PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1430003

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1430003

Latin America General Aviation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

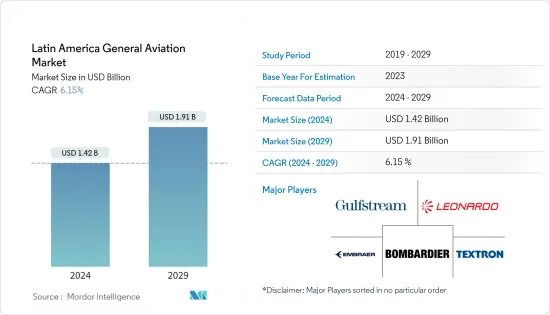

The Latin America General Aviation Market size is estimated at USD 1.42 billion in 2024, and is expected to reach USD 1.91 billion by 2029, growing at a CAGR of 6.15% during the forecast period (2024-2029).

Key Highlights

- The general aviation industry in Latin America is primarily recognized due to the presence of Embraer, a major aircraft OEM headquartered in Brazil. Moreover, Brazil has the largest fleet of business jets in Latin America, and it has the second-largest business jet fleet in the world.

- The key initiatives to improve general aviation (GA) safety, such as the GA Joint Steering Committee (GAJSC), ADS-B Out (that came into force from 2020), new Airman Certification Standards (ACS), streamlining aircraft certification, the External Data Access initiative (EDAi), and the Fly Safe outreach campaign on Loss of Control, are some of the areas of focus currently. With air travel becoming safer over the years due to the introduction of enhanced safety standards has triggered a flurry of procurement of general aviation aircraft in the region.

- Some of the countries in Latin America have plans to modernize and expand their airports, over the next decade. Such improvements in the airport infrastructure may create a positive impact on the general aviation market, in the upcoming period.

Latin America General Aviation Market Trends

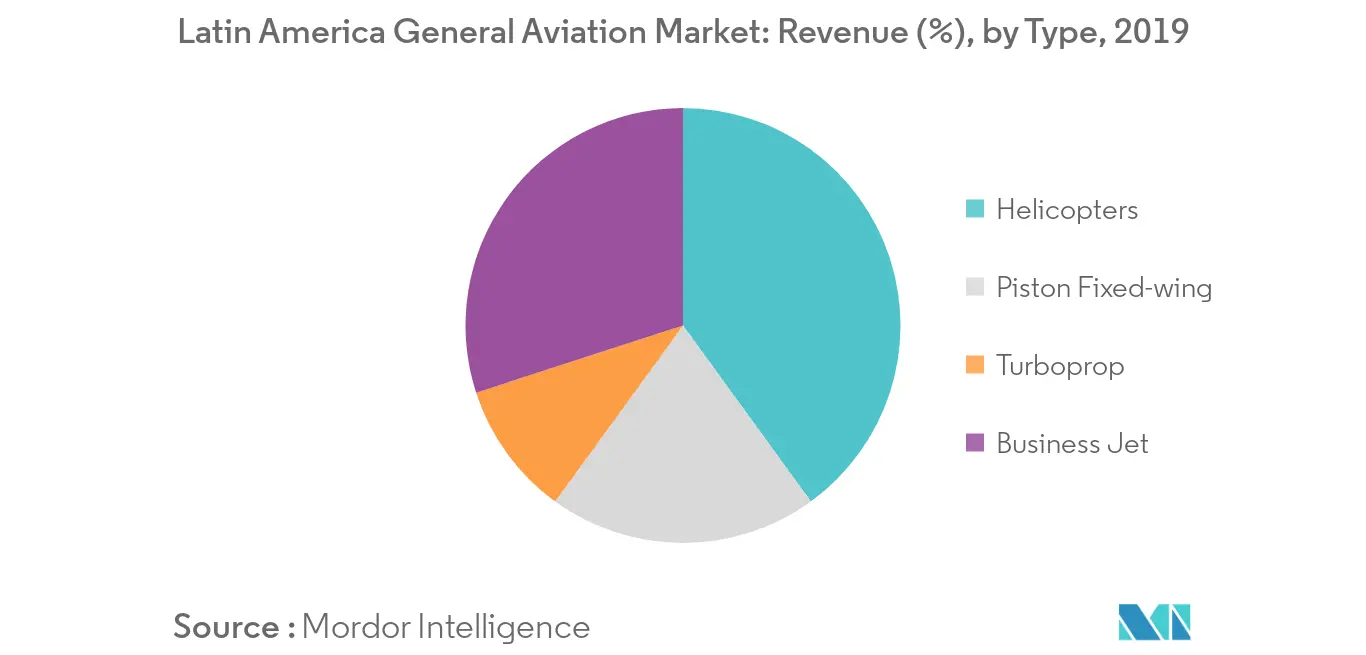

The Helicopters Segment to Experience the Highest Growth During the Forecast Period

Helicopters are excellent for short destinations with no airport. Intelligently designed and highly adaptable to address a range of individual requirements, their capabilities allow access to remote areas and city centers, with the ability to land at helipads, hotels and even private properties. Air charter services have emerged as a potential gamechanger for commercial aviation. On this note, availing a helicopter charter service removes the stress of airports, traffic jams and public transport, while also eliminating the costs of overnight accommodation. Helicopters have become an indispensable aid for conducting rescue missions at remote locations with inaccessible terrain. Post a disaster, helicopters are deployed to gain an overall view of the situation in order to be able to mount a rescue operation in the most effective manner. The demand for helicopters, though facing a slight decline as compared to the demand during the period 2010-2015, is still strong owing to the emergence of new ownership and service models which has enabled market players to achieve sustainability.

The sustained demand for helicopters has encouraged OEMs to release new variants of their product portfolio to cater to the specific requirements of a broad clientele. For instance, in March 2019, Airbus helicopters, the helicopter manufacturing division of Airbus SE (Airbus), launched an improved version of the H145, featuring a unique five-bladed design. The company also secured 43 orders for its entire range of civil products, namely the H125, H130, H135, H145, H160, H175 and H225. Also, in April 2018, Airbus Helicopters received the first order from an undisclosed customer in Brazil, for a single unit of H160 for private and business aviation operations.

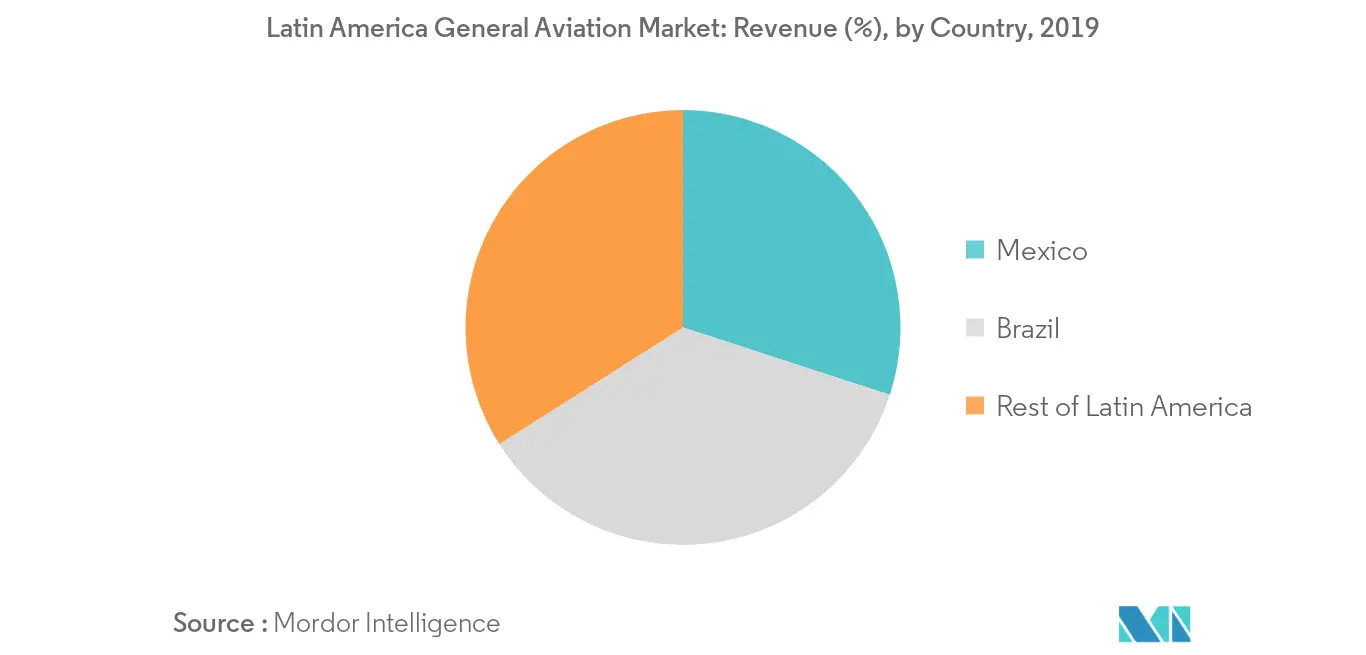

Brazil held the Highest Market Share in 2019

By mid-2019, Brazil had about 2,000 executive turboprops and jets, which connected about 1,225 municipalities across the country. Turboprop operators benefitted from the gaps in airport infrastructure and the challenging geography of the country. Since turboprops require short runways, the demand is high for these aircraft. Currently, turboprops account for over 60% of the executive aircraft fleet in Brazil. In 2019, 19 business jets were delivered in Brazil, as compared to 12 deliveries in 2018.

Sao Paulo, with about 500 registered helicopters and 700 flights per day, has the largest helicopter fleet in the world. The fleet is expected to further increase in the coming years, primarily due to the streets being highly congested and as people who can afford are opting for helicopters as a means of transportation for business operations. To support the growing fleet of helicopters, the city has developed appropriate infrastructure for the fleet, along with a dedicated helicopter traffic tower. In 2019, Leonardo's helicopter division secured five new orders from Brazilian customers, which were valued at nearly USD 33 million. The orders include three AW109 Trekker light twins, an AW109 GrandNew, and an AW169 intermediate twin. All three Trekker helicopters were ordered in VIP configuration. Leonardo estimated the latest order for the VIP-configured AW169 to bring the number of this version operating in Brazil to five before the end of 2019.

Latin America General Aviation Industry Overview

Some of the prominent players in the Latin America general aviation market are Leonardo S.p.A., Embraer SA, Textron Inc., Gulfstream Aerospace Corporation (General Dynamics), Bombardier Inc., and Honda Aircraft Company. With the growing demand for business and VIP transportation in the region, various OEMs, like Leonardo, Airbus, and Bell Helicopters, among others are planning to develop new business strategies for increasing their presence in the general aviation market of Latin America. The companies are also planning to develop new manufacturing and MRO facilities in the region, which may help the existing as well as new customers, thereby making them the preferred aircraft/helicopter OEMs for new orders and deliveries in the upcoming period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Helicopters

- 5.1.2 Piston Fixed-wing

- 5.1.3 Turboprop

- 5.1.4 Business Jet

- 5.2 Country

- 5.2.1 Mexico

- 5.2.2 Brazil

- 5.2.3 Rest of Latin America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Leonardo S.p.A.

- 6.1.2 Textron Inc.

- 6.1.3 Embraer SA

- 6.1.4 Pilatus Aircraft

- 6.1.5 Dassault Aviation SA

- 6.1.6 Piper Aircraft Inc.

- 6.1.7 Bombardier Inc.

- 6.1.8 AeroAndina SA

- 6.1.9 Gulfstream Aerospace Corporation

- 6.1.10 Honda Aircraft Company

- 6.1.11 Airbus SE

7 MARKET OPPORTUNITIES AND FUTURE TRENDS