Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693732

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693732

Africa Feed Amino Acids - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 210 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

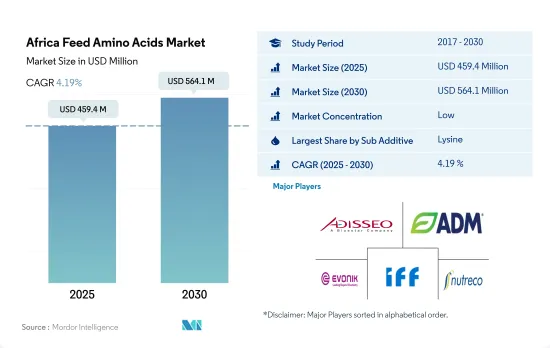

The Africa Feed Amino Acids Market size is estimated at 459.4 million USD in 2025, and is expected to reach 564.1 million USD by 2030, growing at a CAGR of 4.19% during the forecast period (2025-2030).

- The African feed additives market has seen a significant increase in the usage of amino acids in recent years due to their role in the development of muscles and meat productivity in animals. Amino acids accounted for 24.6% of the total feed additives market in the region in terms of market value in 2022. However, the market value of amino acids decreased by 38.9% during 2018-2019, primarily due to the outbreak of diseases such as avian influenza.

- Lysine and methionine were the most significant feed amino acids in Africa, accounting for over 55.2% of the total market value in 2022. This high share can be attributed to their increased efficiency characteristics, such as improved gut health and easy digestion in animals, leading to enhanced meat production. Tryptophan, on the other hand, was one of the fastest-growing feed amino acids in the region, with a projected CAGR of 4.3% during the forecast period. Its rare availability makes it significantly more expensive, but it is still used in animal feed to promote growth and increase feed intake during the early stages.

- Threonine is another essential amino acid for animals, playing a critical role in the modulation of nutritional metabolism, protein synthesis, and nutrient absorption. The market value of threonine is expected to increase from USD 73 million in 2022 to USD 97.3 million by 2029, indicating its growing importance in the African feed additives market.

- The increasing demand for meat and meat products and the awareness of using amino acids to balance the gut pH and reduce infections are expected to be the primary drivers of the feed amino acids market in the region. The feed amino acids market in Africa is expected to register a CAGR of 4.2% during the forecast period.

- In 2022, feed amino acids accounted for approximately 24.7% of the African feed additives market, which experienced more than 7.5% growth from 2017 to 2022. However, there was a sudden dip in 2019 due to inflation in some countries, such as Sudan, Ethiopia, and Nigeria, resulting in reduced market share, particularly in South Africa. The per capita consumption of meat, particularly lamb meat, was reduced by 16.5% in 2019, leading to a decrease in market share.

- South Africa dominated the African market for feed amino acids, valued at around USD 167 million in 2022, followed by Egypt with USD 78.3 million. The high adoption of feed additives in animal diets drove the consumption of feed amino acids in South Africa. Poultry birds accounted for the majority of the market share in the African market for feed amino acids, with 57.1%, followed by ruminants with 28.9% in 2022. The demand for poultry meat is high in some African countries, such as South Africa and Egypt, which accounted for 18% of the region's poultry birds raised in 2021.

- In 2022, Africa produced approximately 131 million metric tons of compound feed for all animal types, with South Africa accounting for more than 29% of the share. It was due to the presence of a significant animal population in the country, as the country accounted for more than 8% of the region's poultry birds in 2021.

- With the increasing demand for meat and growing awareness of healthy diets in animal feeds, the usage of feed amino acids has increased, leading to strong market growth in the region. The market is expected to witness a CAGR of 4.2% during the forecast period.

Africa Feed Amino Acids Market Trends

The increasing per capita consumption of poultry meat and eggs with higher profit margins which is increasing the poultry production in Africa region

- The African poultry industry plays an important role in commercial activities and in providing quality protein to subsistence farmers and rural communities. Poultry birds accounted for 61.5% of the total animal headcount in Africa in 2022, primarily due to the rising demand for poultry meat and eggs in the region. The number of poultry birds increased by 8.8% from 2017 to 2.2 billion heads in 2022, largely driven by the growth of poultry farms in the region.

- Among the poultry birds, broilers were highly raised due to the increasing demand for meat in the region. In South Africa, chicken meat production increased from 1,570 thousand metric tons in 2021 to 1,577 thousand metric tons in 2022 as major producers invested in the industry to capitalize on higher international and domestic poultry prices and profit margins.

