Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690983

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690983

Europe Soy Protein - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 230 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

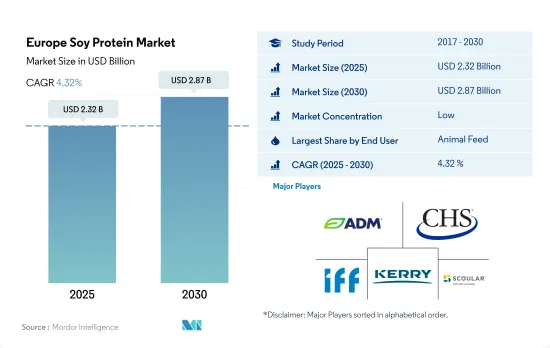

The Europe Soy Protein Market size is estimated at 2.32 billion USD in 2025, and is expected to reach 2.87 billion USD by 2030, growing at a CAGR of 4.32% during the forecast period (2025-2030).

The animal feed segment holds a significant market share due to its suitability and digestibility factors

- Soy protein is projected to register a CAGR of 2.65% by value during the forecast period in the animal feed industry. The European Union imports 18.5 million tonnes of soybean meal every year, of which 95% goes toward feeding animals. The demand for soy protein in animal feed witnessed a major push due to government initiatives and manufacturers' increased competitiveness. For instance, the Protein Plan announced by the European Federation of the Compound Feed Industry (FEFAC) boosted the demand for plant proteins significantly in the animal feed industry, including soy protein.

- The F&B industry is another key end-user segment, primarily driven by the surging demand in the RTE/RTC foods sub-segment. Thus, the segment is projected to witness the fastest CAGR of 8.99% by value. In Europe, the flexitarian population has doubled from 1.3 million to around 2.6 million in recent years, representing 3.2% of the population in 2020. Vegetarians, pescatarians, and flexitarians, the group in total, represented about 30.9% of the population in 2020. Soy protein also serves as an alternative to animal-derived meals and provides numerous functionalities like high digestibility, a great amino acid profile, a low level of anti-nutritional factors, and long shelf life.

- Soy protein holds a significant share of the supplements segment. It is projected to register a growth of 6.19% by value during the forecast period. Soy protein has the properties of lowering cholesterol levels and its high nutritional fiber content. In 2021, there were about 2.5 million Europeans affected with hypercholesterolemia. The market for soy protein witnessed an increase in demand due to the rising nutritional values and health benefits in the supplements segment.

Russia dominates the European market, majorly driven by a large consumer base and high demand from the F&B segment

- In 2020, the soy protein market in Russia saw a significant three-fold year-on-year growth, recording an 8% increase in value. This surge was primarily attributed to the country's rising raw material prices. Despite the Russian government's efforts, including the introduction of export customs duties on soybeans, prices in the Central Federal District continued to climb. Consequently, soy protein prices, specifically SPI, rose by 0.21% in 2020, outpacing the 0.16% average growth seen in the preceding four years.

- France is poised to lead the market in terms of value, with a projected CAGR of 5.14% over the forecast period. The nation had announced ambitious plans to expand its cultivation of protein-rich crops, notably soy, by 40% starting in 2022, with a goal to double this acreage over the next decade. This strategic move aims to drive down soy protein prices, thereby bolstering sales. Additionally, AFNOR (Association Francaise de Normalization) has mandated that domestically sold soy juices contain a minimum of 3.2 g of soy protein per 100 ml and must be free from any dairy traces. This regulation presents a lucrative opportunity for manufacturers in the country.

- As of 2022, Russia retained its position as the leading consumer of soy protein in the region. The country is set to maintain this dominance, with a CAGR of 4.29% over the forecast period. Russia's appetite for soy protein is largely fueled by its sizable consumer base, with the food and beverage (F&B) segment alone commanding a 44.35% volume share in 2020. With a growing number of consumers viewing soybeans as an affordable and healthy alternative to animal proteins, the demand for soy products is expected to surge in the coming years.

Europe Soy Protein Market Trends

The growth in plant protein consumption provides opportunities for key players in the market

- The consumer shift toward vegan diets majorly drives the market. The functional efficiency and cost competitiveness offered by reliable plant protein products are increasing their utilization in a wide variety of processed foods. Plant protein from soy is considered healthy for all age groups and helps keep the body fit. Plant-based protein alternatives are being widely used in the food and beverage industry.

- The region has untapped potential among consumers willing to switch their diets to plant-based protein sources. For instance, within four years, the number of vegans doubled from 1.3 million in 2016 to 2.6 million in 2020. However, the market faces challenges, such as a lack of innovation and restrictions on public policy. There are still a few aspects holding back Italian consumers from making the shift, such as the possible presence of GMOs, doubts over the origin of raw materials used in the product's composition, and the possible use of herbicides on crops.

- Plant protein enhances food items' nutritional and functional values and provides good taste. The market observed an increase of around 45-50% in the consumption of plant-based food across the region. For instance, Bolthouse Farms expanded its beverage range with the "1915 Organic" brand line, which includes cold-pressed juices and vegan protein shakes. Also, protein manufacturers are trying to initiate strategic programs that will impact the improvement of consumption of plant protein sources such as soy protein in the region. For instance, Donau Soja developed a Protein Strategy for Europe in 2023, impacting the availability of soybeans in the region.

