PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911727

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911727

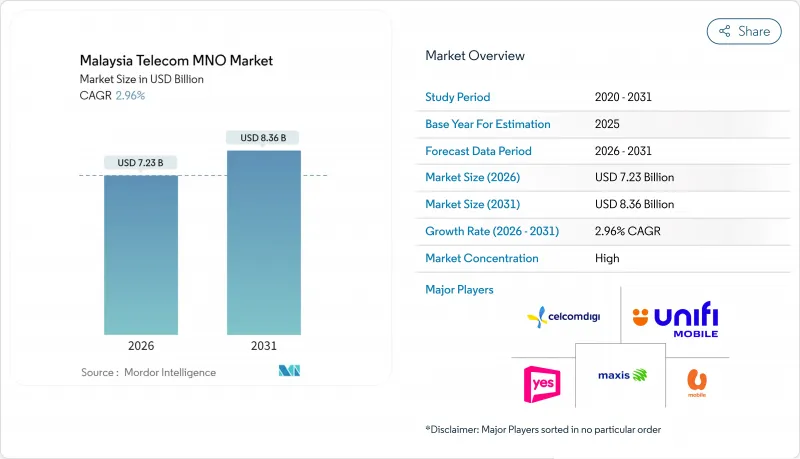

Malaysia Telecom MNO - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Malaysia Telecom MNO Market was valued at USD 7.02 billion in 2025 and estimated to grow from USD 7.23 billion in 2026 to reach USD 8.36 billion by 2031, at a CAGR of 2.96% during the forecast period (2026-2031).

The transition to a dual-network 5G regime, large-scale fiber build-outs, and rising enterprise digitization are the three forces most responsible for this steady uplift. Operators have moved decisively away from legacy voice-centric business models, prioritizing data-first strategies that blend nationwide 5G coverage with partnerships in cloud, content, and edge computing. Government programs such as JENDELA and the National Fiberisation and Connectivity Plan have de-risked much of the required capital outlay by underwriting tower upgrades and backhaul fiber, enabling operators to redeploy cash toward value-added enterprise propositions. At the same time, price-led competition in unlimited data plans continues to compress consumer margins, compelling carriers to chase higher-yield opportunities in private 5G, IoT, and fixed-mobile convergence. Against this backdrop, the Malaysia telecom MNO market is evolving from a scale game to one where differentiated capabilities in network slicing, AI-driven automation, and vertical-specific solutions define competitive advantage.

Malaysia Telecom MNO Market Trends and Insights

5G Coverage Expansion Under JENDELA & Dual-Network Model

The leap from a single wholesale network to a competitive dual-network structure rewrites infrastructure economics for every carrier. Digital Nasional Berhad achieved 80.2% population coverage by December 2024, and U Mobile's mandate to erect a second nationwide grid introduces redundancy that should narrow wholesale fees and improve quality of service. U Mobile pledges 5,000-7,000 5G sites within 18 months in partnership with China Mobile International, an aggressive schedule that accelerates adoption while mitigating the prior fear of a bottlenecked monopoly. The dual-track rollout also unlocks spectrum for private 5G slices, positioning industrial zones for latency-sensitive applications such as machine-vision inspection and autonomous material handling. By removing single-supplier constraints, Malaysia telecom MNO market participants gain room to innovate on differentiated 5G tariffs and service-level agreements rather than competing solely on price.

Rising Per-Capita Mobile Data Consumption & ARPU Uplift

Monthly data usage is projected to jump from 21.6 GB in 2024 to 51.9 GB by 2029, propelled by 4K video streaming, cloud gaming, and AI-enhanced mobile apps. To capture this surge, carriers are phasing out throttled "unlimited" offers in favor of tiered 5G packages that monetize uncapped speeds. OTT alliances, typified by Astro's bundle with Netflix and Disney+Hotstar, deliver sticky content ecosystems that lengthen tenure and combat churn. Operators nevertheless navigate a delicate balance; unlimited data plans below RM 50, now common across all networks, threaten to dilute potential ARPU gains if speed-based differentiation is poorly executed. Success hinges on migrating subscribers to premium speed tiers while reserving exclusive service features-such as edge-hosted gaming or UHD sports streams-for higher-priced plans.

Aggressive Unlimited-Data Price Wars Compressing Margins

Unlimited plans under RM 50 have set a low watermark that squeezes profitability just as 5G capex peaks. U Mobile's prepaid offer with 5G-enabled weekends at RM 25 and CelcomDigi's 3 Mbps plan at the same price have forced every carrier to replicate similar promotions. The resulting margin squeeze is stark: speed-based premiums vanish when baseline tariffs include uncapped data. Fair-usage throttling helps to limit network congestion after roughly 200 GB of use, yet customers increasingly view speed reductions as broken promises, risking churn and social-media backlash. To restore economics, operators now pivot toward enterprise contracts, content bundling and fintech adjacencies where elasticity is lower and willingness to pay is higher.

Other drivers and restraints analyzed in the detailed report include:

- Government-Backed Fiber Rollout Programs (NFCP, JENDELA)

- Manufacturing Clusters' Demand for Private 5G & IoT Solutions

- High Spectrum Fees & USO Levies Straining Cash Flow

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Data and internet services captured 53.62% of Malaysia telecom MNO market share in 2025, running ahead at a 2.99% CAGR through 2031. Growing traffic from UHD streaming, Gen-AI smartphones, and cloud gaming drives operators to upscale backhaul and deploy carrier-grade edge nodes. Voice remains a 19.18% slice of Malaysia telecom MNO market size, cushioned by roaming recovery and unified-communications bundles sold into enterprise accounts, yet its 2.70% CAGR lags data-led verticals. Messaging, value-added services, and wholesale transit combine for 16.04% of revenue and post a 2.98% growth clip, buoyed by rising demand for bandwidth from hyperscale datacenter operators.

IoT & M2M stands at only 5.05% of total receipts but records the highest 3.11% CAGR, propelled by Industry 4.0 roadmaps and smart-city pilots within JENDELA corridors. The Malaysia telecom MNO market size for IoT modules is forecast to expand as manufacturing supervisors switch to predictive maintenance systems that rely on high-density sensor grids. OTT and Pay-TV services contribute 6.11% of revenue on a 3.05% trajectory; Astro's direct billing partnerships with Netflix and Disney+Hotstar illustrate how carriers secure incremental ARPU via content aggregation.

The Malaysia Telecom MNO Market is Segmented by Service Type (Voice Services, Data and Internet Services, Messaging Services, Iot and M2M Services, OTT and PayTV Services, and More), and End User (Enterprises, and Consumers). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Subscribers).

List of Companies Covered in this Report:

- CelcomDigi

- Maxis

- U Mobile

- Yes (YTL Communications)

- Unifi Mobile (Telekom Malaysia)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Regulatory and Policy Framework

- 4.3 Spectrum Landscape & Competitive Holdings

- 4.4 Telecom Industry Ecosystem

- 4.5 Macroeconomic & External Drivers

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Competitive Rivalry

- 4.6.2 Threat of New Entrants

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Bargaining Power of Buyers

- 4.6.5 Threat of Substitutes

- 4.7 Key MNO KPIs (2020-2025)

- 4.7.1 Unique Mobile Subscribers & Penetration Rate

- 4.7.2 Mobile Internet Users & Penetration Rate

- 4.7.3 SIM Connections by Access Technology & Penetration

- 4.7.4 Cellular IoT / M2M Connections

- 4.7.5 Broadband Connections (Mobile & Fixed)

- 4.7.6 ARPU (Average Revenue Per User)

- 4.7.7 Average Data Usage per Subscription (GB/month)

- 4.8 Market Drivers

- 4.8.1 5G coverage expansion under JENDELA & dual-network model

- 4.8.2 Rising per-capita mobile data consumption & ARPU uplift

- 4.8.3 Government-backed fibre rollout programmes (NFCP, JENDELA)

- 4.8.4 Manufacturing clusters' demand for private 5G & IoT solutions

- 4.8.5 Telco-OTT content bundling boosting Pay-TV & data upsell

- 4.8.6 e-SIM tourist & migrant plans adding incremental prepaid revenue

- 4.9 Market Restraints

- 4.9.1 Aggressive unlimited-data price wars compressing margins

- 4.9.2 High spectrum fees & USO levies straining cash flow

- 4.9.3 Fibre backhaul bottlenecks outside Klang Valley

- 4.9.4 Policy uncertainty over DNB stake divestment

- 4.10 Technological Outlook

- 4.11 Analysis of key business models in Telecom Sector

- 4.12 Analysis of Pricing Models and Pricing

5 MARKET SIZE & GROWTH FORECASTS (VALUE)

- 5.1 Overall Telecom Revenue and ARPU

- 5.2 Service Type

- 5.2.1 Voice Services

- 5.2.2 Data and Internet Services

- 5.2.3 Messaging Services

- 5.2.4 IoT and M2M Services

- 5.2.5 OTT and PayTV Services

- 5.2.6 Other Services (VAS, Roaming & International Services, Enterprise & Wholesale Services, etc.)

- 5.3 End-user

- 5.3.1 Enterprises

- 5.3.2 Consumer

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves and Investments by key vendors, 2023-2025

- 6.3 Market share analysis for MNOs, 2024

- 6.4 Product Benchmarking Analysis for mobile network services

- 6.5 MNO snapshot (subscribers, churn rate, ARPU, etc.)

- 6.6 Company Profiles* of MNOs (Includes Business Overview | Service Portfolio | Financials | Business Strategy and Recent Developments | SWOT Analysis)

- 6.6.1 CelcomDigi

- 6.6.2 Maxis

- 6.6.3 U Mobile

- 6.6.4 Yes (YTL Communications)

- 6.6.5 Unifi Mobile (Telekom Malaysia)

7 MARKET OPPORTUNITIES & FUTURE OUTLOOK

- 7.1 White-space & Unmet-Need Assessment