Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690982

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690982

Europe Whey Protein Ingredients - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 240 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

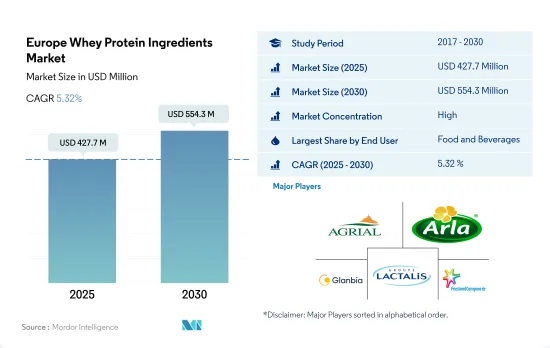

The Europe Whey Protein Ingredients Market size is estimated at 427.7 million USD in 2025, and is expected to reach 554.3 million USD by 2030, growing at a CAGR of 5.32% during the forecast period (2025-2030).

The rising fitness trend among the young population resulted in an increased market share of supplements across the region

- In 2022, food and beverage remained the largest consumer of the whey protein market in Europe. The segment's large share was primarily contributed by its sub-segments, such as snacks, bakery, and beverages, which contributed to the segment's share of 37% by volume in 2022. Boosting the snacks category, in 2021, 46% of European consumers considered protein bars healthy snacks, and 16% of consumers used protein-fortified snacks, such as protein bars, powders, cereals, and pancakes once a week. These factors boosting demand drive the whey protein market in the snacks sub-segment, which is projected to register a CAGR of 2.30% by value during the forecast period.

- The market witnessed consumer diversion from the foodservice to the retail channel in the wake of nationwide lockdowns imposed due to the COVID-19 pandemic. Consumers were engaged in the bulk purchase of food products, which boosted the food and beverage segment's market share in 2022. The demand for whey protein in the segment grew by 12% in 2022, which was about four times the growth rate of the previous year.

- The food and beverages segment was followed by the supplements segment, primarily driven by the sports/performance nutrition sub-segment. In 2022, about 80% of whey protein consumed in the supplements segment was by sports nutrition alone. In Europe, the total number of fitness clubs was 63,173 in 2021. Sports have become a component of an active, healthy lifestyle that is sought after by many consumers. This active way of life has an effect in boosting the use of gyms and the consumption of sports nutrition products. Whey protein supplementation reduces muscle damage and facilitates muscle recovery from strenuous training, thereby assisting sports performance.

Consumers' growing inclination toward functional beverages has resulted in higher demand for whey protein ingredients

- By country, the United Kingdom retained its top position in the European market by volume in 2022. The demand for whey protein in the country is majorly led by an increasing number of fitness enthusiasts and a heavy consumer influx in gyms and fitness clubs. For instance, as of 2021, 10.3 million people held a gym membership, which was over 15% of the total UK population, representing consumers' increasing reliance on performance-boosting supplements over the years. The whey protein market in the United Kingdom is highly driven by the supplements segment, which held a significant share of 64%, followed by the food and beverage industry with a 33.1% share in 2022. Thus, whey protein usage was mainly observed in sports nutrition due to the increasing number of fitness enthusiasts and fitness clubs.

- Germany was another leading country in the market in 2022, driven by high protein consumption in the food and beverage segment. Beverages is the fastest-growing sub-segment, with an expected CAGR of 7.09% during the forecast period. The demand for whey protein in beverages is rising with the growing health awareness in the country. Products such as protein water and energy drinks are becoming a trend as consumers are choosing to move away from carbonated beverages toward healthier options.

- Turkey is the fastest-growing country for whey protein and is projected to register a CAGR of 6.02% during the forecast period. The healthy eating attitudes of the majority of participants are at high and ideal levels. In particular, products containing whey protein have gained importance due to the health benefits they offer. The booming trend of healthy food in the country has created a significant demand for ingredients such as whey protein.

Europe Whey Protein Ingredients Market Trends

The expanding consumer base may benefit the sports supplements segment

- The European sports nutrition market grew by 15% during 2016-2019. However, in 2020, it witnessed a steep decline of 4.33% in the Y-o-Y growth rate. Health clubs, being one of the common sales channels for supplements, impacted the sales of sports supplements adversely as the pandemic took a harsh toll on fitness club operators, employees, and consumers. In 2020, due to government regulations, fitness clubs, health clubs, and gyms were forced to close, and club memberships declined by 10-15% in 2020 compared to the previous year. The number of clubs also decreased under the influence of the pandemic. To regain the market in the second half of 2020, the general VAT rate of 19%, which also applies to fitness services, was reduced to 16% for a limited period until the end of the year to strengthen economic demand.

- The growing number of fitness enthusiasts expands the scope of sports supplements beyond their mainstream users. As consumers flock to buy gym requisites, the demand for health and fitness products is growing, especially in developed countries like Italy, France, and Germany. These countries also emerged as the major spenders on gym memberships, supplements, training, etc. There are around 63,000 fitness centers in the region, and all these clubs jointly witness an increase of 3-4% in memberships yearly.

- The demand for sports nutrition products with natural ingredients supports market growth by providing an opportunity for manufacturers to add value to their products. The United Kingdom, Germany, Spain, and France dominate more than 70% of the European sports nutrition market. In the sports drinks segment, the United Kingdom and Germany capture over 50% of the market share.

Increasing dry whey production to stabilize whey protein prices during the forecast period

- Whey is a highly nutritional byproduct of the dairy industry. Whey powders are obtained from cheese manufacturing units. They are skimmed and concentrated before being spray-dried. European dry whey prices are steady to slightly lower. Industry sources suggest plenty of whey powder is available to meet buyer needs, and production is active. In 2022, the Netherlands had the second-highest production level for whey (about 15% of the EU total) and the fourth-highest for cheese (about 9% of the EU total).

- The significant and widespread production of cheese across major countries contributes to the dry whey production in the region. In 2022, out of the total raw milk production, a vast majority of raw milk (149.9 million tonnes) was delivered to European dairies. As of 2022, 10.4 million tonnes of cheese from 59.2 million tonnes of whole milk and 16.9 million tonnes of skimmed milk were produced in the region. Germany was the biggest producer of cheese in the EU in 2022, accounting for 22% of the total. France placed second, accounting for 18% of the total, with Italy in third. Liquid whey is processed from cheese factories and then converted to dry whey. Other prominent cheese-producing countries in the region include Italy, the Netherlands, Poland, Spain, and Denmark, among others.

- Germany is the leading producer of milk in the European Union, accounting for more than 21% of milk deliveries in 2020. The rise in milk production is attributed to the escalated volume of milk production per cow, which enables the country to produce the raw material for dry whey.

Europe Whey Protein Ingredients Industry Overview

The Europe Whey Protein Ingredients Market is fairly consolidated, with the top five companies occupying 83.71%. The major players in this market are Agrial Enterprise, Arla Foods amba, Glanbia PLC, Groupe Lactalis and Koninklijke FrieslandCampina N.V. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 90138

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 INTRODUCTION

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 KEY INDUSTRY TRENDS

- 3.1 End User Market Volume

- 3.1.1 Baby Food and Infant Formula

- 3.1.2 Bakery

- 3.1.3 Beverages

- 3.1.4 Breakfast Cereals

- 3.1.5 Condiments/Sauces

- 3.1.6 Confectionery

- 3.1.7 Dairy and Dairy Alternative Products

- 3.1.8 Elderly Nutrition and Medical Nutrition

- 3.1.9 Meat/Poultry/Seafood and Meat Alternative Products

- 3.1.10 RTE/RTC Food Products

- 3.1.11 Snacks

- 3.1.12 Sport/Performance Nutrition

- 3.1.13 Animal Feed

- 3.1.14 Personal Care and Cosmetics

- 3.2 Protein Consumption Trends

- 3.2.1 Animal

- 3.3 Production Trends

- 3.3.1 Animal

- 3.4 Regulatory Framework

- 3.4.1 France

- 3.4.2 Germany

- 3.4.3 Italy

- 3.4.4 United Kingdom

- 3.5 Value Chain & Distribution Channel Analysis

4 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 4.1 Form

- 4.1.1 Concentrates

- 4.1.2 Hydrolyzed

- 4.1.3 Isolates

- 4.2 End User

- 4.2.1 Animal Feed

- 4.2.2 Food and Beverages

- 4.2.2.1 By Sub End User

- 4.2.2.1.1 Bakery

- 4.2.2.1.2 Beverages

- 4.2.2.1.3 Breakfast Cereals

- 4.2.2.1.4 Condiments/Sauces

- 4.2.2.1.5 Dairy and Dairy Alternative Products

- 4.2.2.1.6 RTE/RTC Food Products

- 4.2.2.1.7 Snacks

- 4.2.3 Personal Care and Cosmetics

- 4.2.4 Supplements

- 4.2.4.1 By Sub End User

- 4.2.4.1.1 Baby Food and Infant Formula

- 4.2.4.1.2 Elderly Nutrition and Medical Nutrition

- 4.2.4.1.3 Sport/Performance Nutrition

- 4.3 Country

- 4.3.1 Belgium

- 4.3.2 France

- 4.3.3 Germany

- 4.3.4 Italy

- 4.3.5 Netherlands

- 4.3.6 Russia

- 4.3.7 Spain

- 4.3.8 Turkey

- 4.3.9 United Kingdom

- 4.3.10 Rest of Europe

5 COMPETITIVE LANDSCAPE

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Landscape

- 5.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 5.4.1 Agrial Enterprise

- 5.4.2 Arla Foods amba

- 5.4.3 Carbery Food Ingredients Limited

- 5.4.4 Glanbia PLC

- 5.4.5 Groupe Lactalis

- 5.4.6 Koninklijke FrieslandCampina N.V.

- 5.4.7 Lactoprot Deutschland GmbH

- 5.4.8 MEGGLE GmbH & Co. KG

- 5.4.9 Morinaga Milk Industry Co. Ltd

- 5.4.10 Sodiaal Union SCA

6 KEY STRATEGIC QUESTIONS FOR PROTEIN INGREDIENTS INDUSTRY CEOS

7 APPENDIX

- 7.1 Global Overview

- 7.1.1 Overview

- 7.1.2 Porter's Five Forces Framework

- 7.1.3 Global Value Chain Analysis

- 7.1.4 Market Dynamics (DROs)

- 7.2 Sources & References

- 7.3 List of Tables & Figures

- 7.4 Primary Insights

- 7.5 Data Pack

- 7.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.