PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644870

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644870

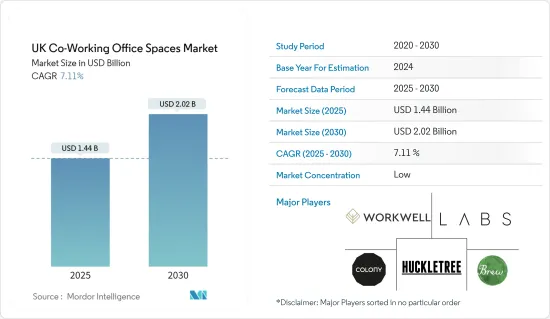

UK Co-Working Office Spaces - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The UK Co-Working Office Spaces Market size is estimated at USD 1.44 billion in 2025, and is expected to reach USD 2.02 billion by 2030, at a CAGR of 7.11% during the forecast period (2025-2030).

Co-working spaces are fast becoming the perfect fit for businesses. Traditional ways of working do not fit the way we live anymore. The world is rapidly moving towards co-working spaces that offer flexibility and space to grow.

The freedom afforded by working from home, according to the research of 1,000 business leaders, is set to alter the way they work permanently. Nearly half of the enterprises with office space (45%) plan to downsize by the end of 2025, and one in seven (18%) have already done so since the pandemic began. According to the study, about 18 million sq. ft of office space will become obsolete in the next five years, accounting for 18% of all currently occupied square footage, significantly impacting how cities in the United Kingdom appear and feel.

Businesses in the United Kingdom will also be looking for shorter, flexible leases and utilizing co-working spaces such as WeWork, with 12% intending to use these locations more often than an 'owned' office. For those businesses planning to stick to the office, 13% will look for accommodation with less desk space per head as the office's main function is set to shift with more space for collaboration, such as break-out areas and meeting rooms.

In this new landscape, flexibility is the driving force for change, transforming office spaces into spaces of possibility. For example, small office spaces outside of London are attracting teams for under EUR 265 (USD 287.51) per person per day. These are flexible spaces that respond to the ever-evolving nature of modern workspaces that not only function but also respond to the evolving needs of contemporary professional life.

UK Co-Working Office Space Market Trends

The Demand for Landlord-Fitted Office Space Surges Amid Rising Costs and Shrinking Availability

Occupants' demand for flexible and landlord-fitted office space is on the rise due to increasing fit-out and finance costs, as well as delayed development completion dates. These options help to mitigate these risks and offer flexibility and convenience for occupiers. The prime flexible office space shortage in key locations also drives demand for landlord-fitted office space. Occupancy rates are increasing to full capacity in many centers.

Fitted space has traditionally been more attractive to smaller tenants, with most transactions being under 5,000 sq. ft. However, there is an increasing number of fit-out office space deals in the 5,000-10,000 sq. ft range. This is especially true in the City, where the number of landlord-fitted transactions doubled in 2022.

Landlord-fitted office space also made up 42% of the total City of London office leasing transactions under 10,000 sq. ft in 2022, compared to just 21% in 2021. There is also a growing interest in fully managed space, where landlords offer soft services. A preference for fitted space among smaller tenants is anticipated to persist, particularly with the rise of 'package deals' where soft services are included as an offer.

The Demand for Co-working Office Space in London is Driving the Market

According to a local survey, London is said to be the best place to open a coworking office. The study looked at 53 locations around the world, taking into account the supply and demand of coworking, average monthly costs, and internet speeds.

The results showed that London outperformed all other cities, taking the number one spot for flexible office spaces. In addition to hybrid working, demand for coworking has been on the rise.

The Instant Group reported last year that occupancy rates in the United Kingdom stood at 83%, the highest level since before the pandemic. This trend is expected to continue in 2024 as companies look to move to serviced offices to weather the economic downturn and reduce overhead costs.

London has the most coworking spaces in the world, with 1,400 available across the UK capital. That's more than 1,000 coworking spaces in Paris, the second-largest city in the world. The average monthly search for coworking spaces in London was 4,400, demonstrating the high demand for coworking spaces. According to recent reports, organizations across the country are turning to coworking as a cost-effective alternative to renting full-time office workspace.

According to Google Trends data, the number of companies searching for coworking offices soared as of March 31, 2023. The spike in searches is likely due to the increase in small business rates, which entered into force on April 1, 2023. The government has said that the new rates will align business premises fees with their market value. Office properties had an average increase in rateable values of around 10% at the start of this month.

UK Co-Working Office Space Industry Overview

The UK co-working spaces market is fragmented, with many companies in the industry. Developers are trying to bring new and lower-cost products to meet the current demand. Evolving technological advancements such as new proptech solutions drive the market in terms of increased transactions and better management of real estate services. Some of the major players in the United Kingdom are Work Well Offices, Labs, The Brew, Huckle Tree, and Jactin House.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 Increasing Shift Toward Co-working Spaces is Driving the Market

- 4.2.1.2 Increasing Focus on Sustainability is Driving the Market

- 4.2.2 Restraints

- 4.2.2.1 Economic Uncertainty is Affecting the Market

- 4.2.3 Opportunities

- 4.2.3.1 Increasing Demand for Collaborative Work Environments is Driving the Market

- 4.2.1 Drivers

- 4.3 Technological Trends

- 4.4 Industry Value Chain Analysis

- 4.5 Government Regulations and Initiatives

- 4.6 Insights on Co-working Startups in the United Kingdom

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers/consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of the COVID-19 Pandemic

5 MARKET SEGMENTATION

- 5.1 By End User

- 5.1.1 Personal User

- 5.1.2 Small Scale Company

- 5.1.3 Large Scale Company

- 5.1.4 Other End Users

- 5.2 By Geography

- 5.2.1 London

- 5.2.2 Manchester

- 5.2.3 Birmingham

- 5.2.4 Leeds

- 5.2.5 Other UK Cities

- 5.3 By Type

- 5.3.1 Flexible Managed Office

- 5.3.2 Serviced Office

- 5.4 By Application

- 5.4.1 Information Technology (IT and ITES)

- 5.4.2 Legal Services

- 5.4.3 BFSI (Banking, Financial Services, and Insurance)

- 5.4.4 Consulting

- 5.4.5 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Work Well Offices

- 6.2.2 Labs

- 6.2.3 The Brew

- 6.2.4 Huckle Tree

- 6.2.5 Jactin House

- 6.2.6 The Skiff

- 6.2.7 Icon Offices

- 6.2.8 Wimbletech CIC

- 6.2.9 Regus

- 6.2.10 Creative Works

- 6.2.11 The Office Group

- 6.2.12 Foyles

- 6.2.13 Soho Works

- 6.2.14 The Hoxton

- 6.2.15 Mare Street Market

- 6.2.16 Southbank Centre*

- 6.3 Other Companies

7 FUTURE OF THE MARKET

8 APPENDIX