PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408878

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408878

Europe Titanium Dioxide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

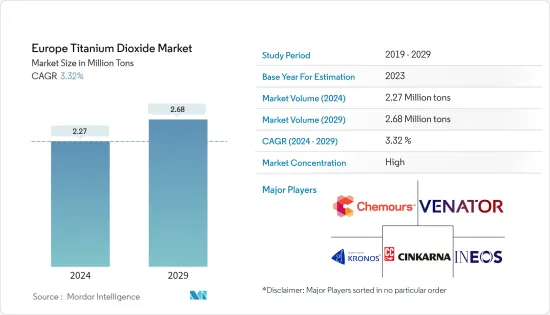

The Europe Titanium Dioxide Market size is estimated at 2.27 Million tons in 2024, and is expected to reach 2.68 Million tons by 2029, growing at a CAGR of 3.32% during the forecast period (2024-2029).

The COVID-19 pandemic majorly affected countries across Europe, resulting in severe lockdowns, confining millions of people in their homes, and shutting down businesses, production, and manufacturing facilities, resulting in no economic activity. However, the market retained its growth trajectory in 2022.

Key Highlights

- The major factor driving the studied market is the growing construction industry in the region. Moreover, increasing demand for titanium dioxide in the plastics industry is expected to fuel the growth of the market.

- On the flip side, toxicity and stringent environmental policies of titanium dioxide are expected to hinder the growth of the market. Nevertheless, the increased use of ultrafine particles of titanium dioxide in cosmetics and construction industries is expected to act as an opportunity in the future. Germany dominated the European titanium dioxide market and is expected to continue doing so in the coming years.

Europe Titanium Dioxide Market Trends

Paints and Coatings to Dominate the Market

- Titanium dioxide is an effective white pigment for achieving high whiteness and high hiding power in paints and coatings. It delivers optimal whiteness and opacity when used in paints and offers strong hiding power, allowing it to mask or hide the substrate beneath.

- Today, titanium dioxide pigment is the most essential ingredient used for achieving whiteness and opacity in the paint industry. This is due to its high refractive index and its ability to transmit visible light. Titanium dioxide is particularly appealing due to its spherical shape, appropriate particle size, and the availability of various post-treatment alternatives."

- Europe is home to many large paint industries, notably in the four largest mainland economies: Germany, France, Italy, and Spain. Germany, among the leading producers of paints and coatings in the region, hosts approximately 300 paints and printing ink manufacturers, including many small- and medium-sized companies. According to Statistisches Bundesamt, the country's industry revenue for manufacturing paints, varnishes, similar coatings, printing ink, and mastics is projected to reach around USD 12.94 billion by 2024.

- Italy is the third-largest paint and coatings market in Europe, with around 766 companies engaged in manufacturing paints, varnishes, similar coatings, printing ink, and mastics, according to the OECD (I.Stat). Some major paint manufacturers in Italy include IVM Chemicals, Impa SPA, Colorificio MPICA Group - division iCO Italian Coatings, Metropolis by Ivas, and Novacolor Srl.

- As of July 2022, AkzoNobel announced a EUR 20 million (USD 23 million) investment to increase and improve production at its two sites in France. Specifically, EUR 15 million (USD 17.4 million) will be invested in the company's aerospace coating facility in Pamiers.

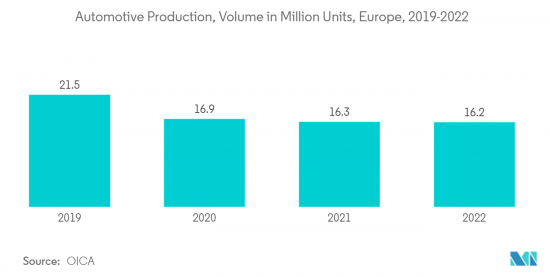

- Additionally, the demand for paints and coatings is rising due to increased automotive and construction activities in the region. According to the International Organization of Motor Vehicle Manufacturers (OICA), vehicle production in Europe reached 16.2 million units in 2022.

- Hence, due to these factors, the paints and coatings sector is expected to dominate the European titanium dioxide market.

Germany to Dominate the Market

- In Europe, Germany dominates the titanium dioxide market. With rising production in industries such as cosmetics, paints and coatings, and paper, the consumption of titanium dioxide is projected to noticeably increase during the forecast period.

- Germany stands as one of the largest manufacturers of paints and coatings globally. The country hosts leading paint manufacturers, including BASF SE, Dow, Beckers Group, Brillux, Altana Chemie, Meffert, and Mankiewicz, which anticipates a surge in the demand for titanium dioxide.

- Moreover, the escalating demand for paints and coatings from the construction and automotive industries within Germany propels the titanium dioxide market. Germany boasts the largest construction industry in Europe, experiencing gradual growth, primarily fueled by increased new residential construction activities. Expectations of significant growth in non-residential and commercial buildings during the forecast period are buoyed by lower interest rates, rising real disposable incomes, and substantial investments from both the European Union and the German government.

- OICA reports that vehicle production in the country surged to 3.67 million units in 2022, marking an 11% increase from 2021. According to data from the German Cosmetic, Toiletry, Perfumery, and Detergent Association (IKW), the total sales value of cosmetic products, detergents, and other care and cleaning products in Germany reached EUR 30.1 billion (USD 35 billion) in 2022, growing by 7.9% year-on-year. Export sales also witnessed robust growth, reaching EUR 10.6 billion (USD 12.32 billion) in 2022, marking a 15.6% increase.

- Moreover, German shoppers spent a total of EUR 14.3 billion (USD 16.62 billion) on various body care and cosmetics products in 2022, marking a yearly increase of 5.4%. With the growing demand for cosmetic products, IKW forecasts a 2.5% growth in sales revenue for 2023.

- Additionally, in 2022, production and deliveries from German pulp, paper, and board mills dropped by over 6% to 21.6 million tons, according to Die Papierindustrie, the association of German paper mills.

- Therefore, given the rapidly growing end-user industries in the country, Germany is poised to dominate the titanium dioxide market throughout the forecast period.

Europe Titanium Dioxide Industry Overview

The European titanium dioxide market is consolidated in nature. Some of the major players (not in any particular order) include The Chemours Company, Venator Materials PLC, Kronos Worldwide, Inc., INEOS, and Cinkarna Celje d.d., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Construction Industry

- 4.1.2 Increasing Demand for Titanium Dioxide in the Plastics Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Toxicity and Stringent Environmental Policies of Titanium Dioxide

- 4.2.2 Fluctuations in the Price of Titanium Dioxide

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Grade

- 5.1.1 Rutile

- 5.1.2 Anatase

- 5.2 Application

- 5.2.1 Paints and Coatings

- 5.2.2 Plastics

- 5.2.3 Pulp and Paper

- 5.2.4 Cosmetics

- 5.2.5 Other Applications (Pharmaceuticals, Textiles, Food Colorants, etc.)

- 5.3 Geography

- 5.3.1 Germany

- 5.3.2 United Kingdom

- 5.3.3 Italy

- 5.3.4 France

- 5.3.5 Spain

- 5.3.6 NORDIC Countries

- 5.3.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Cinkarna Celje d.d.

- 6.4.2 Evonik Industries AG

- 6.4.3 Grupa Azoty

- 6.4.4 ILUKA RESOURCES LIMITED

- 6.4.5 INEOS

- 6.4.6 Kronos Worldwide, Inc.

- 6.4.7 LB Group

- 6.4.8 The Chemours Company

- 6.4.9 Tronox Holdings plc

- 6.4.10 Venator Materials PLC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Usage of Titanium Dioxide Ultrafine Particles in Cosmetics and Construction Industries

- 7.2 Other Opportunities