PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1637918

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1637918

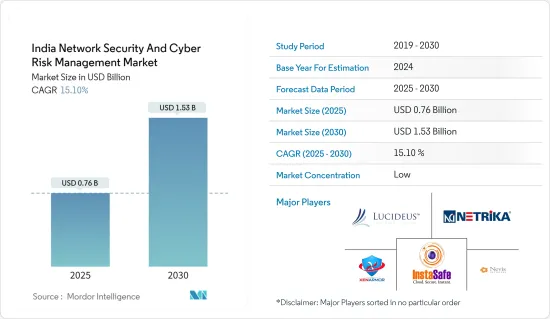

India Network Security And Cyber Risk Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The India Network Security And Cyber Risk Management Market size is estimated at USD 0.76 billion in 2025, and is expected to reach USD 1.53 billion by 2030, at a CAGR of 15.1% during the forecast period (2025-2030).

In the past, India has been targeted through cyber-attacks primarily for political reasons, and trends show that this landscape seems to only gain prominence with the availability of more sophisticated technology and more complex transactions increasing the vulnerability of systems.

Key Highlights

- Government initiatives aimed at digitizing Indian industries are expected to be the major driving factor for the market. Government schemes such as 'Make in India,' 'Start-Up India,' and 'Digital India' supplement the growth of Cyber Security market in India and are a linking pin towards Public-Private Partnership (PPP) models.

- In India, Critical infrastructure is owned by both Public Sector and Private sector, operating with their norms and protocols for protecting their infrastructure from cyber-attacks. But there is no national security architecture that unifies the efforts taking place in the public sphere and the private sphere.

- As the trend of remote working is driving into a borderless network arrangement, cloud adoption has become a critical investment goal internationally. This fast digitization has resulted in a greater regulatory focus on data and privacy, integration of new technology stacks into company IT, and cloud and remote collaboration technologies.

- These changes and increased board are driving global cybersecurity demand and spending. Indian IT services, with their worldwide knowledge and experience, and the creative Indian cybersecurity product ecosystem have been the twin growth engines ensuring customers' global digital transformative journeys.

- Moreover, COVID-19 accelerated the country's digital transformation path. Initially, the emphasis was on business continuity, but there is now a noticeable shift in the dynamics of digitalization. As organizations adjust to the new reality, they are developing digitally led organizational strategies, which has increased the risk of cyber attacks.

India Network Security And Cyber Risk Management Market Trends

Intrusion Detection and Prevention System to Dominate the Market

- An Intrusion Detection and Prevention Software (IDPS) monitors network traffic for signs of a possible attack. When it detects potentially dangerous activity, it takes action to stop the attack. Often this takes the form of dropping malicious packets, blocking network traffic or resetting connections. The IDPS also usually sends an alert to security administrators about the potential malicious activity.

- The two main contributors to the successful deployment and operation of an IDS or IPS are the deployed signatures and the network traffic that flows through it.

- The market is expanding as a result of rising R&D expenditures by both public and commercial organisations to provide novel and affordable secured low-power intrusion detection and prevention solutions. The market size is increased by rising awareness of home and commercial safety and security.

- Moreover, government initiatives like 'Make in India', which aims to promote the development, manufacture, and assembly of products made in India by incentivizing dedicated investments into manufacturing, and government campaigns like 'Digital India,' which was launched to ensure increased Internet connectivity and make the nation digitally empowered in terms of technology, have been influencing the growth of the IDP system in the country.

Growth in Mobile Phones to Significantly Drive the Market Growth

- India has seen a tremendous growth in tech savvy population, with mobile phones being the first digital medium. In India, there are 1.2 billion mobile customers, 750 million of whom use smartphones. The nation is anticipated to be the second-largest smartphone manufacturer in the coming five years.

- With the growing number of smartphones in India, the demand for the Internet is continuously growing in the country. According to the report published by IAMAI (The Internet and Mobile Association of India), there are currently 692 million active internet users in the country, and the number is estimated to hit 900 million by 2025, led by growth in rural areas.

- At the same time, there has been substantial growth in IT spending in India and a scaling up in the use of technologies such as the Internet of Things (IoT), Cloud Computing, Artificial Intelligence (AI), and BlockChain.

- According to Ericsson, In 2022, the dominant technology of smartphone subscriptions used in India was LTE, which had reached nearly 805 million. It was expected to peak in 2024 at around 838.6 million subscriptions, with 3G connections estimated at 22 million by that point. 5G was forecasted to be about 646.5 million of all 1.13 billion smartphone subscriptions in India at the end of 2027.

India Network Security And Cyber Risk Management Industry Overview

India Network Security And Cyber Risk Management Market is fragmented, with the presence of major players like Lucideus Tech, Instasafe, XenArmor, ArraySheild Technologies, and Netrika Consulting India Pvt Ltd. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- February 2023 - Raghnall Insurance Broking, a supplier of insurance and risk management services in India, announced the launch of Business Cyber Shield for companies of all sizes. This technology is intended to offer complete cybersecurity solutions. With the introduction of Business Cyber Shield, Raghnall demonstrates its dedication to giving its clients access to the most up-to-date digital solutions for identifying, minimizing, and managing the risks connected with the rising danger of cyber-attacks.

- January 2023 - InstaSafe announced plans to expand its product offerings through India and the SAARC region by partnering with Value InfoSolutions, a technology services and solutions provider in India and Southeast Asia.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Government Initiatives Towards Digitizing Industries is Driving the Market Growth

- 4.4 Market Restraints

- 4.4.1 Absence of National Security Infrastructure is Discouraging the Market Growth

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Buyers/Consumers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Segment

- 5.1.1 Security Information and Event Management (SIEM)

- 5.1.2 Security Web Gateway (SWG)

- 5.1.3 Identity Governance and Administration (IGA)

- 5.1.4 Enterprise Content-Aware Data Loss Prevention (DLP)

- 5.2 By Solution

- 5.2.1 Encryption

- 5.2.2 Identity and Access Management (IAM)

- 5.2.3 Data Loss Protection (DLP)

- 5.2.4 Intrusion Detection System/Intrusion Prevention System (IDS/IPS)

- 5.2.5 Other Solutions

- 5.3 By Service

- 5.3.1 Network Security

- 5.3.2 Endpoint Security

- 5.3.3 Wireless Security

- 5.3.4 Cloud Security

- 5.3.5 Other Services

- 5.4 By End-user Vertical

- 5.4.1 Aerospace and Defense

- 5.4.2 Retail

- 5.4.3 Government

- 5.4.4 Healthcare

- 5.4.5 IT & Telecom

- 5.4.6 BFSI

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Lucideus Tech

- 6.1.2 Instasafe

- 6.1.3 XenArmor

- 6.1.4 ArraySheild Technologies

- 6.1.5 Netrika Consulting India Pvt Ltd.

- 6.1.6 Aspirantz InfoSec

- 6.1.7 Cyberoam

- 6.1.8 Data Resolve Technologies

- 6.1.9 Mirox Cyber Security & Technology

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS