PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1431251

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1431251

US Securities Brokerage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

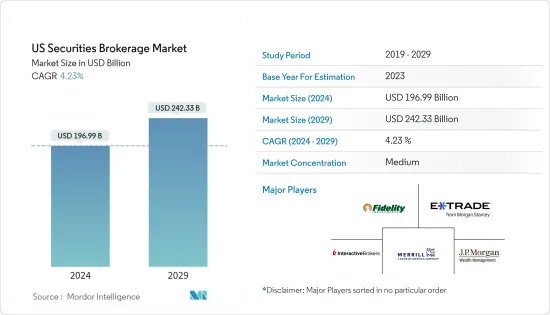

The US Securities Brokerage Market size is estimated at USD 196.99 billion in 2024, and is expected to reach USD 242.33 billion by 2029, growing at a CAGR of 4.23% during the forecast period (2024-2029).

The securities brokerage industry in the US includes about 23,000 establishments (single-location companies and units of multi-location companies) with a combined annual revenue of about USD 126 billion. Demand is driven by the returns on securities relative to alternative investments. The profitability of individual companies depends on efficient operations and good marketing. Large companies have economies of scale in operations and high name recognition. Small companies can compete effectively by offering better customer service.

Investors have different financial and investment needs and should choose their brokerage firms accordingly. Investors who desire advisory services may benefit from a full-service brokerage firm, which charges higher fees than other brokerages. Full-service firms charge either a flat fee based on the size of the account or commissions on the trades that they execute.

One of the major challenges for the securities brokerage market is online brokerages. These online brokerages charge lower fees and may suit investors who wish to conduct their own research, trades, and other account transactions. However, many also offer research and analysis tools to help investors make informed decisions. Many charge a per-transaction commission. Some charge no commissions.

US Securities Brokerage Market Trends

Securities Brokerage is the leading Revenue generating in US Market

A significant number of people think stocks and bonds are the safest investments, while others point to real estate, gold, bonds, or savings accounts. Since witnessing the significant one-day losses in the stock market during the Financial Crisis, many investors were turning towards these alternatives in hopes of more stability, particularly for investments with longer maturities. Nevertheless, some speculators enjoy chasing short-run fluctuations, and others see value in choosing particular stocks. In more recent years, an increasing number of Americans are using an e-trading app, making stock trading more accessible to investors. Securities brokerage is the leading revenue-generating market when compared to investment banking and securities dealing, commodity contracts dealing, and commodity contracts brokerage.

NASDAQ was the Leading Stock Market Worldwide in terms of IPO Proceeds

An Initial Public Offering (IPO) is among the most important and significant steps any company can ever take in its lifetime. Not only does it represent a stage of growth, but it also gives investors a chance to own a piece of it. After all, going through the IPO process means taking the company public and trading on a Stock Exchange. NASDAQ was the leading stock market worldwide in terms of IPO proceeds. The New York Stock Exchange was second on the list with IPO proceeds.Based in New York, the NASDAQ was the largest Stock Exchange in the Americas as of December 2022 in terms of companies listed, with 3,688. The B3 - Brasil Bolsa Balcao was the largest in South America, with 370 companies.

US Securities Brokerage Industry Overview

The US securities brokerage market is highly competitive, as various international and regional vendors are providing new technology to various end-use industries for the expansion of the market. Furthermore, the companies are involved in acquisitions and expansion to improve their product offerings and increase the production process, and they are undergoing partnerships and collaborations with the leading automotive manufacturers to address the demand and strengthen their presence across the United States. The report highlights the numerous strategic initiatives, such as new business deals and collaborations, mergers and acquisitions, joint ventures, product launches, and technological upgrades, implemented by the leading market contenders to set a firm foot in the market. Hence, this section is inclusive of the company profiles of the key players and industry analysis. The US securities brokerage market is offered by groups such as Fidelity, E-Trade, Merrill Edge, Interactive Brokers, and JPMorgan Wealth Management.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Insights on Various Regulatory Trends Shaping the Market

- 4.5 Insights on impact of technology in the Market

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Buyers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Derivatives & Commodities Brokerage

- 5.1.2 Stock Exchanges

- 5.1.3 Bonds Brokerage

- 5.1.4 Equities Brokerage

- 5.1.5 Other Types

- 5.2 By Mode

- 5.2.1 Online

- 5.2.2 Offline

- 5.3 By Type of Establishment

- 5.3.1 Exclusive Brokers

- 5.3.2 Banks

- 5.3.3 Investment Firms

- 5.3.4 Other Types of Establishments

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Fidelity

- 6.2.2 E-Trade

- 6.2.3 Merrill Edge

- 6.2.4 Interactive Brokers

- 6.2.5 JPMorgan Wealth Management

- 6.2.6 Webull

- 6.2.7 Robinhood

- 6.2.8 Ally Invest

- 6.2.9 Firstrade

- 6.2.10 Charles Schwab*

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 DISCLAIMER AND ABOUT US