The decline in soy production is expected to impact prices in Europe

- Europe accounted for about 12% of the global soybean production in 2017. In 2021, nearly 10 MMT of soybean was produced in the region, of which 80% accounted for animal feed usage. It mainly imports soy meal and cake to be used as animal feed. Many European countries are essential trans-shipment hubs, implying that a portion of their imports is re-exported as beans or processed and then exported as soy meal and oil. In July 2018, China imposed a 25% tariff on imports from the United States, including soybeans. The resulting US surplus was then exported to other countries in Latin America and Europe.

- The consumption of soy that complies with the FEFAC Sourcing Guidelines increased from 42.2% in 2019 to 43.8% in 2020. In the same time frame, the proportion of certified conversion-free soy climbed marginally from 25.3% to 25.9%. The region also has a recognizable demand for non-GM soybeans. Despite the growing demand for non-GM soybeans from European countries, there is a growing demand for VSS-compliant soybeans in China, given the country's role as the world's largest soybean consumer, accounting for 66.1% of the global total in 2016.

- There is a shift in consumer preferences in Europe, as they are adding plant-based protein products to their diets that act as meat substitutes, owing to the increasing concerns by governments about the environmental and health impacts of producing and consuming animal meat. This factor substantially benefits the consumption of soybean-based products in the region, including tofu, soybean-based dairy substitutes, and processed plant-based meat products. There was an increase in the sales of plant-based food and drink products from EUR 2.4 billion in 2018 to EUR 3.6 billion in 2020, a growth of 49%.

Europe Soy Protein Industry Overview

The Europe Soy Protein Market is fragmented, with the top five companies occupying 25.65%. The major players in this market are Archer Daniels Midland Company, CHS Inc., International Flavors & Fragrances Inc., Kerry Group PLC and The Scoular Company (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 90143

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 INTRODUCTION

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 KEY INDUSTRY TRENDS

- 3.1 End User Market Volume

- 3.1.1 Baby Food and Infant Formula

- 3.1.2 Bakery

- 3.1.3 Beverages

- 3.1.4 Breakfast Cereals

- 3.1.5 Condiments/Sauces

- 3.1.6 Confectionery

- 3.1.7 Dairy and Dairy Alternative Products

- 3.1.8 Elderly Nutrition and Medical Nutrition

- 3.1.9 Meat/Poultry/Seafood and Meat Alternative Products

- 3.1.10 RTE/RTC Food Products

- 3.1.11 Snacks

- 3.1.12 Sport/Performance Nutrition

- 3.1.13 Animal Feed

- 3.1.14 Personal Care and Cosmetics

- 3.2 Protein Consumption Trends

- 3.2.1 Plant

- 3.3 Production Trends

- 3.3.1 Plant

- 3.4 Regulatory Framework

- 3.4.1 France

- 3.4.2 Germany

- 3.4.3 Italy

- 3.4.4 United Kingdom

- 3.5 Value Chain & Distribution Channel Analysis

4 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 4.1 Form

- 4.1.1 Concentrates

- 4.1.2 Isolates

- 4.1.3 Textured/Hydrolyzed

- 4.2 End User

- 4.2.1 Animal Feed

- 4.2.2 Food and Beverages

- 4.2.2.1 By Sub End User

- 4.2.2.1.1 Bakery

- 4.2.2.1.2 Beverages

- 4.2.2.1.3 Breakfast Cereals

- 4.2.2.1.4 Condiments/Sauces

- 4.2.2.1.5 Dairy and Dairy Alternative Products

- 4.2.2.1.6 Meat/Poultry/Seafood and Meat Alternative Products

- 4.2.2.1.7 RTE/RTC Food Products

- 4.2.2.1.8 Snacks

- 4.2.3 Personal Care and Cosmetics

- 4.2.4 Supplements

- 4.2.4.1 By Sub End User

- 4.2.4.1.1 Baby Food and Infant Formula

- 4.2.4.1.2 Elderly Nutrition and Medical Nutrition

- 4.2.4.1.3 Sport/Performance Nutrition

- 4.3 Country

- 4.3.1 Belgium

- 4.3.2 France

- 4.3.3 Germany

- 4.3.4 Italy

- 4.3.5 Netherlands

- 4.3.6 Russia

- 4.3.7 Spain

- 4.3.8 Turkey

- 4.3.9 United Kingdom

- 4.3.10 Rest of Europe

5 COMPETITIVE LANDSCAPE

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Landscape

- 5.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 5.4.1 A. Costantino & C. SpA

- 5.4.2 Archer Daniels Midland Company

- 5.4.3 CHS Inc.

- 5.4.4 Fuji Oil Group

- 5.4.5 International Flavors & Fragrances Inc.

- 5.4.6 Kerry Group PLC

- 5.4.7 The Scoular Company

- 5.4.8 Wilmar International Ltd

6 KEY STRATEGIC QUESTIONS FOR PROTEIN INGREDIENTS INDUSTRY CEOS

7 APPENDIX

- 7.1 Global Overview

- 7.1.1 Overview

- 7.1.2 Porter's Five Forces Framework

- 7.1.3 Global Value Chain Analysis

- 7.1.4 Market Dynamics (DROs)

- 7.2 Sources & References

- 7.3 List of Tables & Figures

- 7.4 Primary Insights

- 7.5 Data Pack

- 7.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.