Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693706

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693706

Asia-Pacific Commercial Aircraft Cabin Seating - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 128 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

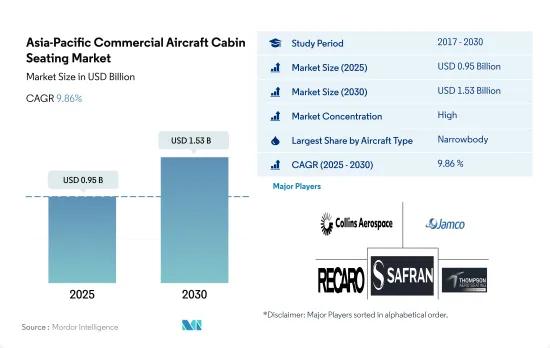

The Asia-Pacific Commercial Aircraft Cabin Seating Market size is estimated at 0.95 billion USD in 2025, and is expected to reach 1.53 billion USD by 2030, growing at a CAGR of 9.86% during the forecast period (2025-2030).

The adoption of narrowbody aircraft in the longer-haul routes by the airlines in Asia-Pacific has increased

- By body type, passenger aircraft have been segmented into narrowbody and widebody. The narrowbody aircraft segment dominated the market in terms of the number of deliveries, with 2,460+ deliveries during 2017-2022. In 2020, the overall passenger aircraft category, including narrowbody and widebody, witnessed a decline of 35% in the region. New aircraft orders were also affected by delays by airline companies due to travel restrictions on domestic and international routes.

- Airlines in Asia-Pacific are using narrowbody aircraft more frequently on longer routes, facilitating the introduction of ergonomic seats in the market. For instance, Asiana Airlines and Korean Air are working to improve the level of comfort and overall experience during the flight by implementing ergonomic design, individually adjustable calf rests, and privacy features. Air Premier, the first hybrid airline in South Korea, also offers full-service amenities and low-cost air travel through its widebody aircraft fleet. The airline equipped its B787-9 fleet with Recaro's PL3530 Premium Economy Class and CL3710 Economy Class seats. The Indian aviation market is dominated by low-cost carriers like IndiGo, SpiceJet, and Go First, which operate a fleet of only narrowbody aircraft. Full-service carriers like Air India and Vistara have a mixed fleet of narrowbody and widebody aircraft.

- An enhanced seating structure with more developed space is becoming highly preferred among travelers. During 2023-2030, around 5,000+ aircraft are expected to be delivered in the region. Through their huge orders for narrowbody and widebody aircraft, these airlines are projected to drive the growth of commercial aircraft seats during the forecast period.

China will witness the highest growth in the Asia-Pacific

- The Asia-Pacific region is expected to become one of the fastest-growing commercial aircraft cabin seating markets during the forecast period. Despite the impact of the pandemic on the region's aviation industry, domestic air passenger traffic witnessed gradual growth in 2021. The region accounted for 27.5% of the global air passenger traffic in 2021.

- The rising per capita income due to increased economic and infrastructure development aided the growth of air passengers. It also supported the fleet expansion plans of domestic and regional airlines.

- In the past few years, major countries in the region, like China, India, and Japan, witnessed a rapid increase in passenger traffic, resulting in large orders for new aircraft from airlines operating in the region. China drives the commercial aviation market in the region, one of the largest global aviation markets.

- The growing number of deliveries of new commercial passenger aircraft positively drove the growth of the region's commercial aircraft cabin seating market. In 2021, Boeing delivered 91 aircraft to the region, while Airbus delivered 30% of its aircraft.

- The latest generation aircraft seats are made from non-metallic materials and lightweight designs to reduce fuel expenses and increase the aircraft's sustainability. The demand for seats with enhanced features and technological convenience is increasing, which may boost the market's expansion in the future. For instance, Thompson Aero Seating launched the next-generation VantageXL, a business-class suite with a multi-function bi-fold table, a PED holder, and improved console surface space.