- The African poultry industry is expanding due to the growing demand for poultry products from key importing countries, leading to increased investments in poultry farming. For example, in 2021, Quantum Foods, one of South Africa's largest poultry producers, invested over USD 14 million in its poultry operations, including constructing hatcheries and upgrading broiler farms to boost productivity.

- The per capita consumption of poultry meat in South Africa rose to 35.09 kg in 2022 from 33.7 kg in 2017 and is expected to grow by 7.5% during the forecast period (2023-2029), driven by the increasing prices of other animal proteins like beef and lamb. These factors are projected to increase the number of farms and headcount during the forecast period (2023-2029).

Expansion of integrated fish farming and development of inland fisheries is increasing the demand for compound aqua feed

- Aquaculture farming has become one of the largest industries in the agricultural sector in many countries across Africa. Due to unfavorable climatic conditions and a reduction in fish catch, the usage of compound feed in the region decreased by 60% in 2019 compared to the previous year. Nevertheless, the increase in freshwater and marine aquaculture farming in the region has caused a surge in demand for compound feed, which grew by 152% from 2019 to reach 1.5 million metric tons in 2022. Despite this increase, aquaculture feed production only accounted for 4.3% of the total feed production in the region in 2022.

- The rise in aquaculture production in recent years is credited to a significant expansion in the application of nutritional feed, such as the use of extruded feed and improved farm management practices, as well as an increase in investments, which led to a 1.3% increase in the production of compound feed from 2020 to 2022. For example, the Egyptian aquaculture feed industry has undergone rapid development, with a shift from conventionally pelleted feeds (10%) to high-quality extruded feeds (90%). The Fish Farming Development Fund and similar government schemes in other countries, such as Nigeria, are expected to drive aquaculture farming in the region, thereby increasing feed production.

- Egypt's fisheries and aquaculture development plan aims to increase fish production to 3 million metric tons by 2025 through the expansion of integrated fish farming, development of inland fisheries, and mega-national productions. Therefore, an increase in aquaculture production, a rise in the usage of high-quality extruded feed, and an increase in investments are expected to drive feed production in the region.

Africa Feed Amino Acids Industry Overview

The Africa Feed Amino Acids Market is fragmented, with the top five companies occupying 22.23%. The major players in this market are Adisseo, Archer Daniel Midland Co., Evonik Industries AG, IFF(Danisco Animal Nutrition) and SHV (Nutreco NV) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 93766

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Animal Headcount

- 4.1.1 Poultry

- 4.1.2 Ruminants

- 4.1.3 Swine

- 4.2 Feed Production

- 4.2.1 Aquaculture

- 4.2.2 Poultry

- 4.2.3 Ruminants

- 4.2.4 Swine

- 4.3 Regulatory Framework

- 4.3.1 Egypt

- 4.3.2 Kenya

- 4.3.3 South Africa

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Sub Additive

- 5.1.1 Lysine

- 5.1.2 Methionine

- 5.1.3 Threonine

- 5.1.4 Tryptophan

- 5.1.5 Other Amino Acids

- 5.2 Animal

- 5.2.1 Aquaculture

- 5.2.1.1 By Sub Animal

- 5.2.1.1.1 Fish

- 5.2.1.1.2 Shrimp

- 5.2.1.1.3 Other Aquaculture Species

- 5.2.2 Poultry

- 5.2.2.1 By Sub Animal

- 5.2.2.1.1 Broiler

- 5.2.2.1.2 Layer

- 5.2.2.1.3 Other Poultry Birds

- 5.2.3 Ruminants

- 5.2.3.1 By Sub Animal

- 5.2.3.1.1 Beef Cattle

- 5.2.3.1.2 Dairy Cattle

- 5.2.3.1.3 Other Ruminants

- 5.2.4 Swine

- 5.2.5 Other Animals

- 5.2.1 Aquaculture

- 5.3 Country

- 5.3.1 Egypt

- 5.3.2 Kenya

- 5.3.3 South Africa

- 5.3.4 Rest of Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Adisseo

- 6.4.2 Alltech, Inc.

- 6.4.3 Archer Daniel Midland Co.

- 6.4.4 Evonik Industries AG

- 6.4.5 IFF(Danisco Animal Nutrition)

- 6.4.6 Impextraco NV

- 6.4.7 Kemin Industries

- 6.4.8 Novus International, Inc.

- 6.4.9 Prinova Group LLC

- 6.4.10 SHV (Nutreco NV)

7 KEY STRATEGIC QUESTIONS FOR FEED ADDITIVE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Global Market Size and DROs

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.