PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408559

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408559

Aviation Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

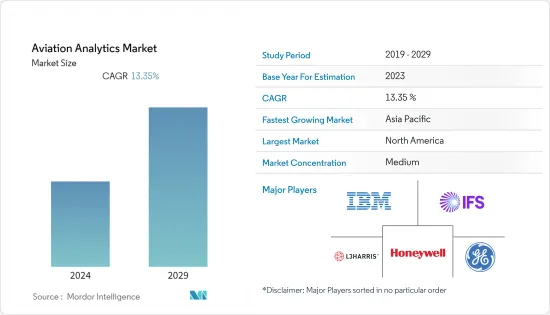

The Aviation Analytics Market is valued at USD 3.65 billion in 2024 and is expected to grow to USD 6.82 billion by 2029, registering a CAGR of 13.35% during the forecast period (2024-2029).

Data analytics plays a critical role in the airline industry as it provides valuable benefits such as improved efficiency, enhanced customer experience, increased security, and reduced costs. The increasing demand for optimized business operations is one of the major factors driving the market for aviation analytics. The market growth is also attributed to the rising adoption of advanced analytics solutions across business functions in the aviation industry. Airlines are widely adopting analytics for various aspects of airline operation management. For instance, airlines use analytics with built-in machine learning algorithms to collect and analyze flight data regarding each route's distance and altitude, aircraft type and weight, weather, etc. Based on the findings, systems estimate the optimal amount of fuel needed for a flight. Additionally, an increase in focus on digitalizing airport operations and reducing human interference is also creating opportunities for the aviation analytics market. However, a lack of expertise in integrating conventional devices with modern technology will restrain the growth of the market in the forecast years.

Aviation Analytics Market Trends

Airlines Segment to Witness Highest Growth During the Forecast Period

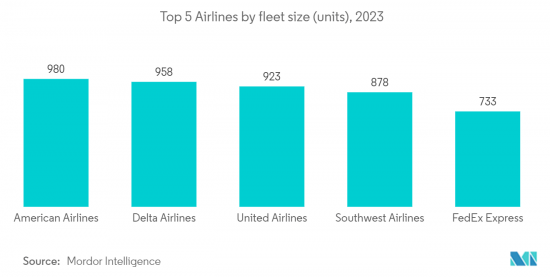

To meet the needs of rising passenger traffic, airlines globally are expanding and modernizing their existing fleet. For instance, in November 2022, Ethiopian Airlines Group announced to increase their fleet size from 140 (currently) to 271 aircraft by 2035. To achieve this, the airline is considering the addition of at least 130 aircraft, with the replacement of older aircraft as well. Similarly, in June 2023, Wizz Air also announced its plans to expand its fleet to over 200 aircraft by the end of 2024. The company aspires to build a fleet of over 500 aircraft by 2030. In September 2021, United Airlines placed an order for 270 single-aisle Boeing and Airbus planes to increase the number of planes in its fleet and their average size. Thus, an increase in fleet size will create a simultaneous demand for aviation analytics for multiple applications such as fleet management, fuel management, revenue management, etc.

Airlines are increasingly adopting the use of analytics for their business operations. In this regard, in May 2022, American Airlines and Microsoft Corporation partnered to use technology to create better, more connected experiences for customers and American Airlines team members. As a part of the partnership, American Airlines will use Microsoft Azure as its preferred cloud platform for its airline applications and key workloads.

Asia-Pacific to Demonstrate Rapid Growht During the Forecast Period

Asia-Pacific is expected to showcase the highest growth during the forecast period. As per IATA, airlines in Asia-Pacific saw a 105.8% increase in July 2023 traffic compared to July 2022, continuing to lead the regions. To cope with the rising traffic, airlines in the region are placing new aircraft orders. In June 2023, it was announced by the MRO Associations of India that Indian airlines are poised to expand their fleet capacity by 15% annually, with an addition of 100 to 110 aircraft per year, leading to close to 1,200 aircraft by 2027. Air India's fleet will grow by 50 narrowbody and 19 widebody aircraft by 2024 as it aggressively inducts new planes to meet immediate demand. Likewise, in April 2023, China Airlines placed an order for eight Boeing B787 aircraft. An increase in fleet size demands the use of aviation analytics to streamline operations and fleet management challenges. Also, there are instances of airlines in the region adopting aviation analytics for their businesses. In June 2023, Collins Aerospace, an RTX business, and Japan Airlines (JAL) announced that JAL would use Collins Aerospace's Ascentia maintenance performance monitoring solution on its Boeing B787 fleet. Availability of skilled labor and workspace in countries of Asia-Pacific are additional factors driving the aviation analytics market in the region.

Aviation Analytics Industry Overview

The aviation analytics market is consolidated with prominent players owning the major percentage of market shares, such as IBM Corporation, IFS, Honeywell International Inc., L3Harris Technologies, Inc., and GE Digital (General Electric Company). The intensity of rivalry is high among them, mostly for obtaining long-term contracts with big players in the aviation industry. These players offer a wide range of aviation analytics solutions that focus on functions including wealth management and sales & marketing, among others. Various growth strategies such as contracts, acquisitions, expansions, new product launches, and partnerships & agreements are being adopted by the leading players to further expand their presence in the aviation analytics market. For instance, in December 2021, TAP Air Portugal and Lufthansa Technik AG agreed that AVIATAR would provide digital support for the airline's complete Airbus fleet. TAP Air Portugal will leverage AVIATAR products, including condition monitoring, event analytics, and fleet maps, to digitally optimize its aircraft operations and realize cost savings.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 End User

- 5.1.1 Airlines

- 5.1.2 Airports

- 5.2 Business Function

- 5.2.1 Sales & Marketing

- 5.2.2 Finance

- 5.2.3 MRO Opertions

- 5.2.4 Supply Chain

- 5.3 Application

- 5.3.1 Risk Management

- 5.3.2 Inventory Management

- 5.3.3 Fuel Management

- 5.3.4 Revenue Management

- 5.3.5 Customer Analytics

- 5.3.6 Others

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.4.1 Brazil

- 5.4.4.2 Rest of Latin America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 South Africa

- 5.4.5.4 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 LexisNexis Risk Solutions

- 6.2.2 GE Digital (General Electric Company)

- 6.2.3 Collins Aerospace

- 6.2.4 Honeywell International Inc.

- 6.2.5 L3Harris Technologies, Inc.

- 6.2.6 IBM Corporation

- 6.2.7 IFS

- 6.2.8 The Boeing Company

- 6.2.9 IGT Solutions Pvt. Ltd.

- 6.2.10 OAG Aviation Worldwide Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS