PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408877

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408877

China Geopolymer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

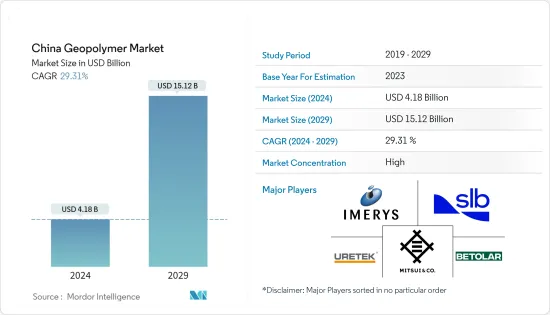

The China Geopolymer Market size is estimated at USD 4.18 billion in 2024, and is expected to reach USD 15.12 billion by 2029, growing at a CAGR of 29.31% during the forecast period (2024-2029).

The market was negatively impacted by COVID-19 in 2020 due to the halt in manufacturing activities and construction activities, and they were completely shut down to control the spread of coronavirus. Since 2021, construction activities started recovering from the pandemic impact, however, the recurring pandemic waves in the country kept the recovery pace slower than expected till 2022.

Key Highlights

- The growing demand for sustainable construction materials and environmental regulations to curb emissions from the cement industry are major factors driving the growth of the market studied.

- However, a lack of awareness related to geopolymer applications is likely to restrain the growth of the studied market.

- Nevertheless, various infrastructure development projects and green building initiatives in the pipeline are likely to create lucrative growth opportunities for the Chinese market.

China Geopolymer Market Trends

Building Segment to Dominate the Market

- Geopolymer concrete is an innovative and eco-friendly construction material and an alternative to Portland cement concrete. It is very resistant to several of the durability issues that can cause traditional concretes to crack and crumble.

- Concrete is one of the most common building materials used in the construction of buildings. While concrete is an excellent construction material, its production releases a large amount of carbon dioxide (CO2). The use of geopolymer reduces the demand for Portland cement which is responsible for high CO2 emission.

- China, the world's largest construction market, is implementing measures to reach peak carbon emissions by 2030 and carbon neutrality by 2060. The Hong Kong government also initiated policies aimed at achieving carbon neutrality by 2050, and the development of green buildings is set as a top priority.

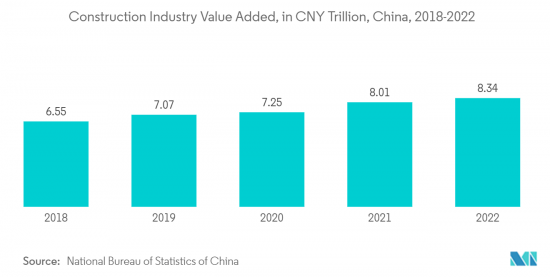

- According to the National Bureau of Statistics of China, the construction industry in China generated an added value of approximately CNY 8.3 trillion (~USD 1.23 trillion) in 2022.

- Similarly, according to the National Bureau of Statistics of China, the value of construction output accounted for CNY 31.2 trillion (~USD 4.5 trillion) in 2022, up from CNY 29.31 trillion (~USD 4.2 trillion) in 2021. Moreover, as per the forecast given by the Ministry of Housing and Urban-Rural Development, China's construction sector is expected to maintain a 6% share of the country's GDP going into 2025.

- Further, in 2022, the 14th Five-Year Plan of China's Green Buildings was issued, which put forward higher requirements for the high-quality development of green buildings.

- In China, large public buildings and international buildings prefer to apply LEED to demonstrate excellent green performance that complies with international standards. Still, other buildings tend to apply the Chinese local green building rating system, named Evaluation Standard for Green Building (ESGB), for the domestic market.

- In 2022, the United States Green Building Council (USGBC) announced China ranks first in the world on its annual list of Top 10 Countries and Regions for LEED.

- Thus, rising green building construction is likely to increase the demand for geopolymers in the forecasted period.

Road and Pavement Segment to Dominate the Market

- Geopolymer cement is an eco-friendly and cost-effective alternative to Portland cement due to its superior performance. In road and pavement construction, it offers superior mechanical properties, abrasion resistance, chemical resistance, and many other benefits.

- China has increased the construction of highway infrastructure to maintain and increase investment for the stabilization of the economy.

- The Belt and Road Initiative is a massive China-led infrastructure project that aims to stretch around the globe and is likely to increase the demand for geopolymers in the forecast period.

- According to the Ministry of Finance of the People's Republic of China, the total public expenditure on transport infrastructure in China amounted to about CNY 1.2 trillion (~USD 0.18 trillion) in 2022.

- China further plans to build a highway network of 461,000 kilometers (km), of which 162,000 kilometers will be expressways by 2035, and further expand it to become a world-class one by 2050.

- Several new highway projects are going ahead in China that are likely to positively influence the geopolymer market. For instance, in June 2023, the procedure for the construction of the Yongjing Jingping Expressway Project started. The Yongjing Jingping Expressway has a total length of 4.12 kilometers with an investment value of CNY 7.06 billion (~USD 1.05 billion).

- Similarly, in Qinghai Province, construction of the G0612 Xining-Hetian Expressway Huangyuan-Xihai Highway Project worth CNY 5.66 billion (~USD 0.84 billion) started in April 2023. The project includes the construction of a two-way, four-lane expressway with a total expressway length of 50.7 kilometers and a roadbed width of 26 meters.

- Therefore, all such aforementioned factors are anticipated to increase the demand for geopolymers through the forecast period.

China Geopolymer Industry Overview

The China Geopolymer Market is highly consolidated in nature. The major players (not in any particular order) include Betolar Plc, Imerys, MITSUI & CO., LTD., SLB (Schlumberger Limited), and URETEK, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Sustainable Construction Materials

- 4.1.2 Increasing Environmental Regulations to Curb Emissions from Cement Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Lack of Awareness Related to Geopolymer Applications

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Cement, Concrete, and Precast Panel

- 5.1.2 Grout and Binder

- 5.1.3 Other Product Types (Composites, Foam and Bricks)

- 5.2 Application

- 5.2.1 Building

- 5.2.2 Road and Pavement

- 5.2.3 Runway

- 5.2.4 Pipe and Concrete Repair

- 5.2.5 Bridge

- 5.2.6 Tunnel Lining

- 5.2.7 Railroad Sleeper

- 5.2.8 Coating

- 5.2.9 Fireproofing

- 5.2.10 Nuclear and Other Toxic Waste Immobilization

- 5.2.11 Specific Mold Products

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Betolar PLC

- 6.4.2 Imerys

- 6.4.3 Milliken & Company

- 6.4.4 MITSUI & CO., LTD.

- 6.4.5 SLB (Schlumberger Limited)

- 6.4.6 URETEK

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Infrastructure Development Projects and Green Building Initiatives

- 7.2 Other Opportunities