PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408578

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408578

Electronic Shift Operations Management Solutions - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

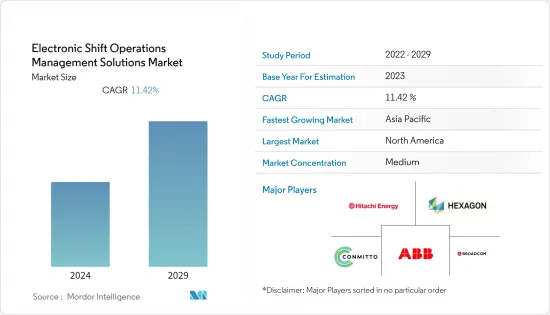

The electronic shift operations management Solutions Market was valued at USD 7.57 billion in the previous year and is expected to grow at a CAGR of 11.42%, reaching USD 13.01 billion by the next five years.

Key Highlights

- An electronic shift operations management solution (eSOMS) is an integrated software that achieves critical functions by automating and integrating the factory's essential processes, such as power generation and manufacturing. Electronic shift operations management solution comes with highly efficient modular designs that allow for maximum flexibility while automating and integrating all major processes in industries.

- Growing demand for transformation technologies to improve customer experiences, business agility, and employee engagement in industry verticals is driving the demand for Electronic Shift Operations Management Solutions. The rise of digital transformation has steered a radical shift in how businesses harness customer insights, technology capabilities, and research and development to drive revenue growth.

- The expansion of industrial sites worldwide is increasing the demand for efficient data collection tools for managing crucial human procedures like shift handover and capturing the events of the day or shift. As the conventional data logging methods are not integrated with industrial software, eSOMS simplifies operations by organizing routine maintenance operations and data in a single electronic suite.

- Inefficient shift handover processes have caused fatal incidents, requiring constant and precise data. To fix these challenges, there is a rising adoption of electronic shift operations management Solutions to offer an efficient operations management solution with enterprise scalability.

- High-end eSOMS solutions can achieve consistent, safe, and fully informed shift handovers, enhance communication, and minimize the risk of dangerous incidents. The software solution is designed to record, track, and manage events within various departments in industrial setups. eSOMS contains a continuous stream of work instructions and ensures the productive completion of tasks.

- With the outbreak of COVID-19, electronic shift operation management solutions had been increasingly deployed by organizations to ensure a safe, efficient, and reliable operation and maintenance of mission-critical facilities with minimum investment. The need for a consistent, organized, and integrated approach to activities in critical industries, including military, nuclear power, chemical production, and others, had increased the deployment of eSOMS post-pandemic. For instance, ABB had deployed its Ability Asset Suite eSOMS to simplify operations in data centers.

Electronic Shift Operations Management Solutions Market Trends

Chemicals industry to witness significant growth

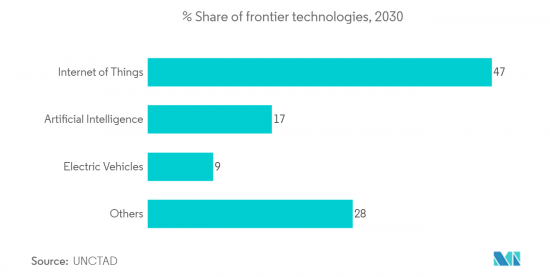

- The world is witnessing rapid growth in the fourth Industrial revolution that combines innovative technologies in production processes and industrial operations, driving the demand for electronic shift operations management Solutions (eSOMS). The rise of frontier technologies such as the Internet of Things, artificial intelligence, robotics, electric vehicles, and additive manufacturing adds to the growing demand of the global eSOMS market. Chemical materials and components are crucial throughout the entire production process across a wide range of industries. Therefore, operational efficiency in chemical facilities is important.

- Chemical facilities utilize multiple management systems, such as plant control systems, information management systems for recording and managing operational conditions, and systems for managing product quality. This has increased the demand for eSOMS owing to its advantages over traditional methods wherein plant operators use handwritten notes to share information and to give instructions on operations. eSOMS enables integrated management by digitizing all critical plat information, operator task instructions, task logs, and workflow information.

- Electronic shift Operations Management System in the chemicals sector helps to ensure safe, reliable, and efficient plant operations and regulatory compliance through standardized work practices and streamlined processes. For instance, Yokogawa Electric Corporation's Operations Management system is a centralized platform that standardizes and digitizes plant operations information to provide intelligent recommendations. Its workflow-based execution helps to automate tasks, permits, and changes effectively through approval lifecycle and email alerts.

- Innovapptive's Mobile Operator Rounds solutions replace paper-based processes with mobile and wearable technology. The solution checks that data collected on non-instrumented plant assets, critical environmental and safety inspections are performed on schedule and operators have the information at their fingertips.

- ABB offers chemical manufacturing operations management software that includes data across all ABB ability manufacturing operations management (MOM) Applications and external data sources hosted by MOM data services.

- According to the India Brand Equity Foundation, the government of India has introduced a production-linked incentive (PLI) scheme to facilitate the domestic manufacturing of agrochemicals. The demand for specialty chemicals, which constitute 22% of India's total chemicals and petrochemicals market, increased significantly in the previous year.

- The Indian government allocated USD 20.93 million under the Union Budget 2023-24 to the Department of Chemicals and Petrochemicals. Such initiatives will accelerate the demand for electronic shift operation management systems to effectively manage an operations manager's efforts with continuous, real-time data to optimize workflows.

Asia-Pacific is Expected to Grow at a Significant Rate

- Asia-Pacific is registering an increasing demand for configurability and scalability across industry verticals. Electronic shift operation management facilitates the supervision of employee and personnel attendance. With the growing scalability in industry verticals, eSOMS helps prevent issues like understaffing, overstaffing, and time wastage.

- The Asia-Pacific region is observing a significant investment in industrial automation and smart factories, which is likely to boost the demand for eSOMS during the forecast period. Singapore is the leader in advanced manufacturing technologies. According to the Wisconsin Economic Development Corporation, Singapore recently announced Manufacturing 2030, a 10-year roadmap aiming to grow the manufacturing sector by 50%.

- Last year, Hyundai Motor Group signed an agreement with JTC. This government agency oversees industrial progress in Singapore to collaborate on transportation and logistics for Singapore's next-generation industrial parks. Malaysia also plans to increase industrial productivity by 30% by this decade, and Thailand's government launched Thailand 4.0, a 20-year national development plan to transition into an innovation-driven economy.

- Vendors in the Asia Pacific region are embracing new ways of achieving automation across industrial setups with advanced industrial software solutions. ABB and Hitachi Energy Ltd are some of the major providers of eSOMS in the Asia Pacific. New tools are being developed much faster than ever in collaboration with ecosystem players.

- Vendors across the Asia Pacific are providing eSOMS software that schedules shifts to rotate automatically according to the company's structure. With the advent of intelligent factories, manufacturers are devoting significant investments, as much as 30%, to smart factories. Countries such as China and Japan are among the early adopters of intelligent factories, followed by South Korea.

- With the rise of numerous small and medium organizations in countries such as India and China, eSOMS solutions are rapidly being adopted to maximize efficiency, increase productivity, and increase profits while reducing costs. The ability of eSOMS to ensure the delivery of high-quality services that suit consumers' necessities is driving the market demand.

Electronic Shift Operations Management Solutions Industry Overview

The electronic shift operations management solutions market is characterized by fragmentation due to the presence of numerous companies. Key players in this market, including ABB, Hitachi Energy Ltd, Hexagon AB, Conmitto, Inc., and Broadcom, among others, are continually introducing innovative products and forging partnerships and collaborations to gain a competitive edge.

In July 2023, Fujitsu established a partnership with Microsoft as a Cloud for Manufacturing partner and introduced its Digital Factory solution on Microsoft's commercial marketplace. Fujitsu's platform is designed to optimize enterprise operations and enhance availability, performance, and quality for customers in the manufacturing sector. This solution aligns all processes with end-to-end business value chains, addressing challenges such as a shortage of skilled craftsmen and enabling labor at manufacturing sites. Manufacturers are leveraging Fujitsu's manufacturing management solutions as a foundation to enhance manufacturing processes and boost productivity.

In March 2023, ENEOS Materials Corporation and Yokogawa Electric Corporation collaborated to implement a reinforcement learning-based AI algorithm known as Factorial Kernel Dynamic Policy Programming (FKDPP) for use at an ENEOS Materials chemical plant. This autonomous control system ensures a high level of performance while managing a distillation column at the plant, marking the first formal adoption of reinforcement learning AI for direct plant control. These two companies are strategically working together to explore innovative approaches for carrying out digital transformation through AI for plant management and condition-based plant maintenance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Macro-economic factor and its Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing demand for automation and integration across mission-critical industrial applications

- 5.1.2 Rising demand across the energy and utilities sector

- 5.2 Market Restraints

- 5.2.1 High cost of initial installation

- 5.2.2 Lack of skilled technical expertise

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Limited Condition of Operation (LCO) Tracking

- 6.1.2 Administration

- 6.1.3 Tracking and Control

- 6.1.4 Personnel, Qualification & Scheduling

- 6.1.5 Other Applications

- 6.2 By End-User

- 6.2.1 Chemicals

- 6.2.2 Oil and gas

- 6.2.3 Military

- 6.2.4 Automotive

- 6.2.5 Energy and Utilities

- 6.2.6 Other End-Users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Conmitto, Inc.

- 7.1.2 Globorise Technologies LLC

- 7.1.3 ABB

- 7.1.4 Hitachi Energy Ltd

- 7.1.5 Trinoor.com

- 7.1.6 Hexagon AB

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS