PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408735

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408735

United States IT Outsourcing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

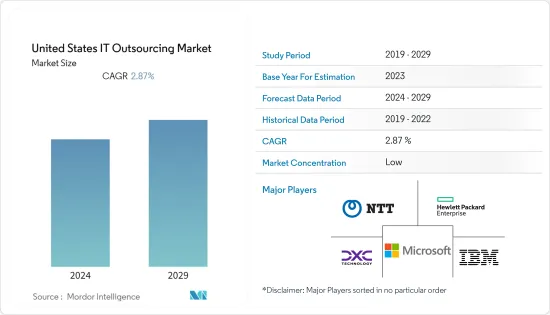

The United States IT Outsourcing Market was valued at USD 164.07 billion in the previous year and is expected to grow at a CAGR of 2.87%, reaching USD 196.81 billion over the forecast period.

The significant drivers for the market growth include a growing emphasis on leveraging the core competencies by outsourcing non-core operations, increasing focus by organizations on IT as a means to gain differentiation by relying on outsourced vendors, and ongoing migration toward the cloud and adoption of virtualized infrastructure. As a result of digital transformation, organizations depend on the performance of creative applications and extensions that IT services can provide.

Key Highlights

- Cloud migration and adoption software have led outsourcing customers to divert resources from low-value assets to specialized employees while focusing on more flexible, tailorable, and evolution-friendly solutions. Other trends favoring cloud migration and opting for cloud services have been fueled by a rapid shift to remote work, which led organizations to adjust their infrastructure and software to connect workers.

- As a result, increasing demand for the outsourcing of cloud services displays that enterprises are becoming increasingly comfortable with using platforms from private sources to store their data. Also, businesses operating over the cloud will likely be disturbed by security threats and will look to eradicate all possible threats by outsourcing IT security services. Therefore, the requirement for expert knowledge of the vendor will be required, along with a simple delegation of responsibilities.

- According to the Bureau of Labor Statistics, employment growth in the United States is likely to upsurge by 31% by 2026. Additionally, about 255,400 IT jobs are expected to be opened in this time frame. Therefore, the growing IT job openings are set to contribute to IT outsourcing in the country.

- The fragmented nature of the market and the growing incidence of data breaches are potential market restraints in the United States IT outsourcing landscape. The landscape of service providers is complex and sometimes fragmented for businesses looking to outsource their IT operations. Businesses are also expected to contend with the need to protect sensitive data in an environment where cybersecurity is becoming increasingly risky. Addressing these restraints requires careful selection of outsourcing partners, rigorous security measures, and a proactive data protection and compliance approach.

- The rising adoption of cloud services since the outbreak of COVID-19 is anticipated to build a favorable market scenario for IT outsourcing market's growth, as organizations using such services often outsource the maintenance and portion of development work to third parties.

United States IT Outsourcing Market Trends

Ongoing Migration Toward Cloud and the Adoption of Virtualized Infrastructure to Drive the Market

- A significant driver behind the migration toward the cloud is the adoption of a "cloud-first" strategy by an increasing number of organizations. Cloud computing offers unparalleled scalability, flexibility, and cost-efficiency. Companies are recognizing the strategic advantages of leveraging cloud services for their IT needs increasingly. This approach enables businesses to access and utilize IT resources on a pay-as-you-go basis, reducing capital expenditure and allowing for rapid deployment of applications and services.

- Concurrently, the adoption of virtualized infrastructure has gained momentum. Virtualization technologies enable organizations to optimize their hardware resources by running multiple virtual machines on a single physical server. This enhances resource utilization, streamlines IT management, reduces hardware costs, and contributes to environmental sustainability.

- Cost optimization is a driving force behind this trend. Cloud-based services and virtualization technologies offer cost-effective alternatives to traditional IT infrastructure. Companies can reduce their capital expenditures on hardware and data centers while benefiting from reduced operational costs through efficient resource allocation.

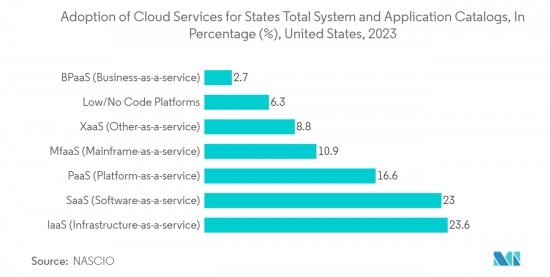

- Moreover, according to the National Association of State Chief Information Officers (NASCIO) report, hybrid and multi-cloud settings have become already standard when it comes to moving to the cloud. Infrastructure as a Service (IaaS) and Software as a Service (SaaS) models are used in around 23% to 24% of the state's overall system and application catalogs. It confirms that hybrid and multi-cloud setups have become normal in IT infrastructure, reflecting the ongoing migration to the cloud.

- In addition, the report states that 30% of respondents completed a cloud strategy or roadmap, while 70% are actively developing strategies, demonstrating that organizations are strategically planning their cloud migration journeys. This aligns with the driver of organizations actively migrating toward the cloud. Further, around 60% of organizations have incorporated cloud adoption into their enterprise IT governance processes, indicating that cloud adoption is a strategic decision with governance structures in place. Such adoption rates of cloud services across organizations are significant factors responsible for market growth.

- In conclusion, the ongoing migration toward the cloud and the adoption of virtualized infrastructure represent a significant market driver in the United States IT Outsourcing market. This transformational trend enables organizations to have enhanced agility, cost optimization, scalability, and innovation capabilities. As businesses continue to leverage cloud services and virtualization technologies, they are expected to drive the complex IT landscape and focus on their core business objectives while relying on trusted IT outsourcing partners to manage their evolving infrastructure needs.

Healthcare Industry to Witness Major Growth

- The healthcare sector in the United States is at the forefront of adopting advanced technologies, such as AI, ML, IoT, etc., to enhance patient care and boost the quality of healthcare services. Hospitals, medical facilities, and physician offices have implemented new technologies to respond to a changing regulatory environment, improve patient care quality, and stay competitive. Technology enablement, agility, scalability, and innovation are the key trends in the country's healthcare sector that are driving the demand for IT outsourcing by the country's healthcare organizations. Moreover, the growing health expenditure is expected to increase the market demand.

- Further, the convergence between IT services and medical fields reflects the emergence of seamlessly connected sensors and devices that can improve healthcare services and an expectation-improved IoT utilization in healthcare. The adoption of the IoT in the country's healthcare sector and growing demands to support M2M and M2H communication can be attributed to advanced medical equipment, thereby driving the application of IT outsourcing during the forecast period.

- Healthcare organizations in the country, primarily large enterprises, are significantly adopting cloud solutions for innovation and efficiencies and providing the foundation for deploying new technologies like analytics, machine learning, and artificial intelligence (AI). Healthcare organizations and medical facilities across the country are rapidly migrating their infrastructure to the cloud to stay agile and competitive while enhancing the delivery of healthcare services. This is anticipated to be a significant driver for the adoption of IT outsourcing services in the country's healthcare sector.

- Overall, the demand for IT outsourcing in the country's healthcare sector is anticipated to be driven by the need for digital transformation, compliance, a rise in the use of e-health services, and the adoption of emerging technologies to facilitate customer service, delivering high-quality patient care.

United States IT Outsourcing Industry Overview

The United States IT Outsourcing Market is competitive. A few players dominate the market landscape by implementing various strategies to gain significant market shares, including NTT Corporation, DXC Technology Company, Microsoft Corporation, Hewlett Packard Enterprise Company, and IBM Corporation.

- June 2023 - DXC Technology announced that it strengthened its strategic managed service provider (MSP) partnership with Oracle to offer innovative application services supported by Oracle Cloud Infrastructure (OCI). This aligns with the broader goals of organizations engaging in IT outsourcing, often improving efficiency, embracing digital transformation, and enhancing competitiveness.

- April 2023 - Microsoft Corp. and Epic, a United States-based healthcare software company, announced the expansion of their long-standing strategic collaboration to develop and integrate generative AI into healthcare by combining the scale and power of Azure OpenAI Service1 with Epic's electronic health record (EHR) software. The collaboration is expected to expand the long-standing partnership, enabling organizations to operate Epic environments on the Microsoft Azure cloud platform.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Recovery from the Impact of COVID-19 on the Market

- 4.5 Impact of Macroeconomic Scenarios Such as Russia-Ukraine War and Economic Recession

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Emphasis on Leveraging the Core Competencies by Outsourcing Non-core Operations

- 5.1.2 Organizations are Increasingly Focusing on IT as a Means to Gain Differentiation by Relying on Outsourced Vendors

- 5.1.3 Ongoing Migration toward the Cloud and Adoption of Virtualized Infrastructure

- 5.2 Market Challenges

- 5.2.1 Fragmented Nature of the Market and Growing Incidence of Data Breaches

- 5.2.2 Dynamic Needs of IT Structure Impacts the Cost of Customization for End Users

- 5.3 Technology Trends (Cloud Computing, Analytics and Artificial Intelligence, Cyber Security, Blockchain, Internet of Things)

- 5.4 Trends Related to Onshoring and Offshoring

- 5.5 Breakdown of Outsourcing Industry - BPO vs IT-based outsourcing

- 5.6 Impact of the Ongoing Commodification of IT Solutions

- 5.7 Analysis of IT Outsourcing and Managed Service Industry

- 5.8 Impact of Digital Transformation and Emergence of "As-a-Service" Model

6 MARKET SEGMENTATION

- 6.1 By Service Type

- 6.1.1 Application Outsourcing

- 6.1.2 Infrastructure Outsourcing

- 6.1.3 Other Services

- 6.2 By Organization Size

- 6.2.1 SMEs

- 6.2.2 Large Enterprises

- 6.3 By Industry

- 6.3.1 Banking, Financial Services, and Insurance

- 6.3.2 IT and Telecom

- 6.3.3 Manufacturing

- 6.3.4 Healthcare

- 6.3.5 Government and Public Sector

- 6.3.6 Retail and E-commerce

- 6.3.7 Energy, Utilities, and Mining

- 6.3.8 Others

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Hewlett Packard Enterprise Company

- 7.1.3 Microsoft Corporation

- 7.1.4 DXC Technology Company

- 7.1.5 NTT Corporation

- 7.1.6 Infinitely Virtual

- 7.1.7 CDW Corporation

8 FUTURE OF THE MARKET