Asia-Pacific Commercial Aircraft Cabin Seating Market Trends

The introduction of long-range narrowbody aircraft is the key market driver in Asia-Pacific

- New aircraft deliveries in Asia-Pacific are expected to register a CAGR of 11% during the forecast period. Airlines are looking to expand their fleet sizes to cater to the growing demand for air travel, which may generate significant demand for new aircraft in the region. China accounted for 37% of the total air passenger traffic in Asia-Pacific. Hence, the country is anticipated to generate the highest demand for new aircraft compared to other Asia-Pacific countries.

- During 2017-2022, a total of 2,469 new aircraft were delivered in the region. In addition, 6,000 new jets are expected to be delivered to the region between 2023 and 2030. The aircraft deliveries in the region during the historic period accounted for 42% of the total commercial aircraft deliveries worldwide. More deliveries are anticipated during the forecast period due to several factors, such as the preference for economical and smaller aircraft, the success of LCCs, and the introduction of long-range narrowbody aircraft.

- Some major airlines in the region, such as Air India, Singapore Airlines, China Southern Airlines, Qantas, Vistara, and Korea Airlines, have a backlog of over 3,500 aircraft, including a mix of both narrowbody and widebody jets. These airlines, in order to stay profitable during the COVID-19 pandemic, opted to retire some of the old aircraft models and purchase new aircraft that are fuel-efficient. As the airlines may try to maintain a younger fleet, large orders for new aircraft are expected over the next three years across Asia-Pacific countries.

An increase in international passenger traffic post the COVID-19 pandemic is driving market demand

- As cross-border travel was progressively restored in 2022 post the COVID-19 pandemic, the carriers in Asia-Pacific raced to increase their flights to meet runaway demand, stimulated by people's desire to travel and cash in on savings accumulated in the two years of isolation. As a result, in 2022, the air passenger traffic in the region recovered more rapidly from the pandemic than in the other regions. For instance, in 2022, air passenger traffic in the whole of Asia-Pacific was recorded at 1.9 billion, a growth of 6% compared to 2021 and 151% compared to 2020. Airline companies in the region are implementing fleet expansion plans to cater to the growing air passenger traffic in the major countries. China, India, Japan, and Indonesia accounted for 70% of the total air passenger traffic in the region, generating higher demand for new aircraft compared to other Asia-Pacific countries.

- Airlines in Asia-Pacific also witnessed a good recovery in international air passenger markets as travel demand continued to fuel growth despite increasingly challenging global economic conditions. For instance, in August 2022, the region recorded 13.1 million international air passenger traffic, an 836% increase compared to August 2021, when it was recorded at 1.4 million. The healthy growth in international passenger traffic in the first eight months of the year showed strong travel demand from business and leisure consumers. The rapid increase in air passenger traffic in the region is expected to drive the air transport industry in the future.

Asia-Pacific Commercial Aircraft Cabin Seating Industry Overview

The Asia-Pacific Commercial Aircraft Cabin Seating Market is fairly consolidated, with the top five companies occupying 74.88%. The major players in this market are Collins Aerospace, Jamco Corporation, Recaro Group, Safran and Thompson Aero Seating (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 93602

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Air Passenger Traffic

- 4.2 New Aircraft Deliveries

- 4.3 GDP Per Capita (current Price)

- 4.4 Revenue Of Aircraft Manufacturers

- 4.5 Aircraft Backlog

- 4.6 Gross Orders

- 4.7 Expenditure On Airport Construction Projects (ongoing)

- 4.8 Expenditure Of Airlines On Fuel

- 4.9 Regulatory Framework

- 4.10 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Aircraft Type

- 5.1.1 Narrowbody

- 5.1.2 Widebody

- 5.2 Country

- 5.2.1 China

- 5.2.2 India

- 5.2.3 Indonesia

- 5.2.4 Japan

- 5.2.5 Singapore

- 5.2.6 South Korea

- 5.2.7 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Adient Aerospace

- 6.4.2 Collins Aerospace

- 6.4.3 Expliseat

- 6.4.4 Jamco Corporation

- 6.4.5 Recaro Group

- 6.4.6 Safran

- 6.4.7 STELIA Aerospace (Airbus Atlantic Merginac)

- 6.4.8 Thompson Aero Seating

- 6.4.9 ZIM Aircraft Seating GmbH

7 KEY STRATEGIC QUESTIONS FOR COMMERCIAL AIRCRAFT CABIN INTERIOR CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.