PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849921

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849921

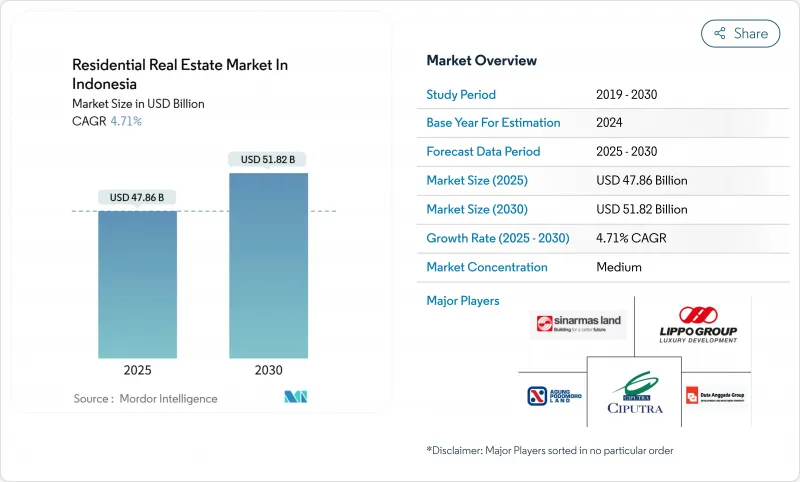

Indonesia Residential Real Estate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

Indonesia residential real estate market size stands at USD 47.86 billion in 2025 and is projected to climb to USD 51.82 billion by 2030, reflecting a 4.71% CAGR.

Steady urban migration, the government's three-million-houses initiative, and persistent demand for owner-occupied housing anchor the growth outlook for the Indonesia real estate market. Suburban townships now absorb the bulk of new supply, easing core-city congestion while stimulating construction activity in surrounding districts. Interest-rate relief from Bank Indonesia, coupled with an expanding pool of fintech mortgage lenders licensed by OJK, has lowered acquisition costs and broadened consumer reach. Developers are reallocating capital toward transit-oriented and integrated township projects that combine housing, retail, and public facilities, positioning themselves to capture the next leg of demand in the Indonesia real estate market.

Indonesia Residential Real Estate Market Trends and Insights

Government-backed integrated township masterplans in tier-1 and tier-2 cities broadening residential supply

The Ministry of Public Works budgeted IDR 29.57 trillion for strategic infrastructure in 2025, funneling resources into public-private township platforms that cut land servicing costs and close a national backlog estimated at 9.9 million homes. State enterprises finance roads and utilities while private developers deliver housing, enabling scale economics and faster absorption in the Indonesia real estate market. Secondary cities gain particular upside because land remains affordable, allowing builders to roll out mixed-income neighborhoods that fit social-housing targets yet still earn commercial margins. Master-planned designs also reinforce disaster resilience and environmental standards, which are being adopted as baseline criteria for bank financing. As these projects mature, buyers benefit from cohesive amenities and clearer titling, shortening decision cycles and sustaining incremental growth for the Indonesia real estate market.

Expansion of transit-oriented developments in Jabodetabek driving middle-class condominiums

MRT Jakarta intends to add roughly 50,000 residential units along its first line, monetizing air rights and deepening ridership catchments. Condominiums built within a 500-meter radius of new stations enjoyed up to 10% price appreciation in 2024, confirming commuter willingness to pay access premiums. Design rules mandate that at least 30% of floor area is set aside for housing, with sub-quotas for different income tiers, ensuring inclusive distribution. Developers align project phasing with rail construction, securing pre-sales earlier and mitigating holding costs. Transport authorities have begun replicating the model with commuter-rail operator PT KAI, indicating that the Indonesia real estate market will increasingly pivot toward vertical, rail-linked formats over the next decade.

Lengthy land titling & PBG permitting delays

Despite the 2025 reform that compresses standard approvals to as little as four hours for subsidized units, fragmented cadastral records still require manual reconciliation in many districts. Developers often carry land for years before construction, tying up capital and inflating final pricing. The Land Bank Agency was set up to pool parcels for social housing, yet limited staffing slows acquisition, causing a mismatch between program targets and on-ground delivery. Protracted permits particularly damage affordable projects where margins run thin; when timelines stretch, builders pivot toward high-end products, reducing supply elasticity and tempering growth of the Indonesia real estate market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid uptake of digital mortgage platforms approved by OJK

- Growing millennial household formation in industrial corridors

- Construction material inflation linked to nickel-driven cement & steel prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Villas & Landed Houses held 65% of the Indonesia real estate market share in 2024, mirroring cultural preferences for private land ownership and larger family layouts. Yet the apartment sub-sector is outpacing overall growth with a 4.90% CAGR, pulled by transit-oriented projects and shrinking urban land availability. Premium Jakarta condominiums averaged IDR 57.7 million per square meter in 2024, still lower than Hong Kong or Singapore benchmarks, preserving upside for capital gains. Developers combine co-working spaces, rooftop gardens, and digital concierge services to attract younger professionals and expatriates, boosting occupancy and stabilizing rental yields near 8%. Many regional municipalities now condition building-height permits on green-building compliance, spurring adoption of energy-efficient facades and smart-home systems that further differentiate vertical offerings.

Land incentives aimed at detached housing have not stalled high-rise momentum. Government VAT relief for units below IDR 5 billion reduces entry costs and reduces unsold inventory. The integration of commuter-rail extensions into suburban districts cuts travel times into the CBD, making mid-rise blocks viable even beyond Jakarta's outer ring. As a result, apartments are forecast to lift the Indonesia real estate market size for vertical living by 4.90% annually through 2030, gradually re-balancing a sector long dominated by ground-level formats.

Mid-Market dwellings-priced between IDR 500 million and IDR 2 billion-captured 46% share of the Indonesia real estate market size in 2024. Rising white-collar incomes, coupled with flexible down-payment schemes from fintech lenders, sustain absorption in this bracket. Conversely, Affordable housing, capped at IDR 166 million in Java and rising to IDR 240 million in Papua, is set to grow at a 4.85% CAGR as fiscal incentives extend through December 2025. Buyers enjoy 100% VAT waivers and BPHTB exemptions that slice effective acquisition costs by up to 13%, reducing the savings period required for home ownership.

Foreign investment rules that stipulate minimum spends of IDR 3 billion for apartments and IDR 5 billion for landed homes naturally steer overseas purchasers toward higher tiers, leaving the mass-market largely domestic. However, Qatar and the UAE's multi-billion-dollar commitments to social-housing ventures have broadened funding channels, enabling developers to scale production runs and secure bulk discounts on materials. Subsidized mortgages, carrying 5% fixed rates and down-payment support of up to IDR 10 million, further compress entry barriers. Collectively these mechanisms widen the funnel of first-time buyers and anchor long-term expansion in the Indonesia real estate market.

The Indonesia Residential Real Estate Market is Segmented by Property Type (Apartments & Condominiums and Villas & Landed Houses), Price Band (Affordable, Mid-Market and Luxury), Mode of Sale (Primary and Secondary), Business Model (Sales and Rental) and Region (Java, Sumatra, Kalimantan, Sulawesi and Rest of Indonesia). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Agung Podomoro Land Tbk

- Sinar Mas Land (BSD, BSD City)

- Ciputra Development Tbk

- Pakuwon Jati Tbk

- Lippo Homes / PT Lippo Karawaci Tbk

- Summarecon Agung Tbk

- Paramount Land

- Agung Sedayu Group

- Intiland Development Tbk

- Duta Anggada Realty Tbk

- PP Properti Tbk

- Tokyu Land Indonesia

- JABABEKA Tbk

- Wijaya Karya Realty

- Metropolitan Land Tbk

- Paramount Enterprise International

- Greenland Indonesia

- Perumnas (National Housing Corp.)

- PT HK Realtindo

- Trans Property

- MNC Land Tbk

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Overview of the Economy and Market

- 4.2 Real Estate Buying Trends - Socioeconomic and Demographic Insights

- 4.3 Regulatory Outlook

- 4.4 Technological Outlook

- 4.5 Insights into Rental Yields in Real Estate Segment

- 4.6 Real Estate Lending Dynamics

- 4.7 Insights Into Affordable Housing Support Provided by Government and Public-private Partnerships

- 4.8 Market Drivers

- 4.8.1 Government-Backed Integrated Township Masterplans in Tier-1 and Tier-2 Cities Broadening Residential Supply

- 4.8.2 Expansion of Transit-Oriented Developments in Jabodetabek Driving Middle-Class Condominiums

- 4.8.3 Rapid Uptake of Digital Mortgage Platforms Approved by OJK

- 4.8.4 Growing Millennial Household Formation in Industrial Corridors (Karawang-Bekasi)

- 4.8.5 VAT Waiver on Units < IDR 2 Billion Accelerating First-Home Purchases

- 4.8.6 Relaxed Foreign Ownership Limits Spurring Expat & Diaspora Demand

- 4.8.7 Township Projects in Secondary Cities (Makassar, Batam) Diversifying Supply

- 4.9 Market Restraints

- 4.9.1 Lengthy Land Titling & PBG Permitting Delays

- 4.9.2 Construction Material Inflation Linked to Nickel-Driven Cement & Steel Prices

- 4.9.3 Persistent Oversupply in Premium CBD Apartments (Central Jakarta)

- 4.9.4 Coastal Flood-Risk Limiting Development in Northern Jakarta

- 4.10 Value / Supply-Chain Analysis

- 4.10.1 Overview

- 4.10.2 Real Estate Developers and Contractors - Key Quantitative and Qualitative Insights

- 4.10.3 Real Estate Brokers and Agents - Key Quantitative and Qualitative Insights

- 4.10.4 Property Management Companies - Key Quantitative and Qualitative Insights

- 4.10.5 Insights on Valuation Advisory and Other Real Estate Services

- 4.10.6 State of the Building Materials Industry and Partnerships with Key Developers

- 4.10.7 Insights on Key Strategic Real Estate Investors/Buyers in the Market

- 4.11 Porter's Five Forces

- 4.11.1 Bargaining Power of Buyers

- 4.11.2 Bargaining Power of Suppliers

- 4.11.3 Threat of New Entrants

- 4.11.4 Threat of Substitutes

- 4.11.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Property Type

- 5.1.1 Apartments & Condominiums

- 5.1.2 Villas & Landed Houses

- 5.2 By Price Band

- 5.2.1 Affordable

- 5.2.2 Mid-Market

- 5.2.3 Luxury

- 5.3 By Mode of Sale

- 5.3.1 Primary (New-Build)

- 5.3.2 Secondary (Existing Home Resale)

- 5.4 By Business Model

- 5.4.1 Sales

- 5.4.2 Rental

- 5.5 By Region

- 5.5.1 Java

- 5.5.2 Sumatra

- 5.5.3 Kalimantan

- 5.5.4 Sulawesi

- 5.5.5 Rest of Indonesia

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Agung Podomoro Land Tbk

- 6.4.2 Sinar Mas Land (BSD, BSD City)

- 6.4.3 Ciputra Development Tbk

- 6.4.4 Pakuwon Jati Tbk

- 6.4.5 Lippo Homes / PT Lippo Karawaci Tbk

- 6.4.6 Summarecon Agung Tbk

- 6.4.7 Paramount Land

- 6.4.8 Agung Sedayu Group

- 6.4.9 Intiland Development Tbk

- 6.4.10 Duta Anggada Realty Tbk

- 6.4.11 PP Properti Tbk

- 6.4.12 Tokyu Land Indonesia

- 6.4.13 JABABEKA Tbk

- 6.4.14 Wijaya Karya Realty

- 6.4.15 Metropolitan Land Tbk

- 6.4.16 Paramount Enterprise International

- 6.4.17 Greenland Indonesia

- 6.4.18 Perumnas (National Housing Corp.)

- 6.4.19 PT HK Realtindo

- 6.4.20 Trans Property

- 6.4.21 MNC Land Tbk

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment