Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693712

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693712

Middle East Commercial Aircraft Cabin Interior - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 171 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

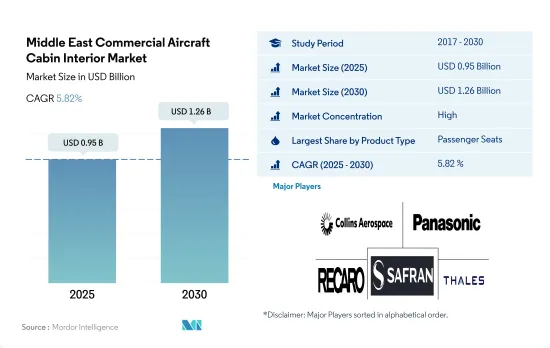

The Middle East Commercial Aircraft Cabin Interior Market size is estimated at 0.95 billion USD in 2025, and is expected to reach 1.26 billion USD by 2030, growing at a CAGR of 5.82% during the forecast period (2025-2030).

Passenger seats accounted for the largest share of 37.2% in the market

- The Middle Eastern commercial aircraft cabin interior market is segmented by product type into seats, cabin lighting, in-flight entertainment systems, windows, galleys and lavatories, and other product types. Airlines in the region are focusing on increasing the utility of these products to improve overall passenger comfort and experience.

- An enhanced seating structure with more developed space than economy-class seats is becoming highly essential due to the rising number of business-class travelers. Middle Eastern airline operators and OEMs are increasing their efforts to reduce aircraft weight and develop a sustainable way to manage the airline industry in consideration of the zero-emission 2050 goal.

- Airlines in the region are adopting advanced LED lighting to eliminate various drawbacks of existing interior cabin lights in terms of efficiency, reliability, durability, and weight. Thus, with the advancement in LED lighting solutions, various OEMs are adopting them over conventional cabin lighting. Major airlines in the region are adopting 4K technology in their in-flight entertainment systems in their active fleet of commercial aircraft. The surging number of aircraft procurements is expected to boost the demand for commercial aircraft cabin interiors in the Middle Eastern passenger aviation sector during the forecast period.

The UAE market is expected to witness the highest growth in the region

- Customer experience is always a top priority for airlines. To provide the best experience, Middle Eastern airlines are focusing on new modernized cabin interiors, providing passengers with a secure, comfortable, and more aesthetically pleasing environment at high altitudes.

- The increase in air passenger traffic is expected to drive new aircraft procurements, thus creating demand for cabin interiors. Middle Eastern airlines registered a 157.4% traffic rise in 2022 compared to 2021. Their capacity increased by 73.8%, while the load factor increased by 24.6% to reach 75.8%. In December 2022, the demand grew by 69.8% compared to the same month in 2021. Major countries, such as the United Arab Emirates, Saudi Arabia, and Qatar, accounted for 55% of the total air passenger traffic in the Middle Eastern market. Hence, growth in these countries is expected to generate a higher demand for new aircraft compared to other Middle Eastern countries.

- Major airlines in the region have registered total orders for 632 commercial aircraft. Of this total, Air Arabia ordered 73 A320neo, 27 A321neo, and 20 A321XLR, Emirates ordered 50 A350-900, 115 B777X, and 30 B787-9, Etihad ordered 26 A321neo, 15 A350-1000, 6 B777-9, 11 B787-9, and 21 BB787-10, Qatar Airways ordered 25 737 Max 10, 40 B777-9, and 23 B787-10, and Flydubai ordered 33 B737 Max 8, 67 B737 Max 9, and 50 B737 Max 10.

- With these deliveries, the demand for cabin interiors has increased, and various airlines in the region are opting for advanced aircraft systems and components such as LED cabin lights, wireless lightweight IFES, comfortable, lightweight seats, and other cabin products.

Middle East Commercial Aircraft Cabin Interior Market Trends

Consistent growth in air travel is the driving factor for air passenger traffic in the Middle East

- The Middle East, a popular connection point for international travelers and trade, is also growing as a starting point and destination for business and leisure passengers. In 2020, air passenger traffic in the Middle East dropped by 64% due to travel restrictions caused by the COVID-19 pandemic. However, in 2022, due to the rising vaccination rates and strong demand over the holiday season, air passenger traffic in the region reached 349.5 million, a growth of 16% compared to 2021, while the growth was at 45% compared to 2019. Major countries, such as the United Arab Emirates and Saudi Arabia, accounted for 42% of the total air passenger traffic, generating higher demand for new aircraft compared to other Middle Eastern countries.

- In 2022, passenger capacity increased by 73.8%, and passenger load factor grew by 24.6% to 75.8% compared to 2021. Air travel recovery in the region continues to gather momentum, and air passenger traffic is expected to double within the next 20 years. Many major Middle Eastern international route areas in Bahrain, Kuwait, Oman, Saudi Arabia, the United Arab Emirates, Iraq, Iran, Jordan, Yemen, and Qatar are already exceeding pre-COVID-19 levels. Such factors indicate that air travel has recovered and continues to gather momentum. Many major international routes, even within the Middle East, are already exceeding pre-COVID-19 levels. Tourism and the high willingness to travel continue to foster the industry's recovery in the Middle East & Africa. The air passenger traffic levels are expected to grow by 34% in 2030 compared to 2022.

Saudi Arabia records the highest GDP per capita in the region

- The Middle East registered a GDP of USD 8,320 billion in 2022, a growth of 21% compared to 2021 and 42% compared to 2020. Of the total region's GDP, Saudi Arabia recorded the highest GDP at USD 833 billion in 2022, followed by the United Arab Emirates at USD 409 billion and Qatar at USD 179 billion. In particular, the air transport industry in Saudi Arabia contributed USD 20.2 billion, whereas the United Arab Emirates contributed USD 19.3 billion to the GDP.

- Saudi Arabia ranks first in terms of GDP and GDP per capita. As of October 2022, the country recorded USD 1.01 trillion in GDP and USD 27.94 thousand in GDP per capita. The improved performance was due to a stronger expansion in the oil sector, which grew by 23.1% in Q2 2022. The growth in the non-oil private sector was 5.4% in Q2 2022, from 4.5% in the previous quarter of the same year.

- The United Arab Emirates recorded a GDP of USD 503.91 billion in 2022 and USD 47.79 thousand per capita. Hydrocarbons continue to play a critical role in the UAE economy, with 30% of the country's GDP directly based on the oil and gas industry and 13% of its exports.

- Qatar recorded USD 221.37 billion in 2022 and USD 68.62 thousand in GDP per capita. The rise in GDP and GDP per capita was primarily due to Qatar's oil and natural gas resources, which recorded a revenue of USD 322.98 billion compared to USD 19.34 billion in the first half of 2021. The rise in profit in most sectors may eventually boost the region's GDP per capita, thereby driving the air transportation industry and creating demand for its associated sectors.

Middle East Commercial Aircraft Cabin Interior Industry Overview

The Middle East Commercial Aircraft Cabin Interior Market is fairly consolidated, with the top five companies occupying 67.35%. The major players in this market are Collins Aerospace, Panasonic Avionics Corporation, Recaro Group, Safran and Thales Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 93608

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Air Passenger Traffic

- 4.2 New Aircraft Deliveries

- 4.3 GDP Per Capita (current Price)

- 4.4 Revenue Of Aircraft Manufacturers

- 4.5 Aircraft Backlog

- 4.6 Gross Orders

- 4.7 Expenditure On Airport Construction Projects (ongoing)

- 4.8 Expenditure Of Airlines On Fuel

- 4.9 Regulatory Framework

- 4.10 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Product Type

- 5.1.1 Cabin Lights

- 5.1.2 Cabin Windows

- 5.1.3 In-Flight Entertainment System

- 5.1.4 Passenger Seats

- 5.1.5 Other Product Types

- 5.2 Aircraft Type

- 5.2.1 Narrowbody

- 5.2.2 Widebody

- 5.3 Cabin Class

- 5.3.1 Business and First Class

- 5.3.2 Economy and Premium Economy Class

- 5.4 Country

- 5.4.1 Saudi Arabia

- 5.4.2 United Arab Emirates

- 5.4.3 Rest of Middle East

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Adient Aerospace

- 6.4.2 Astronics Corporation

- 6.4.3 Collins Aerospace

- 6.4.4 Diehl Aerospace GmbH

- 6.4.5 Expliseat

- 6.4.6 FACC AG

- 6.4.7 GKN Aerospace Service Limited

- 6.4.8 Jamco Corporation

- 6.4.9 Luminator Technology Group

- 6.4.10 Panasonic Avionics Corporation

- 6.4.11 Recaro Group

- 6.4.12 Safran

- 6.4.13 SCHOTT Technical Glass Solutions GmbH

- 6.4.14 STG Aerospace

- 6.4.15 Thales Group

7 KEY STRATEGIC QUESTIONS FOR COMMERCIAL AIRCRAFT CABIN INTERIOR CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.