PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851731

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851731

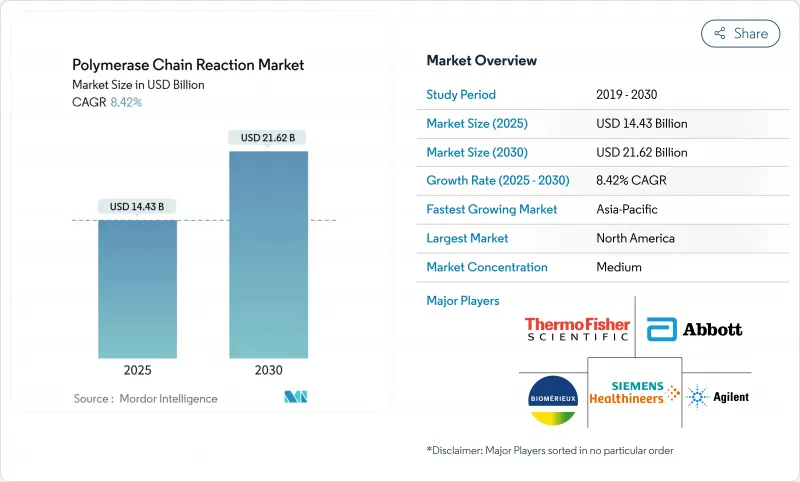

Polymerase Chain Reaction - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Polymerase Chain Reaction Market size is estimated at USD 14.43 billion in 2025, and is expected to reach USD 21.62 billion by 2030, at a CAGR of 8.42% during the forecast period (2025-2030).

Growth arises from the shift toward precision diagnostics, where digital systems and AI-enhanced platforms command premium prices despite lower unit volumes compared with traditional amplification instruments. Liquid biopsy adoption accelerates because circulating tumor DNA testing relies on absolute quantification that only digital PCR can deliver. Competitive intensity is shaped by the bifurcation between high-volume, low-margin testing and premium oncology applications, while sustainability concerns over single-use plastics push vendors to redesign consumables. The PCR market benefits from regulatory harmonization in Asia-Pacific and hospital consolidation in North America, both of which incentivize automated, multiplex systems that fit into streamlined laboratory workflows.

Global Polymerase Chain Reaction Market Trends and Insights

Increasing application in clinical diagnostics

Hospitals now integrate PCR into routine pathology services for cancer biomarker detection and newborn genetic screening. Roche deployed 100 cobas 5800 systems in 2024 to support high-throughput panels that cut per-test costs while boosting laboratory efficiency. FDA Emergency Use Authorization for the cobas Liat assay that simultaneously detects SARS-CoV-2, Influenza A/B, and RSV shows syndromic testing gaining traction in point-of-care settings. Digital PCR further advances minimal residual disease monitoring in hematologic cancers by detecting ultra-low tumor burden levels not reachable by qPCR. Consolidated laboratory networks demand platforms that handle diverse menus with minimal operator intervention, contributing to steady PCR market growth.

Rising demand for personalized & precision medicine

Companion diagnostics have moved from research settings into routine oncology practice, expanding the PCR market as drug developers seek assays that match therapies to biomarker-defined patient subgroups. The European Liquid Biopsy Society standardized circulating tumor DNA workflows across 93 institutions in 2024, paving the way for broader digital PCR adoption. QIAGEN released more than 100 validated assays for its QIAcuity platform, demonstrating the shift from generic reagents toward disease-specific panels. Bio-Rad partnered with Oncocyte to deliver transplant monitoring tests based on droplet digital PCR, pushing the technology beyond oncology.

High cost of instruments and maintenance

Capital budgets in emerging economies seldom cover high-end molecular platforms. A cost-effectiveness model put per-patient PCR testing for oncology biomarkers at USD 18,246 versus USD 8,866 for next-generation sequencing, underscoring economic challenges. QIAGEN's withdrawal of its NeuMoDx system shows the difficulty of sustaining costly hardware once pandemic volumes recede. Leasing programs help spread expenses, yet maintenance contracts still deter smaller labs. Developers exploring yeast-derived polymerases may cut reagent costs, though instrument amortization remains the bigger hurdle.

Other drivers and restraints analyzed in the detailed report include:

- Technological advances in PCR platforms

- Growth in infectious-disease screening outside hospitals

- Emergence of NGS & isothermal amplification alternatives

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Reagents & Consumables held 48.94% of PCR market share in 2024, reflecting the instrument-agnostic demand for enzymes and master mixes that laboratories reorder each week. Digital PCR Systems are forecast to grow at a 13.78% CAGR, lifting their portion of the PCR market size for products that deliver absolute quantification essential for companion diagnostics. Traditional thermal cyclers face commoditization; vendors therefore differentiate through bundled software, automation modules, and inclusive service contracts to protect margins. High-throughput integrated platforms appeal to consolidated laboratories that seek lower labor costs and standardized quality control.

Portable and point-of-care devices represent the frontier where miniaturization and low power consumption unlock new settings such as ambulances and rural clinics. The South Korean Lab On An Array unit shows how MEMS chips trim energy draw while keeping analytical sensitivity. Software and cloud analytics grow in importance as AI suggests primer designs that limit off-target amplification. QIAGEN expects its bioinformatics arm to cross USD 100 million in revenue by 2027, underscoring that data management can now rival hardware in value creation.

