PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1429248

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1429248

Russia Home Appliances - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

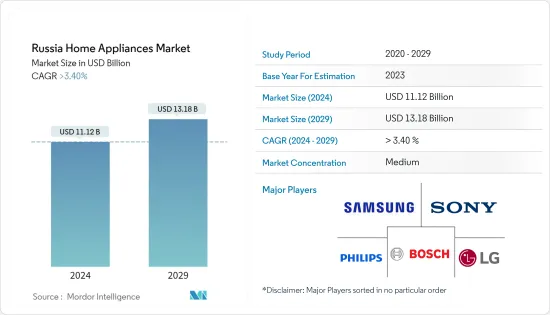

The Russia Home Appliances Market size is estimated at USD 11.12 billion in 2024, and is expected to reach USD 13.18 billion by 2029, growing at a CAGR of greater than 3.40% during the forecast period (2024-2029).

Russian home appliances market is witnessing growth in its market revenue with the improving technology and the rising demand for appliances. Russians are showing greater interest in technologically sound products. Most of the market is driven by innovation, connectivity, and automatic and scheduling features that the products own. Thus, owing to these factors, the market is witnessing growth. Major appliances constitute a significant share of the total revenue generated. The emerging demand for smart appliances is the primary factor driving the market for home appliances in Russia. Although online purchases accounted for a small market share, they are expected to witness significant growth in the forecast period, considering the shift recorded in the study period.

Russia Home Appliances Market Trends

Online Sales are Witnessing a Major Share of the Market

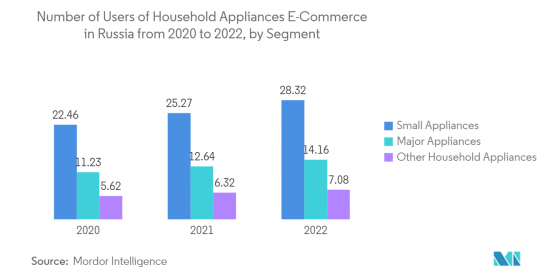

In Russia, the shift to digital online shopping has continued, with E-commerce sales reaching about USD 27.67 billion in the first half of 2023, a 20% increase from last year. As a percentage of total Russian retail sales, e-commerce accounted for 12.7%. The market has seen a rise in e-commerce since 2020 due to the pandemic. This has resulted in an increase in online customers for small appliances, with the highest number of customers ordering small appliances online.

Numerous practices of online retailers can be considered as the primary reason for this shift, and it is expected to increase gradually in the future. Brand loyalty is comparatively high when it comes to the major appliances, and consumers are willing to experiment with brands and their features in the small appliances category, like coffee makers and toasters, only if the prices are not high. Consumers prefer products that have priority functionality and that bring convenience into their lives.

Demand for Turkish and Chinese Household Appliances in Russia is Driving the Market

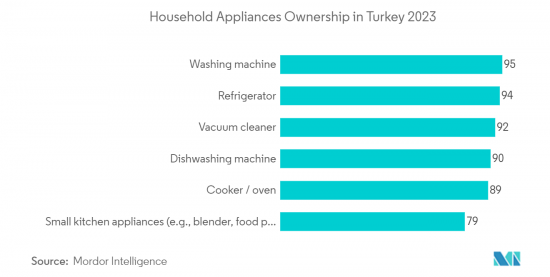

Turkish household appliances are becoming increasingly popular in Russia due to their low prices and increasing variety. The demand for Turkish and Chinese household appliances in Russia has grown year-on-year. Chinese and Turkish household appliances replace electrical appliances from long-gone European brands in Russia. Year-on-year, sales of the top categories in Russia increased by around 20 percent. The increased focus on Chinese and Turkish domestic appliances is mainly due to their wide variety, consistent availability of products, including through manufacturing in Russia, and well-structured logistics. As a result, people started to spend more money on real estate and home improvements. Moreover, household appliances from China and Turkey can be repaired. There are official repair centers of manufacturers in Russia that offer the necessary guarantees. In the first six months of 2023, Russian consumers purchased over 40,000 Turkish household appliances on the Yandex market, with a market share of 7%.

Russia Home Appliances Industry Overview

The report covers major international players operating in the Russian home appliances market. The market is already fragmented, with a growing number of smaller players who are offering moderate-quality products at an affordable range of prices. However, the ever-increasing small appliances segment holds scope for newcomers to enter the market. Many traditional Western brands that Russians are familiar with have exited the market, resulting in a loss of market share that is now being taken advantage of by the Chinese, Turkish, and national brands. For instance, the demand for Russian and Belarusian brands has increased by one-fifth to two-fold. The leading home appliance manufacturers in Russia, Bosch, LG, and Samsung, have ceased their imports and production operations in the country, resulting in a decrease in their market share.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growth in the Demand for Dishwashers

- 4.1.2 Smart Household Appliances is Driving the Growth of the Market

- 4.2 Market Restraints

- 4.2.1 Decreased Production of Household Appliances in Russia

- 4.3 Market Opportunities

- 4.3.1 Rapid Urbanization and Increase in Disposable Income in Russia

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Insights on Current Trends and Technological Innovations in the Market

- 4.6 Impact of COVID-19 on the market

5 MARKET SEGMENTATION

- 5.1 By Major Appliances

- 5.1.1 Refrigerators

- 5.1.2 Freezers

- 5.1.3 Dishwashing Machines

- 5.1.4 Washing Machines

- 5.1.5 Cookers

- 5.1.6 Ovens

- 5.2 By Small Appliances

- 5.2.1 Vacuum Cleaners

- 5.2.2 Hair Clippers Irons

- 5.2.3 Toasters

- 5.2.4 Grills

- 5.2.5 Roasters

- 5.2.6 Hair Dryers

- 5.2.7 Other Small Appliances

- 5.3 By Distribution Channel

- 5.3.1 Multi Brand Stores

- 5.3.2 Exclusive Stores

- 5.3.3 Online

- 5.3.4 Other Distribution channels

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Samsung

- 6.2.2 Bosch

- 6.2.3 LG

- 6.2.4 Sony

- 6.2.5 Philips

- 6.2.6 Indesit

- 6.2.7 Siemens

- 6.2.8 Xiaomi

- 6.2.9 Electrolux

- 6.2.10 Ariston*

7 FUTURE OF THE MARKET

8 DISCLAIMER