote integration solutions market witnessed substantial growth due to the rise in the adoption of increased digitization and cloud services, leading to a new business environment resulting in the demand for automation services and solutions.

Remote Integration Solutions Market Trends

Large enterprise segment is expected to hold major share of the market

- Integration is the process of enabling communication between disparate software components. Integration has been a burning issue for large enterprises in the last twenty years since 70% of the deployment and development budget is spent on integrating complicated and heterogeneous back-end and front-end IT systems. Integrating existing applications is needed to support newer, faster, more accurate business processes and provide meaningful, consistent management information.

- Historically, integration started with point-to-point approaches, evolving into simpler hub-and-spoke topologies. These topologies were connected with custom remote process calls, message-oriented middleware (MOM), and distributed object technologies, continued with enterprise application integration (EAI), and used an application server as an immediate vehicle for integration.

- The present phase of the development is service-oriented architecture (SOA) integrated with an industry service bus (ESB). As mentioned, the technical elements of comparing the technologies are analyzed and presented. The result of the study is the guided integration strategy for large enterprises.

North America to hold the Significant share

- As enterprises upgrade their IT infrastructure to gain more suitable operational efficiency and a competitive advantage in the market, the region has an effective remote integration solution during the forecast period. Furthermore, factors such as the rising need for cloud computing, which plays a vital role in the easy adoption and integration of multiple IT infrastructures and service platforms, immensely contribute to the growth of the enterprise application services market in the region.

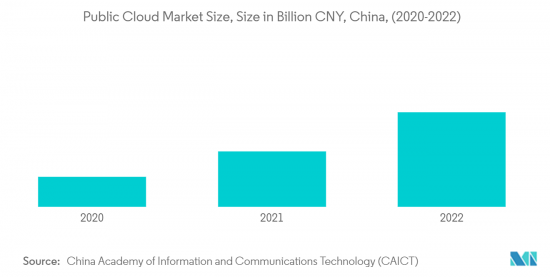

- Also, a growing adoption of customer relationship management (CRM) via the cloud has become significant among organizations that mostly prefer the hybrid model, a combination of the on-premises and public cloud models, to meet their enterprise needs. Hence, such aspects are anticipated to drive the region's growth of remote integration solutions.

- In July 2023, Vislink Technologies, Inc., a global technology leader in the delivery, capture, and management of high-quality, live video and associated data in the media and entertainment, defense markets, and law enforcement, announced the availability of its LinkMatrix remote control management platform on Amazon Web Services (AWS). LinkMatrix allows for comprehensive management of its live broadcast devices. The integration with AWS delivers users improved control, speed, and flexibility, elevating production workflows and facilitating innovation in live broadcasts and performance in the field.

- Remote integrated services have been widely adopted in North America across various industries, including manufacturing, IT, and healthcare. The North American market led to the adoption of cutting-edge technical innovations, such as blending mobile, cloud, and artificial intelligence (AI) technologies into a traditional integrated service. The unusually high Internet penetration in North American nations is one of the leading causes. There, it is anticipated that company usage of services will increase even further. It is important to remember that service providers who focus on client involvement should expect to benefit more from the recurring revenue model.

Remote Integration Solutions Industry Overview

Competitive rivalry in the remote integration solutions market remains low, with several key players dominating the landscape. Prominent companies in this sector include IBM Corporation, Omega Design Corporation, Studio Technologies Inc., Adeptia Inc., and many others. These industry leaders have established a strong foothold and are well-positioned to maintain a competitive edge through continuous product innovation and a keen focus on anticipating consumer needs. They have achieved this by making substantial investments in research and development, engaging in strategic mergers and acquisitions, and forming valuable partnerships, all of which have contributed to their substantial market share.

In September 2023, Boomi, a renowned leader in intelligent connectivity and automation, announced a strategic partnership with Sazae Japan, a prominent digital transformation consulting service provider. Boomi's partnership with Sazae Japan marks a significant milestone as it becomes the first integration platform as a service (iPaaS) partner for Sazae in Japan. With the growing demand for cloud computing among Japanese businesses, iPaaS solutions have garnered increased attention for achieving seamless system integration in the cloud. Initially, this partnership will focus on assisting Sazae Japan's customers in integrating content management systems, including popular platforms like ServiceNow and Drupal.

In August 2023, the Royal Flying Doctor Service (RFDS), a prominent provider of rural and remote health services in Australia, unveiled a nationwide electronic health record (EHR) system powered by Oracle autonomous database, operating on Oracle cloud infrastructure (OCI). This transformational move aims to streamline the collection and analysis of clinical information, facilitating quicker and more informed decision-making by medical personnel. By migrating to the cloud, RFDS has achieved a notable reduction in administrative workloads and a nearly 20 percent reduction in data management costs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid implementation of big data and analytics integration services

- 5.1.2 Surge in need for live streaming of sporting events by sports fans is anticipated to fuel the need for remote integration solutions

- 5.2 Market Restraints

- 5.2.1 High cost of bandwidth to connect differing broadcasting locations

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Sports

- 6.1.2 Broadcast

- 6.1.3 Government

- 6.1.4 Healthcare

- 6.2 By Type

- 6.2.1 Large Enterprise

- 6.2.2 SME

- 6.3 By Products

- 6.3.1 Transmitters

- 6.3.2 Switches

- 6.3.3 Decoders

- 6.3.4 Accessories

- 6.3.5 Receivers

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Africa & Middle East

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Adeptia Inc.

- 7.1.2 Accelerated Media Technologies Inc.

- 7.1.3 IBM Corporation

- 7.1.4 Microsoft Corporation

- 7.1.5 Omega Design Corporation

- 7.1.6 Calrec Audio Ltd

- 7.1.7 Oracle Corporation

- 7.1.8 Salesforce

- 7.1.9 Pliant Technologies

- 7.1.10 Grass Valley

- 7.1.11 Net Insight AB

- 7.1.12 VidOvation

- 7.1.13 Nevion

- 7.1.14 Studio Technologies Inc.

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS