PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408588

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408588

India InFlight Catering - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

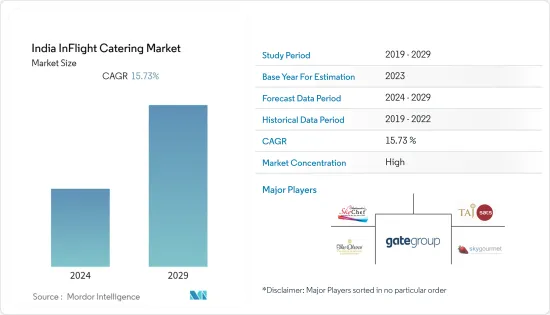

The Indian inflight catering market size is expected to grow from USD 184.46 million in 2024 to USD 382.9 million by 2029, witnessing a CAGR of 15.73% during the forecast period.

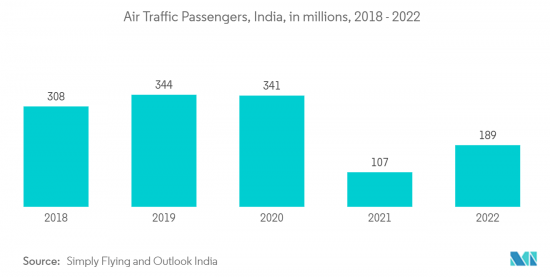

The COVID-19 pandemic resulted in the governments of several countries imposing travel restrictions and lockdown measures, which affected the business travel and tourism sectors in India. According to the International Air Transport Association (IATA), domestic air travel in India crossed 85% of the pre-pandemic level as the aviation industry recovered globally. According to IATA, India's air travel reached 85.7% of 2019 levels in 2022.

The rising emphasis on customer-centric food menus is currently driving the Indian inflight catering market, as most airlines are adding new items to their menus to provide better quality food to passengers by keeping their preferences in mind. With the increasing air travel, the induction of new destinations and new long-haul flights may create future opportunities for the Indian inflight catering market.

India InFlight Catering Market Trends

Low Cost Carriers are Expected to Show Remarkable Growth During the Forecast Period

There has been significant growth with respect to low-cost carriers in India in recent times. The growth in air passenger traffic in India, coupled with various airline companies looking to acquire newer aircraft in order to increase their fleet size, will be the major factors contributing to growth in the market. The Indian aviation industry has witnessed growth in terms of the number of low-cost carriers. Today, the LCC segment has operators such as Go Air, Spice Jet, AIX Connect, and INDIGO, which account for a major share of the Indian aviation industry.

However, various LCCs in the Indian aviation industry do not include inflight catering in order to minimize ticket prices. For instance, in November 2021, Air Asia India, now renamed AIX Connect, announced the resumption of inflight food and beverage service across all its routes. Passengers may pre-book their meals from a wide range of vegetarian, non-vegetarian, and vegan hot meals and sandwiches or purchase light bites, hot and cold beverages, and ready-to-eat meals inflight on long-haul flights above 75 minutes. For short-haul flights under 75 minutes, guests may choose from a wide range of snacks, ready-to-eat meals, and sandwiches. The airline offers a wide range of options, including meals specially curated by MasterChefs. Moreover, The airline offers vegan, eggetarian, pescatarian, non-vegetarian, and Jain meal options, as well as other delectable desserts. AirAsia India's inflight meals are catered by TajSATSAir Catering. In addition, each meal is prepared with the highest standards of hygiene and quality. In the current scenario, TajSATS has established itself as India's premier aviation catering company and the first service partner of choice for the world's leading airlines.

Thus, with an increase in the number of air traffic passengers' various low-cost carriers in India, such as Indigo, have started to provide snacks that are not complimentary but can be purchased onboard the aircraft. This shall lead to a positive outlook in the growth of non-complimentary in-flight catering options for the Indian LCCs in the near future.

The Meals Segment is Projected to Grow at a Rapid Pace During the Forecast Period

There has been a rise in the changes regarding meal preferences in India in recent times. Indian passengers now prefer rice and meals over bakery and confectionary items, unlike air passengers in European and North American countries. The inflight dinners for most airlines in India include meat, a salad or vegetable, a small roll, and a dessert. During morning flights, a cooked breakfast or lighter continental-style meal may be an option. Moreover, the growth of the vegan and vegetarian population is increasing rapidly in India due to factors such as religion, altruism, environmental concerns, etc. The trend of growing vegetarianism has increased the demand for vegan or vegetarian meals on board Indian aircraft.

Moreover, the growth of health-conscious people has resulted in the growing popularity of gluten-free meals and low-salt meals, as they are becoming the major food offerings under the special meals for airlines. On the other hand, various Indian inflight caterers have now started to provide onboard snacks on airlines. In addition, caterers are also offering vegan, eggetarian, pescatarian, non-vegetarian, and Jain meal options and other delectable desserts as part of their menu.

In the present scenario, airline companies in India are now remapping the way meals are served onboard their aircraft. In April 2023, Air India announced that they had completely remapped the way they serve meals on board the aircraft. Air India, in the present scenario, has partnered with Ambassadors Sky Chef to provide meals onboard their flight. The inflight caterer announced that they will now be focused on serving Indian 'Ghar ka Khana' in the flight with some unique fusion culinary touches, elevating the in-flight dining experience of Air India passengers. Air India, in order to transform their inflight catering experience, announced an all-new in-flight menu for domestic flights in October 2022. In April 2023, the new menu was expanded to its international flights as well. Thus, the changing tastes and preferences of Indian passengers will lead to inflight caterers upgrading their offerings, and this is expected to lead to a positive outlook and market growth during the forecast period.

India InFlight Catering Industry Overview

The market is consolidated in nature, with the presence of a few players holding significant shares. Some of the key players are TajSATSAir Catering Limited, Gate Group, Ambassador's Sky Chef, SkyGourmet Catering Private Limited, and Oberoi Flight Service (Oberoi Group). These companies hold a significant market share in the Indian inflight catering market.

Companies in the market are trying their best to extend their presence in the market by gaining new contracts or by extending their existing contracts. In November 2021, the inflight catering services provider SATS was in the process of setting up the first central kitchen in India at Bengaluru, at a total investment of nearly INR 210 crore (USD 27 million). It is planning to open three more large-scale central kitchens. It is exploring sites in northern and western India for its next facility. Such new investments and developments by key players are going to drive growth in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Aircraft Class

- 5.1.1 Economy Class

- 5.1.2 Business Class

- 5.1.3 First Class

- 5.2 By Flight Service Type

- 5.2.1 Full Service Carriers

- 5.2.2 Low-cost Carriers

- 5.2.3 Hybrid and Other Flight Service Types

- 5.3 By Food Type

- 5.3.1 Meals

- 5.3.2 Bakery and Confectionery

- 5.3.3 Beverages

- 5.3.4 Other Food Types

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share**

- 6.2 Company Profiles

- 6.2.1 TajSATS Air Catering Limited

- 6.2.2 Gate Group

- 6.2.3 Ambassador's Sky Chef

- 6.2.4 Casino Air Caterers & Flight Services

- 6.2.5 Skygourmet Catering Private Limited

- 6.2.6 Oberoi Flight Services (Oberoi Group)

- 6.2.7 Muthoot Skychef (Muthoot Finance Ltd)

- 6.2.8 Lufthansa Flight Kitchen (Deutsche Lufthansa AG)

- 6.2.9 Uday Sky Kitchen (USK)

- 6.2.10 Lulu Flight Kitchen Private Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS