PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408871

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408871

Buoys And Beacon - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

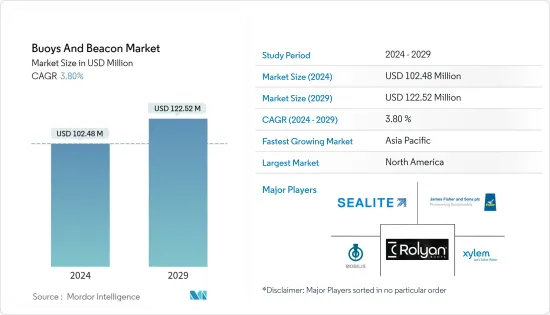

The Buoys And Beacon Market size is estimated at USD 102.48 million in 2024, and is expected to reach USD 122.52 million by 2029, growing at a CAGR of 3.80% during the forecast period (2024-2029).

Key Highlights

- The rapid growth in terms of the marine industry in emerging nations has led to a considerable increase in terms of marine trade. Buoys and beacons form an essential part of the marine navigation ecosystem to safeguard the naval vessels and cargo containers against dangerous submerged landforms and areas that can sink or damage them and lead to potential loss of life and property. This has led to a sustained increase in the demand for buoys and beacons for continuous monitoring of sea-based trade traffic and other natural phenomena, such as weather changes, etc.

- The buoys and beacon market is anticipated to be affected by the adoption of new technologies during the upcoming period, such as remote monitoring and control systems, the use of solar-powered buoys, and the development of smart buoy systems.

Buoys And Beacon Market Trends

The Offshore Segment is Anticipated to Register Highest Growth During the Forecast Period

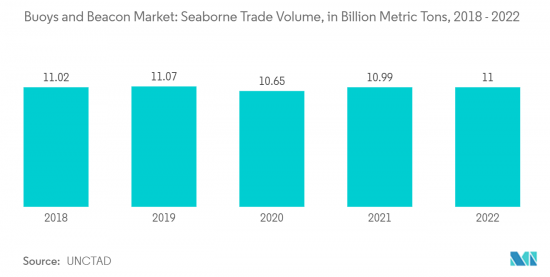

- The offshore segment is expected to show significant growth during the forecast period. The growth in international marine trade can be attributed as one of the major driving factors for the adoption of offshore buoys and beacons to protect naval vessels from imminent threats and provide an early warning in case of any major incoming natural phenomenon. Furthermore, buoys and beacons are also being increasingly used as navigation aids, which drives their adoption in the offshore segment.

- Since the past few years, the shipping industry has seen a general trend of increases in total trade volume. Increasing industrialization and the liberalization of national economies have fueled free trade and a growing demand for consumer products. Advances in technology have also made shipping an increasingly efficient and swift method of transportation. Thus, the growth in the shipping industry has also led to various governments across the world partnering with various manufacturers in order to develop advanced offshore buoys and beacon systems.

- According to the data presented by the International Chamber of Shipping (ICS) in 2022, over 50,000 merchant ships were trading internationally, transporting every kind of cargo. Currently, marine offshore buoys have been used increasingly for the past few years in order to alert the sailors with regards to changes in ocean currents and also help in terms of critical and safe navigation in order to guide the mariner away from rocks and reefs. Moreover, countries globally make use of five different types of buoys, namely cardinal, lateral, isolated danger, special, and safe water marks. In addition, offshore buoys of standardized colors and shapes indicate safe passageways.

- The growth in the number of deep-sea sailing ships has led to various manufacturers worldwide investing in research and development in order to manufacture advanced offshore buoy systems. This, in turn, is expected to create a positive outlook and will also lead to a growth of buoys and beacon systems in offshore applications during the forecast period.

North America to Dominate Market Share During the Forecast Period

- North America is projected to dominate market share during the forecast period. Increasing expenditure in terms of research and development by various companies present in the region that manufacture buoys and beacon systems, coupled with the growing need for maritime safety, will lead to the growth of the market in the future.

- Maritime safety has become crucial in recent years owing to the increasing number of maritime threats as well as the increasing importance of international trade by sea. In North America, maritime safety solutions and services are highly effective due to the increasing need by various maritime safety equipment manufacturing companies which are engaged in providing superior and advanced technology for the detection of various hazards in deep waters.

- Several established companies in the North American region, such as Rolyan Buoys, Whitecap Industries Inc., as well as JFC Marine amongst others, are engaged in the production of advanced maritime buoys. The products of the company have been designed and manufactured in order to meet/exceed US regulations.

- Advanced buoys and beacons are now being manufactured not just for the shipping industry but also for several other applications such as scientific research, marine and weather forecasting, seasonal forecasting, protection of marine life, and planning for extreme weather events, amongst others.

- For instance, in May 2022, a lab at Woods Hole Oceanographic Institution in Massachusetts, the US, announced that they have partnered with French shipping giant CMA CGM and have developed a robotic buoy technology that will be used to record underwater whale sounds in real-time thereby tapping on the whale position and protecting the whales from collision against ships. Thus, such developments are expected to lead to a positive outlook and also lead to significant growth of buoys and beacons within the North American market during the forecast period.

Buoys And Beacon Industry Overview

The buoys and beacon market is fragmented and marked by the presence of several market players competing on both national and international levels to gain market share. Some of the prominent players in the buoys and beacon market are James Fisher and Sons plc (Fendercare), Sealite Pty Ltd, Mobilis, Rolyan Buoys (Performance Health Holding, Inc.), and Xylem, amongst others.

Moreover, the key players in the market are focused on the development of advanced buoys and beacon systems, which will be installed at various locations around the world. Growing expenditure on research and development towards manufacturing advanced buoys and beacon systems will lead to creating better opportunities in the near future.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Metal Buoys

- 5.1.2 Plastic Buoys

- 5.2 Application

- 5.2.1 Offshore

- 5.2.2 Coastal and harbor

- 5.2.3 Inland Waters

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 France

- 5.3.2.3 Italy

- 5.3.2.4 Germany

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Malaysia

- 5.3.3.4 Singapore

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Colombia

- 5.3.4.2 Chile

- 5.3.4.3 Argentina

- 5.3.4.4 Rest of Latin America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Israel

- 5.3.5.2 Egypt

- 5.3.5.3 Saudi Arabia

- 5.3.5.4 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 James Fisher and Sons plc (Fendercare)

- 6.2.2 Xylem

- 6.2.3 Rolyan Buoys

- 6.2.4 Sealite Pty Ltd

- 6.2.5 RESINEX TRADING S.r.l.

- 6.2.6 RYOKUSEISHA CORPORATION

- 6.2.7 Almarin

- 6.2.8 Mobilis

- 6.2.9 Carmanah Technologies Corp

- 6.2.10 Woori Marine Co. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Incorporation of strategies for increasing product adoption to help companies grow