Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693715

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693715

Middle East Commercial Aircraft In-Flight Entertainment System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 105 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

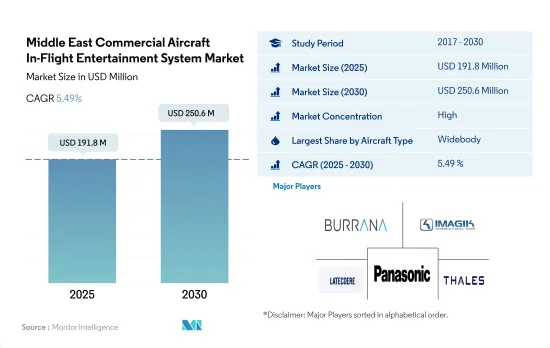

The Middle East Commercial Aircraft In-Flight Entertainment System Market size is estimated at 191.8 million USD in 2025, and is expected to reach 250.6 million USD by 2030, growing at a CAGR of 5.49% during the forecast period (2025-2030).

The Middle East is expected to experience a surge in demand for commercial aircraft in-flight entertainment systems as a result of the increasing popularity of widebody aircraft and airlines that prioritize passenger comfort and entertainment

- In-flight entertainment has become an integral component of cabin interiors over recent years, playing an increasingly crucial part in defining a passenger's entire flight experience. The widebody segment dominated the deliveries in the region, especially the deliveries across Saudi Arabia and the United Arab Emirates, accounting for an overall share of 52% during 2017-2022. The overall passenger aircraft category, including narrowbody and widebody aircraft, witnessed a decline of 30% in 2020. This was due to the restrictions on travel across intercontinental and international routes. The procurement of new aircraft was also affected due to delays by airline companies in adding new aircraft to their fleet sizes.

- In 2022, cabin class, economy, and premium economy accounted for around 90% of the overall IFE systems of all narrowbody aircraft delivered in the region. The adoption of narrowbody aircraft in long-haul routes of many Middle Eastern airlines has increased, thereby increasing the deployment of IFE systems. Emirates, the major airline in the region, is focused on increasing the number of its business-class seats and improving customer experience in the IFE systems segment.

- It is expected that around 543 narrowbody aircraft and 401 widebody aircraft are scheduled to be delivered in the region with major markets such as Saudi Arabia, Qatar, and the United Arab Emirates during 2023-2030. The fleet expansion plans in the region are expected to aid the procurement of both narrowbody and widebody aircraft. These factors will drive the growth of commercial aircraft IFE systems during the forecast period.

The UAE is expected to witness higher growth in the region due to huge aircraft orders placed by the country's airlines

- Customer experience is always a top priority for airlines. Passengers must have a positive experience every time they travel. To provide the best experience, regional airlines are focusing on providing the latest IFE systems that play an increasingly important role in defining the complete passenger experience during their travel.

- Thales, Safran, and Panasonic are the major players in providing IFE systems in the Middle Eastern market. Major airlines, such as Emirates, Qatar Airways, Saudia Arabia Airlines, Etihad Airways, Iran Air, and FlyDubai Airlines are some of the carriers that have opted for the abovementioned OEMs' IFE systems in their newly delivered aircraft, such as A320, A330s, A380s, Boeing 777s, Boeing 737 MAX 8, and Boeing 787 Dreamliner in all cabin classes. Additionally, these airlines are emphasizing the adoption of 4K screens and OLED displays and increasing the availability of IFE systems to improve their existing services and attract new customers.

- The demand for commercial aircraft in-flight entertainment systems in the Middle East is based on the aircraft orders that different airlines are putting out as part of their fleet renewal and the need for fuel-efficient aircraft over long distances. Some of the biggest airlines in the region, like Air Arabia, Emirates, and Etihad, have ordered 391 narrowbody planes and 413 widebody planes. Out of this, UAE's leading airlines like Emirates, Etihad, and Flydubai have ordered 361 planes. The UAE is expected to see higher growth due to these huge orders. According to Boeing, the Middle East will need a fleet of 3,400 jets over the next two decades to keep up with the fast-growing passenger numbers. Innovations and rising customer preferences are expected to drive the market during the forecast period.

Middle East Commercial Aircraft In-Flight Entertainment System Market Trends

The main reasons for market growth are the expansion of the fleet and the increased demand for passenger air travel in Middle Eastern countries

- The aviation industry in the Middle East recovered from the COVID-19 pandemic faster and stronger than the rest of the world. In 2021, air passenger traffic in the Middle East reached 302 million, a growth of 249% compared to 2020 and 25% compared to 2019. The increase in air passenger traffic may eventually drive new aircraft procurements, boosting the cabin interior market in the region. Major airlines have adopted fleet expansion strategies.

- A total of 498 new aircraft were delivered in the region between 2017 and 2022. During 2023-2030, around 1,058 new aircraft are expected to be delivered in the region. During the forecast period, the majority of aircraft are expected to be narrowbody. In addition, the popularity of small and economical aircraft, the success of low-cost carriers, and the advent of narrowbodies with long ranges have contributed to this trend. Saudi Arabia and the United Arab Emirates are the major countries accounting for a significant number of aircraft deliveries.

- New aircraft deliveries and backlogs are expected to generate demand for cabin interiors, as various airlines in the region are opting for advanced aircraft systems and components such as LED cabin lights, wireless lightweight IFES, comfortable, lightweight seats, and other cabin products. As of November 2022, major airlines, such as Emirates, Qatar Airways, Saudia Arabia Airlines, Etihad Airways, and FlyDubai Airlines, together had a backlog of over 1,013 aircraft, of which 589 were expected to be narrowbody jets. Factors such as these are expected to drive the cabin interior market positively during the forecast period.

Consistent growth in air travel is the driving factor for air passenger traffic in the Middle East

- The Middle East, a popular connection point for international travelers and trade, is also growing as a starting point and destination for business and leisure passengers. In 2020, air passenger traffic in the Middle East dropped by 64% due to travel restrictions caused by the COVID-19 pandemic. However, in 2022, due to the rising vaccination rates and strong demand over the holiday season, air passenger traffic in the region reached 349.5 million, a growth of 16% compared to 2021, while the growth was at 45% compared to 2019. Major countries, such as the United Arab Emirates and Saudi Arabia, accounted for 42% of the total air passenger traffic, generating higher demand for new aircraft compared to other Middle Eastern countries.

- In 2022, passenger capacity increased by 73.8%, and passenger load factor grew by 24.6% to 75.8% compared to 2021. Air travel recovery in the region continues to gather momentum, and air passenger traffic is expected to double within the next 20 years. Many major Middle Eastern international route areas in Bahrain, Kuwait, Oman, Saudi Arabia, the United Arab Emirates, Iraq, Iran, Jordan, Yemen, and Qatar are already exceeding pre-COVID-19 levels. Such factors indicate that air travel has recovered and continues to gather momentum. Many major international routes, even within the Middle East, are already exceeding pre-COVID-19 levels. Tourism and the high willingness to travel continue to foster the industry's recovery in the Middle East & Africa. The air passenger traffic levels are expected to grow by 34% in 2030 compared to 2022.

Middle East Commercial Aircraft In-Flight Entertainment System Industry Overview

The Middle East Commercial Aircraft In-Flight Entertainment System Market is fairly consolidated, with the top five companies occupying 75.46%. The major players in this market are Burrana, IMAGIK International Corp., Latecoere, Panasonic Avionics Corporation and Thales Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 93611

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Air Passenger Traffic

- 4.2 New Aircraft Deliveries

- 4.3 GDP Per Capita (current Price)

- 4.4 Revenue Of Aircraft Manufacturers

- 4.5 Aircraft Backlog

- 4.6 Gross Orders

- 4.7 Expenditure On Airport Construction Projects (ongoing)

- 4.8 Expenditure Of Airlines On Fuel

- 4.9 Regulatory Framework

- 4.10 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Aircraft Type

- 5.1.1 Narrowbody

- 5.1.2 Widebody

- 5.2 Country

- 5.2.1 Saudi Arabia

- 5.2.2 United Arab Emirates

- 5.2.3 Rest of Middle East

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Burrana

- 6.4.2 IMAGIK International Corp.

- 6.4.3 Latecoere

- 6.4.4 Panasonic Avionics Corporation

- 6.4.5 Thales Group

7 KEY STRATEGIC QUESTIONS FOR COMMERCIAL AIRCRAFT CABIN INTERIOR CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.