PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644848

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644848

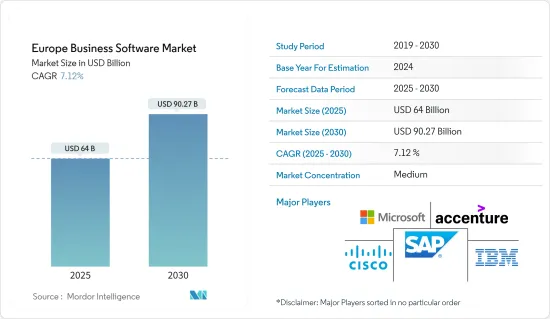

Europe Business Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Europe Business Software Market size is estimated at USD 64.00 billion in 2025, and is expected to reach USD 90.27 billion by 2030, at a CAGR of 7.12% during the forecast period (2025-2030).

Key Highlights

- Digitalization and online data collection have increased companies' requirements for data analysis, consumer reviews, and business processes. This development is driving demand for enterprise software, particularly business intelligence BI. In addition to BI, the business software area also includes software for Enterprise Resource Planning ERP, Customer Relationship Management (CRM), and Supply Chain Management (SCM).

- Business Software facilitates and connects data and processes across the enterprise. It also aids in cloud computing optimization and improves communication with clients, vendors, suppliers, employees, and customers.

- Furthermore, the Business software market is driven by the increasing penetration of artificial intelligence in the workplace to improve organizational productivity and efficiency. Task management with artificial intelligence Software can handle timetables, reminders, and follow-ups effectively and minimize the need for human inputs. They may also save humans time on numerous activities by ensuring nothing is overlooked.

- Moreover, enterprise software offers a variety of benefits, such as managing workflows through a single integrated platform, eliminating the need for multiple systems, improving data quality and reducing data duplication through automated processes, and enabling customers to manage employee health and view data online.

- Global Enterprise Software companies invest in Europe, which results in a rise in demand for the software market. For instance, in December 2023, Better Software Group, based in Poland, announced a strategic partnership with Evergent to enhance customer experiences across the digital media and entertainment landscape. The strategic partnership will deliver superior customer relationship management and user experiences for European streaming and digital subscription businesses.

- The COVID-19 pandemic accelerated digitalization, resulting in increased data collection and the need to analyze the data collected. It also increased digitalization to cope with the remote working environment. Europe is at a crossroads in its digital transition with the cloud. The COVID-19 pandemic compelled European businesses to adopt essential cloud migration quickly.

Europe Business Software Market Trends

Customer Relationship Management Software Show Significant Growth in the Market

- The software provider owns and maintains the infrastructure to run a cloud-based CRM system. CRM software is run on computers by organizations using an internet connection. CRM companies keep and secure the organization's data on their premises. This prevents enterprises from incurring large upfront fees for creating the infrastructure required to store and safeguard all that data.

- The Business Software Market in Europe is expanding through acquisitions and strategic collaborations. For instance, in June 2023, Cloud Software Group announced a strategic partnership with Midis Group to better serve its customers in most of Eastern Europe, the Middle East, and Africa. The partnership will enable the Cloud Software Group to tap into local resources needed by customers in order to support their transformative technology journey and scale necessary for further expansion of its reach across Europe and other regions.

- In May 2023, Salesforce announced a strategic partnership with Accenture to accelerate the adoption of generative artificial intelligence for CRM. Through this collaboration, both companies aim to create a generative AI hub that provides companies with the technology and expertise they need to scale.

- Cloud CRM enables enterprises to take a more holistic approach that improves customer experience outcomes through enhanced machine learning, sentiment analysis, and the ability to harness the emotional affinity between customers and the brand. Such considerations are expected to drive the use of Cloud CRM for regional businesses.

- Furthermore, the growing retail and wholesale services sector in the region will create new growth opportunities for the market. The Retail Customer Relations Management System collects and stores the customer's information and profiles, including their most recent purchase, telephone number, relevant dates, and further contact details. More than 80% of businesses use CRM systems for sales process automation and reporting, according to the CRM Cloud Survey Report from SoftClouds.

- Moreover, in Europe, one-third of all enterprises operating within the non-financial economy are active in the sector, representing mainly small to medium-sized retailers and wholesalers that serve local markets.

- According to stats published by the OECD, Portugal, Turkiye, and Poland had the highest rise in retail sales volume at 13.3, 10.2, and 10.1 percent, respectively. Such an increase in the region's retail sales will drive the demand for CRM and support the market growth during the projected timeline.

Germany is Expected to Witness Significant Growth in the Market

- With digitalization and IT security high on the European agenda, companies and organizations are increasingly moving from traditional on-premise software to more secure, efficient, and easy-to-connect cloud solutions. The transition to cloud technology in Germany is expected to continue to accelerate as more and more small and medium-sized businesses discover the benefits of cloud-based ERP systems for automating manual and labor-intensive processes.

- The ERP market is once again evolving with the times in the country. SAP, in particular, sees Software-as-a-Service and AI products as the next step in strengthening its stranglehold in European markets. Indeed, with the introduction of its S/4HANA and SAP Leonardo platforms, SAP has properly positioned itself to capitalize on future market trends. This is in addition to its aggressive acquisition strategy, including Gigya, a consumer profile and identity management company, and Altiscale, a start-up focused on big data applications.

- Enterprise software companies are focusing on expanding their presence in the German market by making Acquisitions. For instance, in January 2023, Visma announced it entered the German market by acquiring Berlin-based software companies H&H and BuchhaltungsButler. Visma is a European provider of business-critical cloud-based software for SMEs and the public sector, offering ERP solutions for areas such as payroll, accounting, and human resources.

- Moreover, the German IT and software industry is considered one of the most innovative in the world and, therefore, a very lucrative market. Due to recent events, government incentives and support programs, low interest rates, and the urgent need for digital services have created enormous demand in all areas of the German economy, which will further drive the market growth.

- Furthermore, as digitalization and cloud technologies continue to impact global business, German organizations, especially SMEs, are focusing on digital business strategies, with cloud services, preferably hybrid cloud services, playing an essential role in their success.

- Moreover, according to bitkom.org, in 2022, the German software industry generated EUR 35.5 billion (USD 38.58) in revenue. This was an increase of about EUR 3 billion (USD 3 billion) compared to the year before. The income of the software industry over the past ten years has been growing steadily.

Europe Business Software Industry Overview

Europe Business Software Market is moderately competitive, with significant global and regional companies. These industry participants have a sizable market share and are focused on extending their client base globally. To gain a competitive advantage over the forecast period, these firms are spending on R&D to bring innovative solutions, strategic partnerships, and other organic & inorganic growth methods.

- In October 2023, Leidos announced to launch ProSight, its newest enterprise software platform. ProSight provides airports and commercial organizations with high risk access points with a centralized security management system. ProSight brings together systems and technologies such as security screening equipment, threat detection algorithms or other third party data which were traditionally incompatible at the check points.

- In September 2023, OneStream Software and KPMG announced strategic partnership to help organizations conquer complexity and drive finance transformation in France. The partnership will support activities ranging from project implementation to marketing and strategic business collaboration, using KPMG's expertise as the leading provider of consulting services for businesses and technology including CPM OneStream's unified cloud computing software.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand from SMEs

- 4.2.2 Move Towards Integrated Solutions Expected to Drive Demand

- 4.2.3 Cloud & Networking-Based Advancements

- 4.3 Market Challenges

- 4.4 Market Opportunities

- 4.5 Industry Attractiveness Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers/Consumers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

- 4.6.1 Move Towards Remote/Hybrid Working and Their Role in Driving Adoption of Software

- 4.6.2 Regional Drivers for Adoption & Pre vs Post-Pandemic Scenarios

- 4.7 Recent trends and innovations in Business Software

5 EUROPE BUSINESS SOFTWARE MARKET SEGMENTATION (Trends, revenue for the period of 2022-2027 & Market Outlook)

- 5.1 By Software Type

- 5.1.1 ERP Software

- 5.1.2 CRM Software

- 5.1.3 BI Software

- 5.1.4 Supply chain Software

- 5.2 By Deployment

- 5.2.1 Cloud

- 5.2.2 On-Premise

- 5.3 By End-User Vertical

- 5.3.1 BFSI

- 5.3.2 Healthcare

- 5.3.3 Public & Institutions

- 5.3.4 Retail

- 5.3.5 Transportation

- 5.3.6 Manufacturing

- 5.3.7 Other End-User Verticals (Telecom, Defense, etc.)

- 5.4 By Country

- 5.4.1 United Kingdom

- 5.4.2 Germany

- 5.4.3 France

- 5.4.4 Italy

- 5.4.5 Spain

- 5.4.6 Poland

- 5.4.7 Benelux

- 5.4.8 Romania

- 5.4.9 Czech Republic

- 5.4.10 Hungary

- 5.4.11 Rest of Europe

- 5.4.12 Further Breakdown by Software Type (CRM, ERP, BI & SCM to be included in the final study)

6 COMPETITIVE LANDSCAPE

- 6.1 Analysis of Top 10 ERP Vendors (with relative shares for major vendors) - SWOT, Strategies & Recent Developments

- 6.2 Analysis of Top 10 CRM Vendors (with relative shares for major vendors)

- 6.3 Analysis of Major BI Software Vendors (with coverage on their core competencies)

- 6.4 Analysis of Major SCM Vendors (with coverage on their core competencies)

7 INVESTMENT ANALYSIS

- 7.1 Recent Mergers & Acquisitions

- 7.2 Most Adopted Strategies

- 7.3 Gap Analysis

- 7.4 Analyst View

8 MARKET OUTLOOK