PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851997

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851997

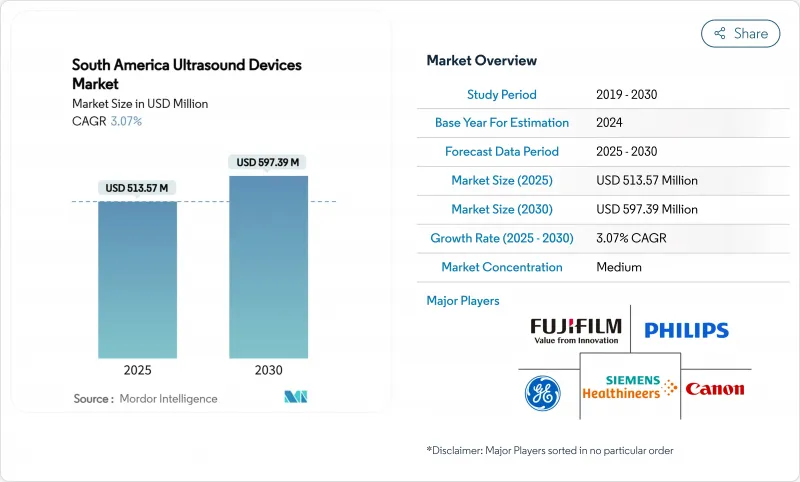

South America Ultrasound Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The South America Ultrasound Devices Market size is estimated at USD 513.57 million in 2025, and is expected to reach USD 597.39 million by 2030, at a CAGR of 3.07% during the forecast period (2025-2030).

Current growth is driven by wider reimbursement coverage, rising non-communicable diseases, and the steady roll-out of AI-enabled and wireless systems that improve workflow efficiency and expand access. Brazil continues to anchor the South America ultrasound devices market through a large installed base, while Argentina is setting the growth pace as public and private investment modernizes imaging infrastructure. Portable models are penetrating secondary cities, addressing physician shortages and catalyzing wider usage across point-of-care settings. High-intensity focused ultrasound (HIFU) is gaining traction as an adjunct therapy in oncology, stimulating incremental demand for next-generation platforms.

South America Ultrasound Devices Market Trends and Insights

Expansion of Imaging Reimbursement Boosting Ultrasound Adoption

Broader reimbursement schemes are strengthening the South America ultrasound devices market by lowering out-of-pocket costs for patients and supporting provider economics. Brazil's Medicare now reimburses an average USD 17,500 for histotripsy therapy, encouraging hospitals to procure high-end HIFU systems. Argentina added carotid and femoral ultrasound to preventive screening, revealing carotid plaques in 51% of asymptomatic adults, which underscores early detection value. Colombia extended telemedicine reimbursement to remote ultrasound interpretation, with 86% of facilities using ICTs for maternal care, fueling demand for cloud-connected probes. These policy shifts reinforce supplier incentives to align product portfolios with reimbursed procedures. Healthy reimbursement further alleviates margin pressure for providers operating in cash-limited public systems.

Escalating Non-Communicable Disease Burden Driving Demand for Cardiac & Abdominal Ultrasound

Non-communicable diseases remain the largest mortality contributor in the region and elevate routine imaging needs. Colombia recorded 117,620 new cancer cases in 2024, accelerating uptake of real-time ultrasound for tumor staging and guidance. Vascular ultrasound studies in Argentina detected subclinical carotid plaques in more than half of tested adults, signifying a silent surge in atherosclerosis. Brazil's elderly population is set to reach 37.8% by 2070, and life expectancy could climb to 83.9 years, broadening chronic disease management workloads. Continuous imaging underpins timely intervention, particularly for cardiac, abdominal, and vascular assessments. Consequently, hospitals are enlarging their ultrasound fleets while outpatient centers focus on portable devices for routine follow-up.

Prolonged & Divergent Regulatory Approval Processes

Medical device firms face heterogeneous and often lengthy approval frameworks that slow product launches. Brazil's ANVISA requires Class III and Class IV systems to obtain full registration and Brazil-Good Manufacturing Practice certificates, extending timelines by 5-6 months. Although 2024 regulations permit reliance on foreign approvals, discordant documentation rules across neighboring countries still impose added compliance cost. The constraint curbs initial market entrance for smaller innovators and prolongs access to the latest features, dampening the competitive intensity within the South America ultrasound devices market.

Other drivers and restraints analyzed in the detailed report include:

- Adoption of AI-Enabled & Wireless Ultrasound Solutions Enhancing Workflow Efficiency

- Government and Private Funding for R&D in Ultrasound Imaging

- Limited Availability of Certified Sonographers and Radiologists in Secondary Cities

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Radiology upheld supremacy in the South America ultrasound devices market with 26.81% share in 2024, backed by its integral role in multi-specialty diagnostics and the growing integration of AI-powered measurement tools. The South America ultrasound devices market size for radiology benefited from faster workflow, as seen with Siemens Acuson Sequoia 3.5 that automates organ labeling. Cardiology and gynecology/obstetrics remain sizable due to heightened screening, while critical care leverages point-of-care scanning for rapid triage.

