PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850144

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850144

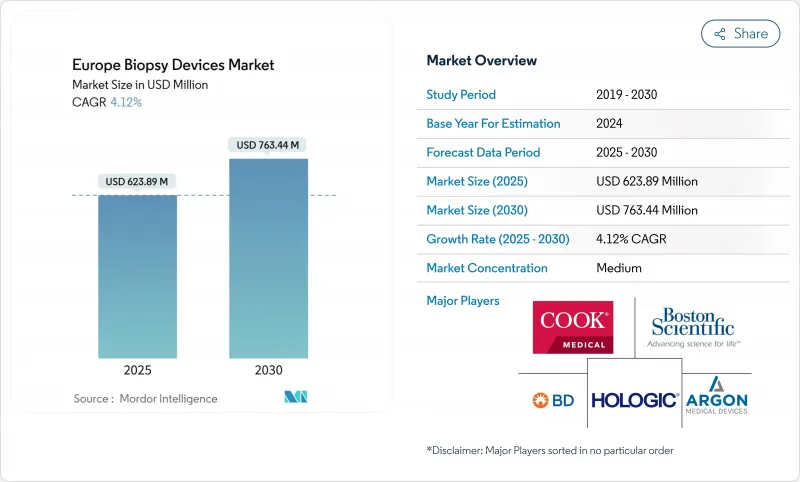

Europe Biopsy Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Europe biopsy devices market size stood at USD 623.89 million in 2025 and is forecast to reach USD 763.44 million by 2030, advancing at a 4.12% CAGR.

Demand continues to rise as organized cancer-screening programs expand, hospitals upgrade to EU Medical Device Regulation (MDR)-compliant equipment, and physicians shift toward imaging-guided, minimally-invasive techniques. Adoption of vacuum-assisted and core needle systems is accelerating because they reduce sampling errors, shorten procedure time, and integrate easily with MRI or CT guidance. Conversely, supply bottlenecks linked to MDR certification delays keep pricing firm and create procurement gaps, especially for smaller facilities. Safety-related product recalls underscore the need for robust post-market surveillance, prompting hospitals to favor vendors that can demonstrate strong quality systems. Across the region, national reimbursement reforms are steering a growing share of biopsies to ambulatory surgical centers, lowering overall procedure costs while preserving hospital capacity for complex oncology cases.

Europe Biopsy Devices Market Trends and Insights

Increasing Preference for Minimally-Invasive Procedures

Transperineal prostate biopsies now represent standard-of-care across leading urology centers after a multicenter trial showed lower infection rates than the traditional transrectal route, without compromising diagnostic accuracy. MRI-guided freehand techniques for small liver lesions reach 90% clinical success, encouraging their dissemination to oncology units that previously relied on CT guidance. Such patient-friendly modalities shorten recovery time and reduce hospital stays, aligning with payer cost-containment goals. Research groups are now testing nanoneedle patches capable of sampling intracellular biomarkers painlessly, a breakthrough that could reach clinical practice by 2026. These advances should keep the Europe biopsy devices market on a steady adoption curve even as regulatory hurdles rise.

Rising Cancer Screening Programs Across EU-27

The European Commission's Beating Cancer Plan earmarked EUR 4 billion to achieve 90% screening coverage for breast, cervical, and colorectal cancers by 2025, and has broadened scope to lung and prostate cancers. Organized programs replace opportunistic screening, compelling health systems to buy standardized biopsy kits, training mannequins, and AI-enabled image-review software. Updated mortality projections for 2025 already show a 9.8% decline in breast-cancer deaths among women aged 50-69, a result that is reinforcing political support for national screening budgets. Central and Eastern European countries, historically under-equipped, are channeling EU cohesion funds into mobile biopsy units to close access gaps. This policy-driven demand supports a predictable, multi-year order pipeline for device suppliers.

Product Recalls & Safety Notices

Hologic voluntarily withdrew more than 91,000 BioZorb 3D markers after 188 adverse-event reports of pain, infection, and migration, triggering a Class I recall and heightening regulatory scrutiny. The FDA also flagged Stereotactic disposable needle kits that risked stainless-steel debris contamination, prompting EU vigilance notices and procurement freezes. Hospitals now impose stricter supplier audits and require real-time batch traceability, lengthening sales cycles and raising support costs for manufacturers. These episodes dampen near-term volume growth within the Europe biopsy devices market but reinforce the strategic value of robust quality-management systems.

Other drivers and restraints analyzed in the detailed report include:

- Shift Toward Ambulatory & Outpatient Biopsy Centers

- EU In-Vitro Diagnostic Regulation Driving Device Upgrades

- Stringent MDR Certification Timelines Causing Supply Gaps

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Needle-based systems dominated the Europe biopsy devices market with a 48.25% revenue share in 2024, and they will grow at an 8.35% CAGR toward 2030 as physicians upgrade to core and vacuum-assisted platforms that minimize sampling errors. Core devices now feature sharper tip designs, proprietary coatings, and adjustable throw lengths that preserve tissue architecture for genomic assays. Vacuum-assisted handpieces collect multiple contiguous cores through a single incision, reducing repeat procedures; the VACIS trial even positions vacuum excision as a surgery-sparing option for low-grade ductal carcinoma in situ. Steady demand also persists for localization wires and radioactive seed systems that guide breast-conserving surgery, although adoption varies with reimbursement. Digital guidance consoles integrate electromagnetic tracking with real-time ultrasound, easing workflow in busy ambulatory centers. NeoDynamics' pulse-technology device underscores continuing innovation aimed at shortening procedure time and operator learning curves.

Procedure trays, markers, and ancillary kits deliver recurring consumable sales that insulate vendors from capital-budget cycles. Price competition remains moderate because MDR compliance costs limit new entrants. Hospitals prioritize suppliers that offer comprehensive portfolios-core needles, vacuum systems, localization tools, and AI-ready consoles-along with field-service capabilities that ensure uninterrupted screening workflows.

The Europe Biopsy Devices Market Report is Segmented by Product (Needle-Based Biopsy Instruments [Core Biopsy Devices, and More], Procedure Trays, and More), Application (Breast Biopsy, Lung Biopsy, Colorectal Biopsy, and More), End User (Hospitals, Diagnostic & Imaging Centers, and More), and Geography (Germany, United Kingdom, France, Italy, Spain, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Beckton Dickinson

- Hologic

- Devicor Medical Products

- Cook Group

- Boston Scientific

- Intact Medical

- Gallini Medical

- TSK Laboratory Europe

- Argon Medical Devices

- Medtronic

- Olympus

- Cardinal Health

- Danaher

- Stryker

- IZI Medical Products

- FUJIFILM

- Merit Medical Systems

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Preference For Minimally-Invasive Procedures

- 4.2.2 Rising Cancer Screening Programs Across EU-27

- 4.2.3 Shift Toward Ambulatory & Outpatient Biopsy Centers

- 4.2.4 Technological Convergence Of Imaging-Guided Robotics

- 4.2.5 EU In-Vitro Diagnostic Regulation Driving Device Upgrades

- 4.3 Market Restraints

- 4.3.1 Product Recalls & Safety Notices

- 4.3.2 Stringent MDR Certification Timelines Causing Supply Gaps

- 4.3.3 Limited Reimbursement For Novel Vacuum-Assisted Systems

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Needle-based Biopsy Instruments

- 5.1.1.1 Core Biopsy Devices

- 5.1.1.2 Aspiration Biopsy Needles

- 5.1.1.3 Vacuum-assisted Biopsy Devices

- 5.1.2 Procedure Trays

- 5.1.3 Localization Wires

- 5.1.4 Other Products

- 5.1.1 Needle-based Biopsy Instruments

- 5.2 By Application

- 5.2.1 Breast Biopsy

- 5.2.2 Lung Biopsy

- 5.2.3 Colorectal Biopsy

- 5.2.4 Prostate Biopsy

- 5.2.5 Other Applications

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Diagnostic & Imaging Centers

- 5.3.3 Ambulatory Surgical Centers

- 5.3.4 Others

- 5.4 Geography

- 5.4.1 Germany

- 5.4.2 United Kingdom

- 5.4.3 France

- 5.4.4 Italy

- 5.4.5 Spain

- 5.4.6 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Becton, Dickinson and Company

- 6.3.2 Hologic Inc.

- 6.3.3 Devicor Medical Products Inc.

- 6.3.4 Cook Medical

- 6.3.5 Boston Scientific Corporation

- 6.3.6 Intact Medical Corporation

- 6.3.7 Gallini Medical

- 6.3.8 TSK Laboratory Europe BV

- 6.3.9 Argon Medical Devices

- 6.3.10 Medtronic plc

- 6.3.11 Olympus Corporation

- 6.3.12 Cardinal Health

- 6.3.13 Danaher Corporation

- 6.3.14 Stryker Corporation

- 6.3.15 IZI Medical Products

- 6.3.16 FUJIFILM Holdings Corporation

- 6.3.17 Merit Medical Systems

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment