Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1645157

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1645157

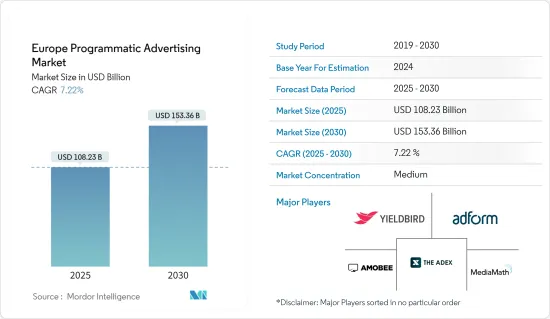

Europe Programmatic Advertising - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 100 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

The Europe Programmatic Advertising Market size is estimated at USD 108.23 billion in 2025, and is expected to reach USD 153.36 billion by 2030, at a CAGR of 7.22% during the forecast period (2025-2030).

Key Highlights

- The market for programmatic advertising in Europe is expanding swiftly and will do so in the next years. It is a highly automated form of advertising that makes the best use. one of the advatnages of programmatic advertising is that it lets users buy and sell internet advertising stock by using a machine or a product, which is proplling the market growth.

- Programmatic Advertisement videos are mainly traded through Programmatic marketplaces. Further, there has been an increase in automated guaranteed buying methods. Additionally, it aids in automating the dynamic cycle of selecting the optimal media component and making the media purchase to advance a goal in the programmatic advertising sector.

- According to a survey by IAB Europe, better use of data acted as an accelerator for programmatic investments in 2021. The survey states that Agencies and Publishers have increased better use of data for programmatic advertisement as better usage of data by agencies increased from 75% in 2020 to 94% in 2021, and better usage of data by publishers increased from 48% in 2020 to 62% in 2021.

- Further, with changes to digital privacy practices, contextual targeting practices are increasing in adoption by agencies to increase their market share. A strong audience targeting is a crucial way to optimize programmatic advertising campaigns and efficiently use the media budget.

- Also, with increasing digitalization, customers are becoming increasingly aware of data collection and privacy. This increasing awareness of the collection and utilization of consumer data is restricting the growth of the Programmatic advertising market.

- The Covid-19 pandemic had a positive effect on the Programmatic Advertising Market in Europe as businesses and organizations in Europe are swticihng to digital advertising methoda in the wake of global lockdown imposed in the region. Also the adoption of industry standards such as App ads.txt, Sellers.json, Buyers.json, Supply Path Object, Demand Path Object, has increased.

Europe Programmatic Advertising Market Trends

Better use of Data for Programmatic Advertising drives the growth.

- Programmatic advertising refers to real-time bidding, which means multiple advertisers bidding for advertising at the same spot whenever an ad inventory is available using machine-to-machine automation of advertising and media transactions.

- In programmatic advertising, advertisers use three data types: advertisers, publishers, and third-party data. Using this data, advertisers can find the most suitable audiences among billions of ad impressions and increase the efficiency of Programmatic advertising.

- With every interaction between the consumer and advertiser, there is a lot of data being generated. This generated data comprises customer interests, decisions, points of contact, activities relative to those moments of engagement, perceived needs, the key demographic and behavioral background, and many more. Such data serves as a robust platform to build insights about customers and create personalized marketing content.

- Advertisers are utilizing tools such as audience discovery algorithms that find data attributes that over-index for those users that have converted to identify new targeting segments, look-alike targeting, and building audiences in real-time based on all data signals to create more sophisticated audiences.

- Advertisers, media agencies and media owners can utilize the data and audiences available to match data to campaign objectives, enhance creativity using audience data, optimise campaign performance using campaign data, gain insights and make decisions.

Mobile Programmatic Advertisements to Drive the Market Growth

- Mobile Programmatic Advertisement refers to the automated process of buying, selling, and displaying mobile ads. Mobile Ads include mobile banner ads, mobile video ads, mobile native ads, and many more.

- Mobile Programmatic necissates cooperation between the Demand-side platform (DSP) and supply-side platform (SSP) and automates mobile programmatic advertising. Mobile Programmatic advertising will define the characteristics according to which the system needs to target audiences such as geolocation, operational system, and type of smartphone of your target audience and many more.

- Mobile Programmatic Advertising provides precise targeting which allows advertisers to reach their specific audience in real-time and dictate right audience using certain metrics and demographics.

- Also the mobile programmatic advertisement is a great channel for expanding reach and increasing user acquisition rate as Europe has nearly 1,090 million mobile subscription in 2021 and it is expected to increase to 1,110 million by 2027 according to Ericcson, and further individuals spend more time on their mobile devices than on conventional screens such as television.

Europe Programmatic Advertising Industry Overview

The Europe Programmatic Advertising Market is moderatively competitive. The market appears to be moderately concentrated, with players adopting key strategies like mergers, acquisitions, and service innovation. Some of the major players in the market are Yieldbird Sp. z o.o., MediaMath, The ADEX, Adform, etc. Some of the recent developments are:

- April 2022 - Amobee, a wholly owned subsidiary of Singtel and global leader in advertising technology announced a partnership which brings innovative streaming ad technology to the Amobee platform. The partnership allows brands to stream their high-quality video assets using SeenThis technology across the programmatic ecosystem of the company.

- April 2022 - Frankfurt Airport marketing agency Media Frankfurt has partnered with technical partner VIOOH. This partnership enabled the company to launch a new programmatic media solution for airport advertising. This new system will enable digital client campaigns to be controlled more precisely and flexibly across the airport.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 91332

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness-Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Europe Programmatic Advertising Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth of Digital Media Advertisement

- 5.1.2 Better use of Data for Programmatic Advertising

- 5.2 Market Challenges

- 5.2.1 Lack of Skilled personel in Programmatic Advertisement

6 Market Segmentation

- 6.1 By Trading Platform

- 6.1.1 Real Time Bidding (RTB)

- 6.1.2 Private Marketplace Guaranteed

- 6.1.3 Automated Guaranteed

- 6.1.4 Unreserved Fixed-rate

- 6.2 By Advertising Media

- 6.2.1 Digital Display

- 6.2.2 Mobile Display

- 6.3 By Enterprise size

- 6.3.1 SMB's

- 6.3.2 Large Enterprises

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Yieldbird Sp. z o.o.

- 7.1.2 MediaMath

- 7.1.3 The ADEX

- 7.1.4 Adform

- 7.1.5 Amobee, Inc.

- 7.1.6 IPONWEB Limited.

- 7.1.7 Eskimi DSP

- 7.1.8 PubMatic, Inc.

- 7.1.9 Teads SA.

- 7.1.10 Digital East GmbH

8 Investment Analysis

9 Future Outlook of the Market

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.