Anesthesiology is projected to log a 4.97% CAGR through 2030, marking the quickest rise among applications. Wider uptake of ultrasound-guided nerve blocks improves procedural success and patient outcomes; Mindray's regional anesthesia education series strengthens clinician proficiency. Hospital procurement teams now bundle portable probes with operating-room carts, sustaining momentum. Rising surgical volumes and enhanced patient safety protocols will continue to propel anesthesiology's contribution to the South America ultrasound devices market.

The 3D/4D technology tier captured 47.27% of the South America ultrasound devices market share in 2024, driven by superior volumetric clarity essential for fetal assessments and oncology staging. AI-enabled platforms like GE Voluson Signature 20 shorten second-trimester exams by 40%, underscoring efficiency gains. Conventional 2D remains relevant through AI-enhanced image optimisation, while Doppler supports cardiovascular evaluation.

HIFU systems will record a 5.15% CAGR to 2030, the fastest among technologies, buoyed by non-invasive tumor ablation success. Liver cancer histotripsy cases surpassing 300 globally demonstrate clinical acceptance. Expansion into prostate and uterine fibroid therapy will widen indications, adding momentum to the South America ultrasound devices market size growth for therapeutic platforms.

The South America Ultrasound Devices Market Report is Segmented by Application (Anesthesiology, Cardiology, Gynecology/Obstetrics, and More), Technology (2D Ultrasound Imaging, and More), Portability (Stationary Systems, and More), End User (Hospitals & Surgical Centers, and More), and Geography (Brazil, Argentina, Chile, Colombia, and Rest of South America). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- GE HealthCare Technologies Inc.

- Siemens Healthineers

- Koninklijke Philips

- FUJIFILM

- Canon

- Mindray Bio-Medical Electronics Co., Ltd.

- Samsung Group

- Hitachi, Ltd. (Healthcare Solutions)

- Hologic

- Esaote

- Konica Minolta

- Clarius Mobile Health Corp.

- Butterfly Network, Inc.

- Terason (Teratech Corp.)

- Shimadzu

- Telemed Medical Systems

- EDAN Instruments Inc.

- Vinno Technology Co. Ltd.

- Landwind Medical

- ContextVision AB

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of Imaging Reimbursement Boosting Ultrasound Adoption

- 4.2.2 Escalating Non-Communicable Disease Burden Driving Demand for Cardiac & Abdominal Ultrasound

- 4.2.3 Adoption of AI-Enabled & Wireless Ultrasound Solutions Enhancing Workflow Efficiency

- 4.2.4 Government and Private Funding for R&D in Ultrasound Imaging

- 4.2.5 Rising Cancer Incidence Driving Demand for Radiation-Free Imaging

- 4.2.6 Growth in Portable & Telemedicine-Integrated Ultrasound Devices

- 4.3 Market Restraints

- 4.3.1 Prolonged & Divergent Regulatory Approval Processes

- 4.3.2 Limited Availability of Certified Sonographers and Radiologists in Secondary Cities

- 4.3.3 High Equipment Costs & Maintenance Burden

- 4.3.4 Limited Access in Remote & Underserved Regions

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Application

- 5.1.1 Anesthesiology

- 5.1.2 Cardiology

- 5.1.3 Gynecology / Obstetrics

- 5.1.4 Musculoskeletal

- 5.1.5 Radiology

- 5.1.6 Critical Care

- 5.1.7 Other Applications

- 5.2 By Technology

- 5.2.1 2D Ultrasound Imaging

- 5.2.2 3D & 4D Ultrasound Imaging

- 5.2.3 Doppler Imaging

- 5.2.4 High-intensity Focused Ultrasound (HIFU)

- 5.2.5 Other Technologies

- 5.3 By Portability

- 5.3.1 Stationary Systems

- 5.3.2 Portable Cart-based Systems

- 5.3.3 Handheld / Wireless Systems

- 5.4 By End User

- 5.4.1 Hospitals & Surgical Centers

- 5.4.2 Diagnostic Imaging Centers

- 5.4.3 Ambulatory Care & Emergency Centers

- 5.4.4 Other End Users

- 5.5 By Country

- 5.5.1 Brazil

- 5.5.2 Argentina

- 5.5.3 Chile

- 5.5.4 Colombia

- 5.5.5 Rest of South America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 GE HealthCare Technologies Inc.

- 6.3.2 Siemens Healthineers AG

- 6.3.3 Koninklijke Philips N.V.

- 6.3.4 FUJIFILM Holdings Corporation

- 6.3.5 Canon Medical Systems Corporation

- 6.3.6 Mindray Bio-Medical Electronics Co., Ltd.

- 6.3.7 Samsung Medison Co., Ltd.

- 6.3.8 Hitachi, Ltd. (Healthcare Solutions)

- 6.3.9 Hologic, Inc.

- 6.3.10 Esaote SpA

- 6.3.11 Konica Minolta, Inc.

- 6.3.12 Clarius Mobile Health Corp.

- 6.3.13 Butterfly Network, Inc.

- 6.3.14 Terason (Teratech Corp.)

- 6.3.15 Shimadzu Corp.

- 6.3.16 Telemed Medical Systems

- 6.3.17 EDAN Instruments Inc.

- 6.3.18 Vinno Technology Co. Ltd.

- 6.3.19 Landwind Medical

- 6.3.20 ContextVision AB

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment