Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692029

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692029

Gelatin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 369 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

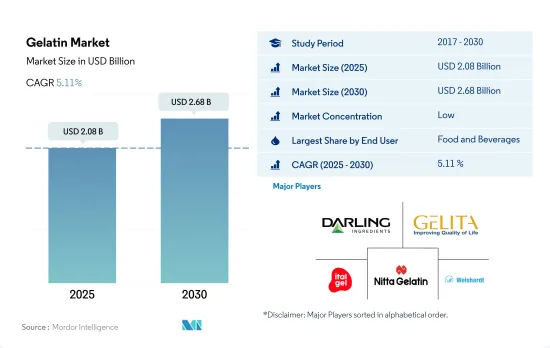

The Gelatin Market size is estimated at 2.08 billion USD in 2025, and is expected to reach 2.68 billion USD by 2030, growing at a CAGR of 5.11% during the forecast period (2025-2030).

Rising emphasis on personal care, demand for protein-based skincare and hair care products will gain prominence during the forecast period

- By application, F&B remained the largest segment in the global gelatin market. It is also anticipated to register a nominal CAGR of 4.46%, by volume, during the forecast period. This growth is primarily due to shifting preferences from traditional foods to more protein-based solutions. Globally, about 93% of consumers want to eat healthy at least a few times, with 63% trying to eat healthy most or all of the time. Consumers are also more conscious about the foods they are consuming and how the ingredients in any product affect their health. The proteins in gelatin can help support the intestinal wall, including building the protective mucus lining in the intestines.

- During the COVID-19 outbreak, in-home consumption of convenience meals increased to 26% in 2020. The importance of health as a lifestyle choice influenced consumers in the F&B sector. However, during the forecast period, personal care is expected to be the market's fastest-growing segment, with a CAGR of 6.29% by value, as gelatin has a higher average protein content of 5% than other dairy proteins.

- The only other segment with an application for gelatin is the personal care and cosmetics segment. The segment is projected to record a CAGR of 6.31%, by volume, during the forecast period. Numerous cosmetic products, such as face creams, body lotions, shampoos, hair sprays, sunscreens, bath salts, and bubble bath liquids, use gelatin as a gelling agent. It is safe for use on the skin, contains no toxic substances, and works well as a moisturizer in creams and lotions. It benefits the shine and combability of hair and the smoothness of skin due to its film-forming properties. It also ensures that pigments in hair colors and tints are absorbed more uniformly.

Europe holds significant share in 2022 due to growing demand for dietary supplements across the region drove the application of gelatin

- Asia-Pacific is the largest and fastest-growing market for gelatin, followed by Europe. Both regions account for approximately 78.6% of the overall gelatin protein demand. The established meat industry of the Asia-Pacific region yields immense gelatin, making it easier to access the ingredient in the region. The increasing obesity in the Asia-Pacific region, particularly in countries like China and India, has also been another major factor boosting the market's growth. In India, the percentage of overweight women rose from 20.6% to 24%, while in men, the number increased from 18.9% to 22.9% in 2021. Consuming gelatin-based products as part of a balanced diet may help promote weight loss due to gelatin's high protein and low-calorie contents.

- In Europe, Russia dominated the market and accounted for 22.5% of the regional market. In 2021, gelatin sales in Russia went up by 8.18% compared to 2020, attributed to the increasing usage of bovine-based gelatin in various food and beverage applications. The rising demand for dietary supplements in the region accounts for the shifting inclination of consumers toward healthy and protein-rich diets, which is expected to drive the growth of the gelatin market.

- The African region holds a significant share of the gelatin market due to increased commercial activity, reflecting an aggressive expansion strategy in the country. High gelatin integration in the F&B industry, particularly in bakeries and beverages, drove the market. Companies are promoting their gelatin offerings as a natural fit for clear beverages, which are becoming increasingly popular among consumers. About 2-3% of gelatin is useful for removing fruit juice precipitates that may cause haze.

Global Gelatin Market Trends

Europe is the leading market with a high demand for bread and biscuits

- The bakery segment thrives on strong demand for bread and biscuits, celebrated for celebrated for their snack convenience. Europe is the leading market, with bakery items firmly rooted as dietary staples. Bread tops the consumption list, followed by cakes, pastries, sweet biscuits, and cookies. Production remains consistent, with Germany, France, and Italy leading in consumption.

- Consumers gravitate toward products with functional benefits, natural sugars, and ingredients celebrated for their health and mood-boosting properties. This trend focuses on energy enhancement, mood elevation, and stress reduction. Also, consumers have a heightened consciousness of labels, particularly evident in their scrutiny of biscuit labels. In 2021, 87% of US adults routinely checked the nutrition facts label on food packages. This vigilance has significantly spurred demand for multigrain and gluten-free breads, protein-enriched biscuits, and digestive biscuits. Other prominent trends in the global bakery landscape encompass a rising demand for bite-sized treats, organic biscuits and breads, an emphasis on sustainable packaging, and an increasing preference for vegan and plant-based offerings.

- Ingredient manufacturers are innovating to help biscuit makers meet the demand for 'free-from' and 'clean-label' products. For instance, Puratos, a Belgium-based baking ingredient supplier, unveiled its clean-label ingredient, Intens Soft & Fine, in January 2024. According to the company, this ingredient replaces mono- and diglycerides, offering improved texture and quality throughout their shelf life for products such as toast bread, hamburger buns, brioche, panettone, and donuts.

Meat is majorly used as raw material by gelatin manufacturers

- The gelatin industry's raw materials differ depending on the source. Animal-based gelatin is derived from bones, tissues, and other animal parts, while marine-based gelatin primarily uses fish. As a result, companies rely significantly on raw materials from slaughterhouses and cattle, pig, and fish farms. India had 72 government-approved abattoirs in 2017, making it one of the largest meat-producing countries across the world.

- The production of bovine, porcine, and fish meat witnessed a decline as slaughterhouses shuttered during the pandemic, affecting all regions. Despite the challenges posed by the COVID-19 pandemic, the European Union's swine industry entered 2020 with a larger sow herd, eyeing robust export demand from China. However, the market faced hurdles due to the pandemic, including slaughter restrictions in Northwestern Europe. Notably, pig prices in Germany surged, even in the face of diminished Chinese sales, climbing by about 10 cents to EUR 1.54 (USD 1.67) per kg in May 2021. Over the past five decades, global meat demand has surged, with production tripling to exceed 350 million tonnes annually. In a notable shift, Asia-Pacific has emerged as the world's largest meat producer, significantly altering the global landscape.

- Countries like China are pivoting toward self-sufficiency in animal protein. A prime example is China's National Conference of Agricultural and Rural Affairs, which, in December 2021, unveiled an ambitious pork production target of 55 million tons annually, marking a 35% increase from its current output.

Gelatin Industry Overview

The Gelatin Market is fragmented, with the top five companies occupying 10.96%. The major players in this market are Darling Ingredients Inc., Gelita AG, Italgelatine SpA, Nitta Gelatin Inc. and SAS Gelatines Weishardt (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 90228

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 INTRODUCTION

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 KEY INDUSTRY TRENDS

- 3.1 End User Market Volume

- 3.1.1 Baby Food and Infant Formula

- 3.1.2 Bakery

- 3.1.3 Beverages

- 3.1.4 Breakfast Cereals

- 3.1.5 Condiments/Sauces

- 3.1.6 Confectionery

- 3.1.7 Dairy and Dairy Alternative Products

- 3.1.8 Elderly Nutrition and Medical Nutrition

- 3.1.9 Meat/Poultry/Seafood and Meat Alternative Products

- 3.1.10 RTE/RTC Food Products

- 3.1.11 Snacks

- 3.1.12 Sport/Performance Nutrition

- 3.1.13 Animal Feed

- 3.1.14 Personal Care and Cosmetics

- 3.2 Protein Consumption Trends

- 3.2.1 Animal

- 3.3 Production Trends

- 3.3.1 Animal

- 3.4 Regulatory Framework

- 3.4.1 China

- 3.4.2 France

- 3.4.3 Germany

- 3.4.4 India

- 3.4.5 Italy

- 3.4.6 Japan

- 3.4.7 United Kingdom

- 3.4.8 United States

- 3.5 Value Chain & Distribution Channel Analysis

4 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 4.1 Form

- 4.1.1 Animal Based

- 4.1.2 Marine Based

- 4.2 End User

- 4.2.1 Food and Beverages

- 4.2.1.1 By Sub End User

- 4.2.1.1.1 Bakery

- 4.2.1.1.2 Beverages

- 4.2.1.1.3 Condiments/Sauces

- 4.2.1.1.4 Confectionery

- 4.2.1.1.5 Dairy and Dairy Alternative Products

- 4.2.1.1.6 RTE/RTC Food Products

- 4.2.1.1.7 Snacks

- 4.2.2 Personal Care and Cosmetics

- 4.2.3 Supplements

- 4.2.3.1 By Sub End User

- 4.2.1 Food and Beverages

- 4.3 Region

- 4.3.1 Africa

- 4.3.1.1 By Form

- 4.3.1.2 By End User

- 4.3.1.3 By Country

- 4.3.1.3.1 Nigeria

- 4.3.1.3.2 South Africa

- 4.3.1.3.3 Rest of Africa

- 4.3.2 Asia-Pacific

- 4.3.2.1 By Form

- 4.3.2.2 By End User

- 4.3.2.3 By Country

- 4.3.2.3.1 Australia

- 4.3.2.3.2 China

- 4.3.2.3.3 India

- 4.3.2.3.4 Indonesia

- 4.3.2.3.5 Japan

- 4.3.2.3.6 Malaysia

- 4.3.2.3.7 New Zealand

- 4.3.2.3.8 South Korea

- 4.3.2.3.9 Thailand

- 4.3.2.3.10 Vietnam

- 4.3.2.3.11 Rest of Asia-Pacific

- 4.3.3 Europe

- 4.3.3.1 By Form

- 4.3.3.2 By End User

- 4.3.3.3 By Country

- 4.3.3.3.1 Belgium

- 4.3.3.3.2 France

- 4.3.3.3.3 Germany

- 4.3.3.3.4 Italy

- 4.3.3.3.5 Netherlands

- 4.3.3.3.6 Russia

- 4.3.3.3.7 Spain

- 4.3.3.3.8 Turkey

- 4.3.3.3.9 United Kingdom

- 4.3.3.3.10 Rest of Europe

- 4.3.4 Middle East

- 4.3.4.1 By Form

- 4.3.4.2 By End User

- 4.3.4.3 By Country

- 4.3.4.3.1 Iran

- 4.3.4.3.2 Saudi Arabia

- 4.3.4.3.3 United Arab Emirates

- 4.3.4.3.4 Rest of Middle East

- 4.3.5 North America

- 4.3.5.1 By Form

- 4.3.5.2 By End User

- 4.3.5.3 By Country

- 4.3.5.3.1 Canada

- 4.3.5.3.2 Mexico

- 4.3.5.3.3 United States

- 4.3.5.3.4 Rest of North America

- 4.3.6 South America

- 4.3.6.1 By Form

- 4.3.6.2 By End User

- 4.3.6.3 By Country

- 4.3.6.3.1 Argentina

- 4.3.6.3.2 Brazil

- 4.3.6.3.3 Rest of South America

- 4.3.1 Africa

5 COMPETITIVE LANDSCAPE

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Landscape

- 5.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 5.4.1 ASAHI GELATINE INDUSTRIAL Co. Ltd

- 5.4.2 Darling Ingredients Inc.

- 5.4.3 Gelita AG

- 5.4.4 Italgelatine SpA

- 5.4.5 Jellice Pioneer Private Limited

- 5.4.6 Nippi. Inc.

- 5.4.7 Nitta Gelatin Inc.

- 5.4.8 SAS Gelatines Weishardt

6 KEY STRATEGIC QUESTIONS FOR PROTEIN INGREDIENTS INDUSTRY CEOS

7 APPENDIX

- 7.1 Global Overview

- 7.1.1 Overview

- 7.1.2 Porter's Five Forces Framework

- 7.1.3 Global Value Chain Analysis

- 7.1.4 Market Dynamics (DROs)

- 7.2 Sources & References

- 7.3 List of Tables & Figures

- 7.4 Primary Insights

- 7.5 Data Pack

- 7.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.