The Polymerase Chain Reaction Market Report Segments the Industry Into by Product (Instruments, Reagents and Consumables, Software and Services), Application (Clinical Diagnostics, Drug Discovery and Development, and More), End User (Hospitals and Diagnostic Laboratories, and More), and Geography (North America, Europe, Asia-Pacific, Middle-East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 36.85% of PCR market share in 2024, supported by well-funded healthcare systems and a dense pharmaceutical industry. Hospital chains favor high-throughput automation to meet consolidated testing loads, and federal laboratories invest in biosecurity panels that keep the PCR market dynamic. The region's regulatory clarity encourages next-generation platform launches that offer faster run times and multiplex abilities.

Asia-Pacific is set to grow at a 13.23% CAGR through 2030, becoming the engine of PCR market expansion. Governments allocate record budgets for genomics as they roll out universal health coverage. China's Healthy China 2030 initiative channels capital toward domestic manufacturing that reduces import reliance, creating local competitors alongside global brands. India's Production Linked Incentive scheme grants tax credits for diagnostic device production, directly bolstering regional PCR capability.

Europe benefits from strong academic networks and pan-regional data initiatives. The forthcoming European Health Data Space regulation will unify electronic health records, easing multi-country clinical research that relies on PCR-based endpoints. Although austerity budgets in some member states restrict capital spending, demand for liquid biopsy assays in major oncology centers sustains revenue. Middle East & Africa and South America remain nascent but show rising infrastructure investment, particularly in private labs that cater to medical tourism and agriculture testing, gradually enlarging their role in the global PCR market.

- Thermo Fisher Scientific

- Roche

- Bio-Rad Laboratories

- QIAGEN

- Abbott Laboratories

- Danaher (Cepheid)

- Agilent Technologies

- Merck

- PerkinElmer

- Illumina (Veridose PCR lines)

- Siemens Healthineers

- bioMerieux

- Promega

- Eppendorf

- Takara Bio

- LGC Biosearch Technologies

- QuantuMDx Group

- Beckton Dickinson

- Analytik Jena GmbH

- Hamilton Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Application in Clinical Diagnostics

- 4.2.2 Rising Demand for Personalized & Precision Medicine

- 4.2.3 Technological Advances in PCR Platforms

- 4.2.4 Growth In Infectious-Disease Screening Outside Hospitals

- 4.2.5 Mini-Microfluidic PCR For Point-of-Care in Emerging Markets

- 4.2.6 AI-Driven Multiplex Assay Design Accelerating Adoption

- 4.3 Market Restraints

- 4.3.1 High Cost of Instruments and Maintenance

- 4.3.2 Emergence of NGS & Isothermal Amplification Alternatives

- 4.3.3 Sustainability Concerns Over Single-Use Plastic Waste

- 4.3.4 Data-Privacy Regulation Limiting Cloud-PCR Data Sharing

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product

- 5.1.1 Instruments

- 5.1.1.1 Standard PCR Systems

- 5.1.1.2 Real-time (qPCR) Systems

- 5.1.1.3 Digital PCR Systems

- 5.1.1.4 High-throughput & Automation Platforms

- 5.1.1.5 Portable/POC PCR Devices

- 5.1.2 Reagents & Consumables

- 5.1.2.1 Enzymes & Master Mixes

- 5.1.2.2 Kits & Panels

- 5.1.2.3 Plastics & Microplates

- 5.1.3 Software & Services

- 5.1.1 Instruments

- 5.2 By Application

- 5.2.1 Clinical Diagnostics

- 5.2.1.1 Infectious Diseases

- 5.2.1.2 Oncology & Liquid Biopsy

- 5.2.1.3 Genetic & Prenatal Testing

- 5.2.2 Drug Discovery & Development

- 5.2.3 Food Safety & Agriculture

- 5.2.4 Environmental & Water Testing

- 5.2.5 Forensic Science

- 5.2.1 Clinical Diagnostics

- 5.3 By End User

- 5.3.1 Hospitals & Diagnostic Laboratories

- 5.3.2 Academic & Research Institutes

- 5.3.3 Pharmaceutical & Biotechnology Companies

- 5.3.4 Contract Research & Manufacturing Organizations

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Thermo Fisher Scientific Inc.

- 6.3.2 Roche Holding AG

- 6.3.3 Bio-Rad Laboratories Inc.

- 6.3.4 QIAGEN N.V.

- 6.3.5 Abbott Laboratories

- 6.3.6 Danaher (Cepheid)

- 6.3.7 Agilent Technologies Inc.

- 6.3.8 Merck KGaA (Sigma-Aldrich)

- 6.3.9 PerkinElmer Inc.

- 6.3.10 Illumina (Veridose PCR lines)

- 6.3.11 Siemens Healthineers

- 6.3.12 bioMerieux SA

- 6.3.13 Promega Corporation

- 6.3.14 Eppendorf SE

- 6.3.15 Takara Bio Inc.

- 6.3.16 LGC Biosearch Technologies

- 6.3.17 QuantuMDx Group Ltd

- 6.3.18 Becton, Dickinson and Company

- 6.3.19 Analytik Jena GmbH

- 6.3.20 Hamilton Company

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment