PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692472

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692472

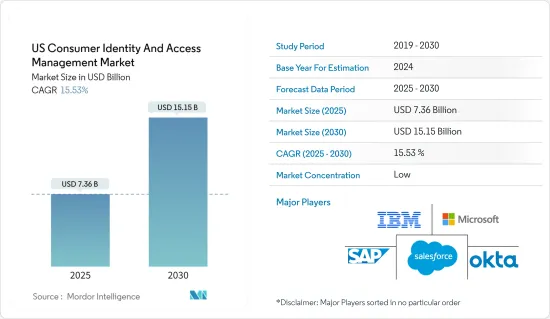

US Consumer Identity And Access Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The US Consumer Identity And Access Management Market size is estimated at USD 7.36 billion in 2025, and is expected to reach USD 15.15 billion by 2030, at a CAGR of 15.53% during the forecast period (2025-2030).

CIAM includes features such as customer registration, self-service account management, consent and preference management, single sign-on (SSO), multi-factor authentication (MFA), access management, directory services, and data access governance.

Key Highlights

- Through consumer identity and access management (CIAM), businesses can securely collect, store, and manage consumer identity and profile data and monitor and restrict consumer access to software and services.

- CIAM includes features such as customer registration, self-service account management, consent and preference management, single sign-on (SSO), multi-factor authentication (MFA), access management, directory services, and data access governance.

- With the increase in customer expectations and concerns regarding their data security, coupled with the growing technological capabilities and regulatory requirements in the United States, consumers are stimulated to adopt a proactive approach to security. Thus, this fuels the demand for consumer identity and access management (CIAM) solutions.

- As hackers target consumer accounts across several platforms and providers with access to multiple systems, data from one individual is frequently used to get into another's account. This means that personal information or identity numbers acquired from another individual can lead to significant data breaches and even more serious crimes, like financial transfers or deleting client data from an insurance provider.

- Several websites are using the Internet to offer essential services to customers. The need for a CIAM system grew among users. Several governments and regulatory bodies ordered public and private businesses to adopt new teleworking techniques and preserve social distancing in the wake of the COVID-19 pandemic.

USA Consumer Identity and Access Management Market Trends

Cloud Segment is Expected to Gain Significant Traction

- Cloud technologies make it easy for service providers to offer on-demand access to a shared pool of resources, e.g., networks, servers, storage, applications, and custom services that can be quickly set up and discharged with low management efforts.

- Consumers can benefit from advantages such as scalability, flexibility, quick returns, and rapid implementation of hardware and software through cloud computing. In addition, consumers benefit from a range of benefits, such as improved data storage and seamless access to the Internet, email, social media, and other types of information. The adoption of cloud technologies by different consumer product companies and many consumers is due to these advantages.

- Consumer identity and access management solutions are being developed and used in the cloud as a result of an increasing demand for cloud technologies. Cloud-based CIAM solutions offer a variety of benefits compared to on-premise solutions.

- Users who have been considering moving from an on-premise CIAM solution to a cloud-based CIAM solution are primarily checking the potential solutions for their capabilities concerning critical features that include supporting a wide range of operating systems, platforms, and providers through one central console, providing consistent control access to all of the platform's resources from anywhere, increased compliance and audibility, and increased speed of deployment.

Increasing Cyber Attacks Drive Market Growth in the United States

- In the digitalized world, when every activity is online, the birth of cybercrime has threatened the safety of individuals, resulting in financial or other losses. The need for consumer identity solutions in the region is being driven by an increasing number of data breaches among different users within the United States.

- In addition, new methods are constantly being explored by cyber criminals, and a series of major data breaches across the various users in the region have once again shown that supposedly secure systems are often surprisingly vulnerable. The United States ranked second, with 285 users' accounts breached as of 2023.

- Furthermore, while cyberattacks and data breaches at Fortune 500 companies tend to dominate the headlines, users are starting to push the demand for cybersecurity and insurance significantly. Due to this, the cyber threat landscape is growing, leading to their appetite for consumer identity and access management solutions.

- Moreover, the introduction of new rules on data protection is expected to boost the country's emerging market for access management and consumer identity as consumers are informed about the risks posed by such breaches.

USA Consumer Identity and Access Management Industry Overview

The US consumer identity and access management market appears to be fragmented due to the presence of many players. Furthermore, prominent market participants invest heavily in research and development to strengthen security and launch efficient solutions in consumer identity, and access management market products are driving the competition in the market. Major players include Microsoft Corporation, SAP SE, Salesforce Inc., and IBM Corporation.

- April 2024: Akamai Technologies Inc. announced the launch of the Akamai Guardicore Platform, which helps businesses meet their zero trust goals. The Akamai Guardicore Platform is the first security platform to combine industry-leading zero trust network access (ZTNA) and micro-segmentation to help security teams stop ransomware, meet compliance mandates, and secure their hybrid workforce and hybrid cloud infrastructure.

- October 2023: Okta Inc. Identity Threat Protection AI announced a new product for Okta workforce identity cloud, which provides real-time detection and response to identity-based threats. The ID Threat Protection uses Okta AI to extend security beyond authentication at any time a user is logged in based on information drawn from an organization's security stack. This enables administrators and security teams to continuously assess user risk throughout active sessions, which automatically responds to identity threats across their entire ecosystem.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Cyber Attacks

- 4.2.2 Growing Personal Data Privacy Concerns

- 4.3 Market Restraints

- 4.3.1 Lack of Regulations Regarding Privacy

- 4.4 Impact of COVID-19 on the Market

5 TECHNOLOGY OUTLOOK

6 MARKET SEGMENTATION

- 6.1 Cloud

- 6.2 On-premise

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Microsoft Corporation

- 7.1.3 Salesforce Inc.

- 7.1.4 SAP SE

- 7.1.5 Okta

- 7.1.6 Akamai Technologies

- 7.1.7 Ping Identity Holding Corp.

- 7.1.8 ForgeRock Inc.

- 7.1.9 Ubisecure Inc.

- 7.1.10 Auth0 Inc.

- 7.1.11 WSO2 LLC

- 7.1.12 Open Text Corporation

- 7.1.13 Optimal IDM

- 7.1.14 Loginradius Inc.

8 MARKET OPPORTUNITIES AND FUTURE TRENDS