PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408772

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408772

Germany Data Center Networking - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2030

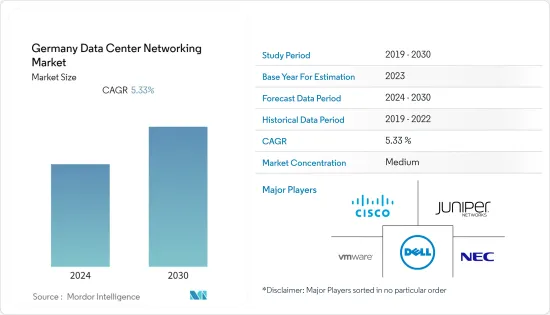

The Germany data center networking market reached a value of USD 1.05 billion in the previous year, and it is further projected to register a CAGR of 5.33% during the forecast period.

Key Highlights

- The increasing demand for cloud computing among SMEs, government regulations for local data security, and growing investment by domestic players are some of the major factors driving the demand for data centers in the country.

- The upcoming IT load capacity of the German market is expected to reach 2356 MW by 2029. The country's construction of raised floor area is expected to increase more than 11.6k million sq. ft by 2029.

- The country's total number of racks to be installed is expected to reach 356,000 units by 2029. Frankfurt will likely house the maximum number of racks by 2029. There are close to 7 submarine cable systems connecting Germany, and many are under construction.

Germany Data Center Networking Market Trends

IT & Telecommunication Segment to Hold Major Share in the Market

- Increased adoption of cloud computing services in the country has increased IT infrastructure components. Many technology companies have launched cloud services to support the digital transformation efforts of many enterprises. As the amount of data generated continues to increase, the need for backup and storage solutions increases. This accommodates the increasing number of network solutions in data centers.

- The strong growth of mega data centers, high penetration of 100GB switch ports, increased broadband development, increasing demand for high-speed internet, and development of internet infrastructure are positively contributing to the market growth.

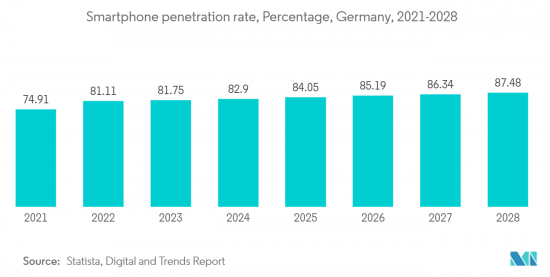

- The growth is driven by an increase in telecom subscribers and an increasing number of smartphone users to generate more information and increase demand for data center network solutions in the country.

- Mobile broadband communication in Germany has evolved drastically. The 4G internet services were launched around 2011 in Germany, with major operators rolling out their services, with maximum download speeds recorded at around 45 Mbps. Moreover, with the introduction of 5G around 2019, the average download speed of mobile internet in Germany accounted for about 24 Mbps, down to the increasing demand for faster internet speeds, outpacing the capacity to handle the increasing demand. As the amount of data generated continues to increase, the need for backup and storage solutions increases. This accommodates the increasing number of network solutions in data centers.

- The rise in artificial intelligence (AI), Internet of Things (IoT), and big data workloads is driving demand for ingenious data center network infrastructure solutions among data facilities. This allows providers to constantly innovate their network portfolio to adapt to the environment and deliver greater efficiency, scalability, and reliability.

Ethernet Switches to Hold Significant Share in the Market

- Ethernet is a midrange technology that also provides a practical solution to meet growing data center connectivity requirements. Therefore, data center expansion has increased the demand for high-bandwidth switches.

- The segment is growing due to operational flexibility from 10 Mbit/s to 400 Gbit/s. For example, most residential high-speed Internet services currently reach up to around 60 Mbps for copper-based services, while fiber-optic services offer near-gigabit ethernet speeds. This tends to rapidly increase the demand for ethernet technology, further promoting the use of ethernet switches.

- Several companies continue to expand their product portfolios and release higher bandwidth switches. For example, Edgecore Networks launched its EPS120 series, a powerful enterprise product family, in May 2023. Ideal for large retail stores, campuses, and corporate offices, these optimized 1Gbps open switches offer robust 1G switching with high data transfer bandwidth and large packet buffers to handle traffic spikes. Performance. The constant innovation is driving the segment growth in the country.

- Increased investment in the IT industry, increased digitalization, and expansion of many companies, including telecommunications, data centers, and cloud computing, are driving the use of Ethernet switches in the country.

- Ethernet switches are used in diverse applications in industrial infrastructure, including smart grids, surveillance and security, smart rail and transportation, and other utilities. These switches play a crucial role in the substation automation in smart grids. This is because integrating the switch into an Ethernet-based network reduces the complexity and tension of cabling between power transmission and distribution devices within a substation.

Germany Data Center Networking Industry Overview

The data center industry is currently witnessing a shift towards increased fragmentation, as both established vendors and newcomers face fierce competition. This trend is primarily driven by the growing popularity of cloud computing, which has attracted a wave of new investors eager to capitalize on the sector's success. Prominent players in this dynamic market include Cisco Systems Inc., Juniper Networks Inc., Dell Inc., NEC Corporation, and VMware Inc.

In November 2022, VMware, Inc. introduced its cutting-edge SD-WAN solution, featuring a new SD-WAN Client. This innovative solution aims to assist enterprises in achieving more secure, reliable, and optimized delivery of applications, data, and services.

In September 2022, Nokia made a significant contribution to the data center ecosystem by offering data center switching platforms that facilitate the expansion of DCspine's cloud services. Leveraging Nokia's SR Linux-based solution, DCspine can enhance its interconnection and cloud services, along with network operations automation, which results in faster service delivery to its European clientele.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Dynamics

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Utilization of Cloud Storage is Driving the Market Growth

- 4.2.2 Rising Need for Backup and Storage is Expanding the Market Demand

- 4.3 Market Restraints

- 4.3.1 Lack of Skilled Professionals is Hindering the Market Demand

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of COVID-19 Impact

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 By Product

- 5.1.1.1 Ethernet Switches

- 5.1.1.2 Router

- 5.1.1.3 Storage Area Network (SAN)

- 5.1.1.4 Application Delivery Controller (ADC)

- 5.1.1.5 Other Networking Equipment

- 5.1.2 By Services

- 5.1.2.1 Installation & Integration

- 5.1.2.2 Training & Consulting

- 5.1.2.3 Support & Maintenance

- 5.1.1 By Product

- 5.2 End-User

- 5.2.1 IT & Telecommunication

- 5.2.2 BFSI

- 5.2.3 Government

- 5.2.4 Media & Entertainment

- 5.2.5 Other End-Users

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Cisco Systems Inc.

- 6.1.2 Juniper Networks Inc.

- 6.1.3 VMware Inc

- 6.1.4 Huawei Technologies Co. Ltd.

- 6.1.5 Extreme Networks Inc.

- 6.1.6 NVIDIA (Cumulus Networks Inc.)

- 6.1.7 Dell EMC

- 6.1.8 NEC Corporation

- 6.1.9 IBM Corporation

- 6.1.10 Intel Corporation

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS