Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693714

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693714

Middle East Commercial Aircraft Cabin Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 106 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

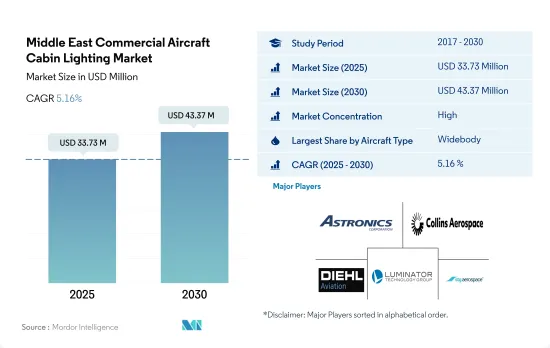

The Middle East Commercial Aircraft Cabin Lighting Market size is estimated at 33.73 million USD in 2025, and is expected to reach 43.37 million USD by 2030, growing at a CAGR of 5.16% during the forecast period (2025-2030).

Rising demand for widebody aircraft and airlines focusing on passenger travel experience is expected to drive the demand for cabin lighting in the Middle East

- The aviation industry in the Middle East has been steadily growing over the years, driven by factors such as increased tourism, economic development, and the expansion of airline fleets. Airlines in the region are moving toward advanced LED lighting systems as they help eliminate various drawbacks of the existing interior cabin lighting systems in terms of efficiency, reliability, durability, and weight. The advancements in LED lighting by various OEMs are more rapid than conventional aircraft cabin lighting. Additionally, LED technology has proved to improve passengers' moods by enhancing the cabin ambiance for boarding, eating, sleeping, and waking up. The widebody segment dominated the deliveries made across the Middle East, accounting for 52% of the total number of deliveries during 2017-2022.

- The demand for aircraft cabin lighting is driven primarily by huge aircraft orders that are being placed by various airlines in the region. As of September 2023, approximately 777 aircraft were placed by various airlines in the region. Of these 777 aircraft, narrowbody accounted for 403 aircraft, and widebody accounted for 374 aircraft. Major airlines in the region, such as Qatar Airways, Etihad, and Emirates, are focusing on improving their interior lighting systems.

- Furthermore, around 944 aircraft are scheduled to be delivered in the region due to the presence of major markets, such as Saudi Arabia, Qatar, and the United Arab Emirates, during 2023-2030. Various fleet expansion plans in the region are expected to boost the procurement of both narrowbody and widebody aircraft. These factors are expected to drive the growth of the commercial aircraft cabin lighting market during the forecast period by 8.30%.

UAE is expected to witness a larger growth in the region due to huge aircraft orders placed by the country's airlines

- Customer experience is always a top priority for airlines. It is important for airlines to offer passengers a positive travel experience. Dissatisfied or disengaged customers inevitably result in fewer passengers and reduced profits for airlines. It is vital for passengers to have a positive experience whenever they travel. Therefore, airlines in the region are focusing on new, innovative products (such as mood lighting) that play an important role in defining the complete passenger experience during their travel.

- Additionally, the demand for the aircraft cabin lighting market in the region is driven by aircraft orders that are being placed by various airlines as part of fleet renewal and the need for long-range, fuel-efficient aircraft. Some of the major airlines, such as Air Arabia, Emirates, Etihad, Qatar Airways, Saudia, Riyadh Air, and Flydubai, have ordered a total of 391 narrowbody and 413 widebody aircraft. Of these total aircraft ordered, UAE's top airlines, such as Emirates, Etihad, and Flydubai, have ordered 361 aircraft. Hence, the UAE is expected to witness larger growth driven by its huge aircraft orders. These ordered aircraft are expected to be delivered throughout the forecast period, and these orders are expected to drive the demand for aircraft cabin lighting market.

- Furthermore, according to Boeing, the Middle East is expected to expand enormously over the next 20 years, requiring a fleet of around 3,400 jets to serve fast-growing passenger traffic. Factors such as these are expected to drive the demand in the region's aircraft lighting market by 9.08% from 2023 to 2030.

Middle East Commercial Aircraft Cabin Lighting Market Trends

The aviation industry's growth is driven by the rising air travel and the high volume of aircraft orders placed by various airlines

- Airbus and Boeing are the two leading commercial aircraft manufacturers worldwide. Both OEMs have shown a similar trend in terms of gross orders between 2014 and 2021. In 2014, Airbus recorded a gross order of 1,796 aircraft, while Boeing recorded 1,550 aircraft. In the historical period, Airbus' gross orders have been higher than Boeing's in most years except in 2018 and 2021. However, in terms of net orders, Airbus has shown better results than Boeing, except in 2018.

- The pandemic in 2020 resulted in several airlines canceling their orders. In 2020, Airbus recorded 115 cancellations, while Boeing lost 655 orders to cancellations and conversions, of which 641 were 737MAX cancelations. Boeing also removed 555 jets from its backlog to align with accounting standards.

- Ongoing political tensions between China and the United States have impacted Boeing, and it now plans to remarket some 737 MAX jets earmarked for Chinese customers. Boeing is facing a difficult situation as Chinese airlines no longer order jets. Boeing is stuck with a completion and delivery center in Zhoushan that it does not need until the political situation improves.

- In 2022, the ease in the global travel restrictions aided airlines in resuming their services and reconsidering fleet expansion plans. The demand for new aircraft increased and was reflected in the net orders. From 2022 until November, Boeing booked 685 gross orders and received 114 cancellations for 571 net new orders. Similarly, until November 2022, Airbus booked 1,062 gross orders and received 237 cancellations for 825 net new orders. The fleet expansion plans of airlines globally will further improve the net orders of both manufacturers.

Consistent growth in air travel is the driving factor for air passenger traffic in the Middle East

- The Middle East, a popular connection point for international travelers and trade, is also growing as a starting point and destination for business and leisure passengers. In 2020, air passenger traffic in the Middle East dropped by 64% due to travel restrictions caused by the COVID-19 pandemic. However, in 2022, due to the rising vaccination rates and strong demand over the holiday season, air passenger traffic in the region reached 349.5 million, a growth of 16% compared to 2021, while the growth was at 45% compared to 2019. Major countries, such as the United Arab Emirates and Saudi Arabia, accounted for 42% of the total air passenger traffic, generating higher demand for new aircraft compared to other Middle Eastern countries.

- In 2022, passenger capacity increased by 73.8%, and passenger load factor grew by 24.6% to 75.8% compared to 2021. Air travel recovery in the region continues to gather momentum, and air passenger traffic is expected to double within the next 20 years. Many major Middle Eastern international route areas in Bahrain, Kuwait, Oman, Saudi Arabia, the United Arab Emirates, Iraq, Iran, Jordan, Yemen, and Qatar are already exceeding pre-COVID-19 levels. Such factors indicate that air travel has recovered and continues to gather momentum. Many major international routes, even within the Middle East, are already exceeding pre-COVID-19 levels. Tourism and the high willingness to travel continue to foster the industry's recovery in the Middle East & Africa. The air passenger traffic levels are expected to grow by 34% in 2030 compared to 2022.

Middle East Commercial Aircraft Cabin Lighting Industry Overview

The Middle East Commercial Aircraft Cabin Lighting Market is fairly consolidated, with the top five companies occupying 88.36%. The major players in this market are Astronics Corporation, Collins Aerospace, Diehl Aerospace GmbH, Luminator Technology Group and STG Aerospace (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 93610

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Air Passenger Traffic

- 4.2 New Aircraft Deliveries

- 4.3 GDP Per Capita (current Price)

- 4.4 Revenue Of Aircraft Manufacturers

- 4.5 Aircraft Backlog

- 4.6 Gross Orders

- 4.7 Expenditure On Airport Construction Projects (ongoing)

- 4.8 Expenditure Of Airlines On Fuel

- 4.9 Regulatory Framework

- 4.10 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Aircraft Type

- 5.1.1 Narrowbody

- 5.1.2 Widebody

- 5.2 Country

- 5.2.1 Saudi Arabia

- 5.2.2 United Arab Emirates

- 5.2.3 Rest of Middle East

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Astronics Corporation

- 6.4.2 Collins Aerospace

- 6.4.3 Diehl Aerospace GmbH

- 6.4.4 Luminator Technology Group

- 6.4.5 SCHOTT Technical Glass Solutions GmbH

- 6.4.6 STG Aerospace

7 KEY STRATEGIC QUESTIONS FOR COMMERCIAL AIRCRAFT CABIN INTERIOR CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.