PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1694005

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1694005

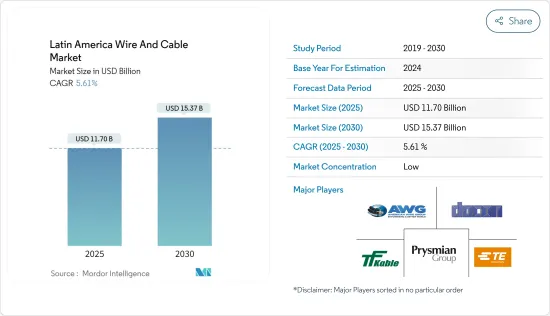

Latin America Wire And Cable - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Latin America Wire And Cable Market size is estimated at USD 11.70 billion in 2025, and is expected to reach USD 15.37 billion by 2030, at a CAGR of 5.61% during the forecast period (2025-2030).

Surging energy demand, fueled by population growth and urbanization, drives the growth of the market studied. Additionally, industrial expansion, the integration of renewable energy, and infrastructure development necessitate extensive power distribution networks that depend on these cables.

Growing Construction Activities Driving the Growth of the Wire & Cable Market

Key Highlights

- As the region's population grows and its economy develops, electricity consumption is surging, leading to the need for extensive power distribution networks. This urbanization and population boom have catalyzed the rise of new residential and commercial buildings.

- In response to the escalating demand for construction products, cable manufacturers are ramping up their production capacities for fire-resistant cables. These cables are engineered to curb flame spread and come equipped with sheaths that gauge smoke and toxic gas emissions. They're predominantly utilized in commercial buildings, as well as in wiring for expansive residential and manufacturing units.

The Rising Number of Data Center Facilities and Investment from IT and Telecom Providers are Further Driving the Studied Market

Key Highlights

- An increase in data centers in the regions may further propel the growth of the studied market. For instance, In January 2023, the Santos Port Authority (SPA) partnered with Brazilian firm Zeittec to construct a new data center. Zeittec and SPA, the state-owned entity overseeing the Port of Santos in Sao Paulo, finalized a building agreement. Work on the SPA Safe Room is set to commence in January and conclude by mid-2023. The SPA Safe Room boasts NBR 10.636-certified walls, ensuring fire resistance for up to 120 minutes (CF 120), and is equipped with OM4 laser multimode optical fibers and CAT 6A structured cabling.

- In October 2023, Elea Digital, a Brazilian data center provider, expanded its RJO1 data center to 2.5MW. The company invested Brazilian Real (BRL) 100 million (USD 20.15 million) to add 500 sqm (5,382 sq ft) of space and 2.5MW of IT capacity in Rio de Janeiro.

Fluctuating Raw Material Prices Could Hinder the Market Growth

Key Highlights

- The price fluctuations in four key materials-gold, copper/brass, steel, and thermoplastics-account for 75% of the costs in connector production. While these are the primary materials, others like nickel and silver are also utilized in connectors. Due to a slowdown in the Chinese economy, which usually buys about 50% of newly mined copper, copper prices are expected to remain flat with a slight increase for the rest of 2024.

As the demand for speed and efficiency surges, fiber-optic technology is evolving. Innovations like optical couplers and optical switches are paving the way for AON (all-optical networks) communication. This advancement enables data transmission without electrical processing, facilitating longer transmission distances. Such technological strides in fiber optics are poised to propel market growth in the region during the forecast period.

Latin America Wire And Cable Market Trends

Power Cable Holds Major Market Share

- Power cables are used in power transmission and distribution networks to transport electricity over long distances from power plants to substations and industrial facilities, commercial buildings, and residential areas. These cables are designed to carry high-voltage electrical currents of more than 1,000 volts.

- Power cables find diverse applications, from subsea installations and onshore facilities to the construction sector. They play a crucial role in large-scale power transmission projects, powering construction machinery and providing temporary power distribution through generators or temporary substations. Beyond construction, these cables serve automotive, industrial, and residential needs.

- Also, increasing investment in grid modernization is expected to drive market growth. Many countries are upgrading and modernizing their electrical grids to enhance efficiency, reliability, and resilience. This involves replacing existing power cables with more advanced technologies, such as high-voltage direct current cables or superconducting cables, to accommodate higher power demands and improve grid stability.

- Leading the charge in Latin America's smart meter adoption are Mexico and Brazil. Brazilian utilities, including AES Eletropaulo, Celpa, Eletrobras, and Light, have progressed from pilot projects to extensive multimillion-meter deployments. Highlighting the momentum, state-run utility CFE aims to transition 30.2 million consumers to smart meters in Mexico by 2025. Emerging markets like Peru, Colombia, and Chile are also projected to show heightened demand for smart meters, further fueling market growth during the forecast period.

- According to 5G Americas, as of June 2023, 28 5G networks were deployed in Latin America and the Caribbean. Brazil and Chile accounted for four networks of this next-generation technology each. Mexico, Peru, and Puerto Rico followed with 3 5G network deployments each.

Brazil to Hold Major Share

- Brazil is making substantial investments in its Wire & Cable market, driven by a surge in demand from the power generation and transmission sectors, particularly as power transmission networks undergo renewal.

- Rising electricity consumption is poised to drive the growth of the market under study. Camara de Comercializacao de Energia Eletrica (CCEE) (Brazil) forecasts that Brazil's electricity consumption will hit 519.4 TWh in 2023, marking a roughly 25% increase from the previous year. Looking ahead, Brazil's electricity consumption is set to keep climbing, with projections exceeding 590 terawatt-hours by 2027.

- Brazil has made significant advancements in renewable energy, with these sources now powering over 80% of the nation's electrical grid, a stark contrast to the 20% in the United States. Yet, the oil sector remains influential, contributing 3% to Brazil's GDP and showing signs of growth. In August 2024, President Lula unveiled the New Growth Acceleration Program (New PAC), emphasizing increased funding for environmental sustainability and a transition to a greener economy. Notably, the program also anticipates heightened investments in fossil fuels.

- Brazil is making substantial investments in its telecom sector, potentially driving up demand in the studied market. The Brazilian Software Association (ABES) highlights Brazil as the largest technology ecosystem in Latin America. Data from Equinix indicates that Information Technology (IT) investments in Latin America grew by 1.3% in recent years, with a projected upswing of 4-5% in the near future. Brazilian investments in the IT and telecom sectors are set to reach approximately USD 40-50 billion each. Such investments are poised to significantly bolster both the cloud computing and data center markets.

- As reported by GSMA, Brazil is on track to surpass 218 million smartphone connections by 2025. This surge in smartphone adoption is expected to drive a substantial demand for 5G network deployments. Leading the region, Brazil boasts 77% of the total 5G connections.

Latin America Wire And Cable Industry Overview

Rising demand, fueled by heightened awareness, internet service penetration, and investments in digital infrastructure, intensifies competition among market players.

The Latin America wire and cable market features established players with significant investments in products and manufacturing. While new entrants face moderate investment requirements, their survival hinges on robust competitive strategies. Product innovations can bolster their market presence by targeting emerging, less-explored application areas.

Vendors such as Tele-Fonika Kable SA, Prysmian Group, TE Connectivity, American Wire Group, Dacon Systems Inc., Fujikura Ltd, Encore Wire, Coherent Corporation, Belden Incorporated, and Southwire Company LLC have strategically aligned themselves to large-scale cable and wire production. Product launches, partnerships, and acquisitions are intensifying the competitive landscape. Industry players focus on product development, innovative breakthroughs, and expansions to tap into high-growth and emerging use cases.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY AND KEY FINDINGS

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Infrastructure Development and Continuing Smart City Projects

- 5.1.2 Continuous Expansion in the Telecommunications Industry

- 5.2 Market Restraints

- 5.2.1 High Cost of Installation and Associated Complexities

6 MARKET SEGMENTATION

- 6.1 By Cable Type

- 6.1.1 Fiber Optic Cable

- 6.1.2 Signal and Control Cable

- 6.1.3 Power Cable

- 6.1.4 Others

- 6.2 By End-user Vertical

- 6.2.1 Construction (Residential and Commercial)

- 6.2.2 Telecommunications (IT & Telecom)

- 6.2.3 Power Infrastructure (Energy and Power, Automotive)

- 6.2.4 Others End-user Verticals

- 6.3 By Country

- 6.3.1 Mexico

- 6.3.2 Brazil

- 6.3.3 Argentina

7 BRAZIL MARKET OUTLOOK

- 7.1 Key Vendors in Brazil

- 7.1.1 Acome

- 7.1.2 Grupo Alubar

- 7.1.3 Brascopper

- 7.1.4 Cabelauto

- 7.1.5 Cablena

- 7.1.6 Cabletech Cabos

- 7.1.7 Cobrecom

- 7.1.8 Cobreflex

- 7.1.9 Cofibam

- 7.1.10 Condex.

- 7.1.11 Condumax Industria e Comercio Ltda

- 7.1.12 Condumig Wire & Cables

- 7.1.13 Dipro do Brasil (Conduspar)

- 7.1.14 Copperfio S.A.

- 7.1.15 Induscabos Industria e Comercio de Condutores Eletricos Ltda.

- 7.1.16 Italcabos

- 7.1.17 Lamesa Cabos Eletricos.

- 7.1.18 Nexans

- 7.1.19 Pan Electric

- 7.1.20 Prysmian S.p.A

- 7.1.21 Tramar Condutores Especiais

- 7.1.22 Yangtze Optical Fiber & Cable Joint Stock Limited Company

- 7.1.23 ZTT Group

- 7.1.24 AF Datalink Cabos, Conexoes E Sistemas Ltda.

- 7.1.25 Dacota Cabos Eletricos

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 TELE-FONIKA KABLE SA (TFKABLE)

- 8.1.2 Prysmian S.p.A

- 8.1.3 TE Connectivity Corporation

- 8.1.4 American Wire Group

- 8.1.5 Dacon Systems Inc.

- 8.1.6 Fujikura Ltd.

- 8.1.7 Encore Wire

- 8.1.8 Coherent Corporation

- 8.1.9 Belden Inc.

- 8.1.10 Southwire Company LLC

9 MARKET OUTLOOK