PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1431239

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1431239

North America Financial Advisory Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

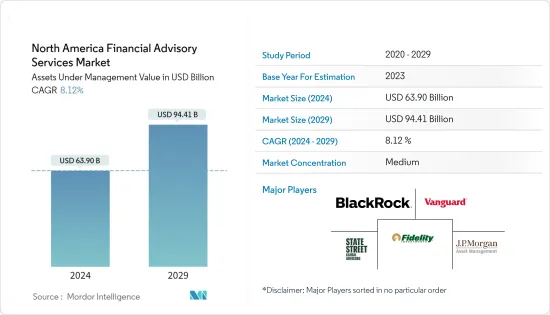

The North America Financial Advisory Services Market size in terms of assets under management value is expected to grow from USD 63.90 billion in 2024 to USD 94.41 billion by 2029, at a CAGR of 8.12% during the forecast period (2024-2029).

The Financial Advisory segment delivers consulting services based on a strong financial analytical fundament. Service offerings span a wide variety of topics, such as transaction services, risk management, tax advisory, real estate advisory, compliance, and litigation services, to name a few. However, financial and accounting skills always stand at the heart of the services delivered.

Financial advisors can provide insight into how they can save more and build their wealth. It is often done by constructing a portfolio of well-suited investments to the client's risk attitude. Some clients are more willing to take on risk if the prospect of a potentially greater reward is more compelling than the prospect of potentially losing money.

Financial advisory services can provide clients with a wide range of services, from investment advice and portfolio management to retirement planning and tax advice. Financial advisors can work with individuals or businesses, and their goal is to help their clients grow and preserve their wealth.

North America Financial Advisory Services Market Trends

The Use of Robot Advisory Services is Growing in North America.

North America has one of the biggest market shares for robot-advisors worldwide. The robot-advisory market has grown rapidly due to the high adoption trends of technology in the North American investment industry. Around two-thirds of emerging wealthy and high-net-worth investors in North America prefer hybrid financial advisory services over human-only or robot-only services.

Additionally, the North American players are being pressured to introduce technologically cutting-edge robot-advisory services to the market by a strong emphasis on research and development in the developed economies of the US and Canada. For example, in the US, Revolut launched a robo-advisor in July 2023. In comparison to traditional businesses, this new feature offers a more seamless and economical investing experience by automating the management of investment portfolios on behalf of customers.

Financial Investment is the leading Financial Advisory Service using in USA

Companies that require expertise in accounting, finance, insurance, and other aspects of finance hire a business financial consultant. Individual clients use the services of financial consultants to manage their investments, property holdings, and long-term financial plans. Clients include a specific plan or concept they want an independent opinion about in a business financial consulting arrangement. The role of the consultant is to review the proposed plan and identify strengths and weaknesses. They are also expected to advise on risk management, pending government regulations, industry trends, and long-term viability. Financial Investment is the major service occupying one-third of the advisory market. Source:

North America Financial Advisory Services Industry Overview

The report covers major players operating in North American Finacial Advisory services Market. In terms of market share, few of the major players currently dominate the market. The report presents detailed profiling of a few major companies, including product offerings, regulations governing them, their headquarters, and financial performance. These players adopted various techniques to increase their market penetration and strengthen their position in the industry. The major market players include BlackRock, Vanguard, Fidelity Investments, State Street Global Advisors, and State Street Global Advisors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Insights on Various Regulatory Trends Shaping the Market

- 4.5 Insights on impact of technology in the Market

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Corporate Finance

- 5.1.2 Accounting Advisory

- 5.1.3 Tax Advisory

- 5.1.4 Transaction Services

- 5.1.5 Risk Management

- 5.1.6 Others

- 5.2 By Organization Size

- 5.2.1 Large Enterprises

- 5.2.2 Small & Medium-Sized Enterprises

- 5.3 By Industry Vertical

- 5.3.1 BFSI

- 5.3.2 IT And Telecom

- 5.3.3 Manufacturing

- 5.3.4 Retail And E-Commerce

- 5.3.5 Public Sector

- 5.3.6 Healthcare

- 5.3.7 Others

- 5.4 By Country

- 5.4.1 USA

- 5.4.2 Canada

- 5.4.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concetration Overview

- 6.2 Company Profiles

- 6.2.1 BlackRock

- 6.2.2 Vanguard

- 6.2.3 Fidelity Investments

- 6.2.4 State Street Global Advisors

- 6.2.5 J.P. Morgan Asset Management

- 6.2.6 Boston Consulting Group

- 6.2.7 Ernst & Young Global Limited

- 6.2.8 Bain & Company

- 6.2.9 PWC

- 6.2.10 Deloitte*

7 MARKET OPPORTUNTIES AND FUTURE TRENDS

8 DISCLAIMER AND ABOUT US