Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693710

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693710

Europe Commercial Aircraft Cabin Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 116 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

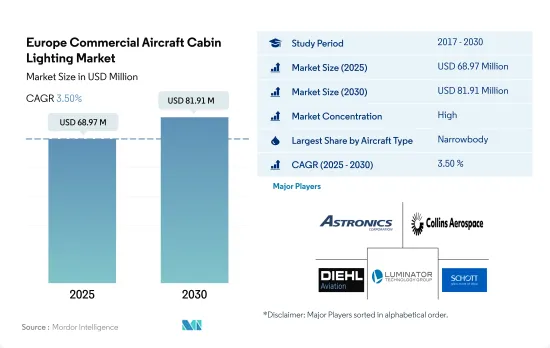

The Europe Commercial Aircraft Cabin Lighting Market size is estimated at 68.97 million USD in 2025, and is expected to reach 81.91 million USD by 2030, growing at a CAGR of 3.50% during the forecast period (2025-2030).

The increasing demand for narrowbody aircraft and the emergence of airlines in the region are leading to a shift toward sophisticated LED lighting in order to reduce weight and improve the overall passenger experience

- Modern-generation aircraft seats are made from lightweight, non-metallic materials and lightweight designs to reduce fuel expenses and increase the aircraft's sustainability. Compared to widebody aircraft, narrowbody aircraft may witness a more aggressive growth rate. During 2017-2022, narrowbody aircraft recorded a majority of the deliveries, accounting for 82% of the total number of aircraft delivered.

- The region's airlines are also transitioning to high-quality LED lighting, as it eliminates many of the shortcomings of the current interior cabin lighting in terms of performance, dependability, durability, and weight. The widespread implementation of LED Ambient Lighting (LED) on next-generation aircraft has helped keep cabin modernization activities ongoing while maintaining consistent service quality.

- It is anticipated that the huge number of aircraft orders placed by various airlines will drive the market as most airlines are opting for innovative cabin lighting to enhance passengers' experience. Major airlines, such as Rostec, Ryanair, Wizz Air, Air France, Lufthansa, and Turkish Airlines, have ordered approximately 670 aircraft. Huge aircraft orders such as these are expected to boost the demand for aircraft cabin lighting during the forecast period.

- The rising emphasis on improving comfort and experience is driving the demand for aircraft cabin lighting. Constant innovations to reduce maintenance costs and replace traditionally bulky lighting with modern and compact LED lighting solutions are critical in aiding the growth of the aircraft cabin lighting market.

The development and implementation of cutting-edge technologies in cabin lighting and other advanced cabin lighting products are significantly increasing the need for aircraft lighting solutions in Europe

- The innovations and introduction of new technologies, such as LED mood lighting, human-centric lighting, and other innovative cabin lighting products, are significantly fueling the demand for aircraft lighting systems in Europe. A wide range of lighting options in several colors is aiding airlines and aircraft manufacturers in enhancing customers' moods and experiences during air travel and lessening jetlag.

- The success of LCCs is high in this region. Major airline companies in the region, such as Air France, British Airways, and Lufthansa, are focusing on improving the overall passenger experience in the commercial aircraft market. This is expected to play a vital role in aiding the demand for commercial aircraft cabin interior products such as lighting systems in the region.

- A considerable number of aircraft orders placed by various airlines is expected to drive the market. The majority of airlines in Europe are utilizing cutting-edge cabin lighting to improve the passenger experience while on the move. Major European carriers, such as Russian Airlines, Air Ryanair, and Wizz Air, as well as French Air France, German Airlines, and Turkey Airlines, have placed orders for a total of 670 aircraft. Some of the other major airlines, such as British Airways and Aeroflot, also implemented advanced LED mood lighting in their aircraft. Such huge aircraft orders for narrowbody and widebody aircraft and the implementation of new technologies for better travel experience are expected to create demand for aircraft cabin lighting during the forecast period.

Europe Commercial Aircraft Cabin Lighting Market Trends

Factors such as recovery in air travel and substantial aircraft orders being placed by various airlines are driving the growth of the market

- Ongoing political tensions between China and the United States have impacted Boeing, and it now plans to remarket some 737 MAX jets earmarked for Chinese customers. Boeing is facing a difficult situation as Chinese airlines are no longer ordering its jets. The Boeing delivery center in Zhoushan, China, is ready and is expected to resume delivery of 737 MAX aircraft. The Zhoushan plant can accommodate 100 aircraft annually.

- Year-to-date, Airbus accumulated 1,044 net new orders (1,080 gross orders), compared to 259 net new orders (442 gross orders) in the first half of 2022. In 2022, Airbus booked 820 net new orders (1,078 gross orders), surpassing both 2021 gross orders and net new orders. In 2022, Airbus won the orders crown for the fourth consecutive year by a fairly slim margin of just 46 aircraft compared to Boeing. In 2021, Airbus booked a total of 771 gross orders and received 264 cancellations, for a total of 507 net new orders. In June 2023, Airbus booked orders for a whopping 902 aircraft for 12 different customers and reported two A321neo cancellations, for a total of 900 net new orders.

- Year-to-date, Boeing accumulated 415 net new orders (527 gross orders), compared to 186 net new orders (286 gross orders) in the first six months of last year. In 2022, Boeing booked 774 net new orders (935 gross orders), up from 479 net new orders (909 gross orders) in 2021. As of June 2023, Boeing booked orders from nine customers for a total of 304 jets (gross orders). However, the company also reported 16 777X cancellations, resulting in 288 net new orders.

The growth in air passenger traffic is expected to be supported by the increasing demand for domestic and international air travel

- The gradual relaxation of travel restrictions in various European countries in 2022 made travel within the continent much easier than during the COVID-19 pandemic. Due to this trend, international demand soared, with passengers unable to travel during the lockdowns eager to fly abroad once again instead of taking domestic vacations. In 2022, air passenger traffic in the whole of Europe reached 1.3 billion, a growth of 8% compared to 2021. The United Kingdom, Germany, and Spain accounted for 36% of the total air passenger traffic in Europe and, hence, may generate more demand for new aircraft compared to other European countries over the coming years. European airlines have also been responsible for carrying almost 40% of global international air passengers.

- European airport traffic grew by 247% in the first six months of 2022 compared to 2021, resulting in an additional 660 million passengers handled across the continent. The United Kingdom, the Netherlands, Turkey, and Germany, which have some of the countries with the busiest airports, recorded a significant rise in passenger traffic in H1 2022. In August 2022, passenger traffic in the top five European airports increased by 68.1% but remained -17.5% below pre-pandemic August 2019 levels, mainly due to continued travel restrictions in Asia. A similar increase in air passenger traffic was observed at airports in the Rest of Europe in August 2022. Commercial air traffic declined from Ukrainian airports, and airports in Belarus and Russia recorded declining passenger volumes as well since the beginning of the Russia-Ukraine War. The air passenger traffic is expected to surge by 31% during 2023-2030, with increased demand in domestic and international aviation.

Europe Commercial Aircraft Cabin Lighting Industry Overview

The Europe Commercial Aircraft Cabin Lighting Market is fairly consolidated, with the top five companies occupying 90.56%. The major players in this market are Astronics Corporation, Collins Aerospace, Diehl Aerospace GmbH, Luminator Technology Group and SCHOTT Technical Glass Solutions GmbH (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 93606

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Air Passenger Traffic

- 4.2 New Aircraft Deliveries

- 4.3 GDP Per Capita (current Price)

- 4.4 Revenue Of Aircraft Manufacturers

- 4.5 Aircraft Backlog

- 4.6 Gross Orders

- 4.7 Expenditure On Airport Construction Projects (ongoing)

- 4.8 Expenditure Of Airlines On Fuel

- 4.9 Regulatory Framework

- 4.10 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Aircraft Type

- 5.1.1 Narrowbody

- 5.1.2 Widebody

- 5.2 Country

- 5.2.1 France

- 5.2.2 Germany

- 5.2.3 Spain

- 5.2.4 Turkey

- 5.2.5 United Kingdom

- 5.2.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Astronics Corporation

- 6.4.2 Collins Aerospace

- 6.4.3 Diehl Aerospace GmbH

- 6.4.4 Luminator Technology Group

- 6.4.5 Safran

- 6.4.6 SCHOTT Technical Glass Solutions GmbH

- 6.4.7 STG Aerospace

7 KEY STRATEGIC QUESTIONS FOR COMMERCIAL AIRCRAFT CABIN INTERIOR CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.