Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693764

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693764

China Biopesticides - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 123 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

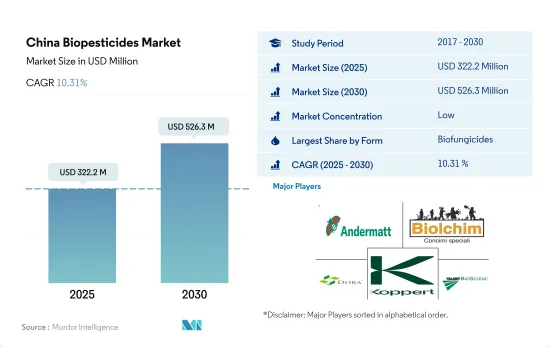

The China Biopesticides Market size is estimated at 322.2 million USD in 2025, and is expected to reach 526.3 million USD by 2030, growing at a CAGR of 10.31% during the forecast period (2025-2030).

- Biopesticides are naturally occurring substances or agents derived from animals, plants, insects, and microorganisms, including bacteria and fungi, used to manage agricultural pests and infections. In 2022, Chinese biopesticides accounted for about 47.1% of the entire crop protection market value.

- In the Chinese biopesticides market, biofungicide was the most consumed biopesticide, dominating the market with a volume share of 55.0%, followed by bioinsecticides, other biopesticides, and bioherbicides, with market shares of 31.0%, 11.5%, 2.4%, respectively, in 2022.

- Row crop cultivation is dominant in the country, and its biopesticides consumption was valued at about USD 204.8 million in 2022. This is due to the large area under cultivation of field crops, which are considered the country's staple food.

- Microbial pesticides are pesticides that contain live organisms as active components, such as bacteria, fungi, viruses, protozoa, or microorganisms that have undergone genetic modification. Bacillus thuringiensis, Bacillus subtilis, Helicoverpa armigera nuclear polyhedrosis virus, Metarhizium anisopliae, and Paenibacillus polymyxa are the top five microbial pesticides in China in terms of manufacturing output.

- Botanical pesticides are pesticides with active components extracted directly from plants. The currently registered botanical pesticides include matrine, rotenone, azadirachtin, veratramine, and pyrethrin.

- Organic farming also expands in China as the demand for organic food rises. From 2017 to 2022, 29.6% of organic acreage increased. Increasing organic acreage and government initiatives are expected to increase the market value of biopesticides between 2023 and 2029, with a projected CAGR of 10.1%.

China Biopesticides Market Trends

Country's zero growth in pesticides use and increasing exports under organic products driving the organic cultivation.

- According to the latest reports by FiBL and the IFOAM, the market for organic food in China is growing at an annual rate of 25.0%. The shift from conventional to organic is a transformation toward a more sustainable food system within China, given the USD 2.91 billion of agri-food commodities exported from China each year.

- The size of organic farmland increased rapidly in China because more people started buying organic products due to increased incomes and the increasing importance of food safety. In the last three years, China's organic planting area increased by 10%, reaching 2.4 million ha in 2020. In addition, national policies have been adopted to promote organic production, advocating the slogans that state, "lucid waters and lush mountains are invaluable assets" and "green development".

- Organic farming in China is majorly export-oriented. The products that are both exported and imported include cereals, soybeans, fruits, and vegetables. China's three northeastern provinces (Liaoning, Jilin, and Heilongjiang) support the largest organic production nationally in terms of output, volume, and area. Most organic farms located in the northern part of China (e.g., Shandong and Liaoning) supply organic vegetables and fruits to nearby cities. In addition, they export some products to Japan, South Korea, Europe, and the United States.

- With the increasing concerns of soil toxicity due to the overuse of synthetic fertilizers and pesticides that lead to soil contamination, the demand for sustainable agriculture practices and organic food production is on the rise in China. This moderately slow yet increasing shift in cultivation practices has also subsequently increased the demand for crop nutrition and protection products.

The growing demand for organic products, approximately 73% of Chinese consumers are willing to have organic food

- China's organic food market is developing rapidly, and the potential demand for organic food among Chinese consumers is enormous. This is due to the growth of the wealthier middle classes and a greater awareness of the health implications. In 2021, organic food sales in China amounted to about USD 77.54 billion.

- Due to various government laws that favor organic food over food safety and customer preferences for organic food over conventional food, the demand for organic food items has considerably expanded. While prices of organic vegetables in China range from 3 to 15 times the cost of conventional produce, prices for organic vegetables are generally between 5 and 10 times that of their conventional counterparts. However, despite the price factor being a barrier, wealthy families and individuals with health problems are eager to increase their budget, with approximately 73% of Chinese consumers willing to pay extra for organic foods.

- The Chinese government is slowly aiming to become self-reliant in the organic food sector. For instance, the economy is slowly moving toward a green agriculture practice by encouraging farmers to scale back the use of chemical fertilizers and switch to bio-based alternatives. The China Chain Store and Franchise Association (CCFA) research in 2020 declared that organic awareness among the Chinese population in developed cities was at 83% when it came to an understanding of the concept of sustainable food production. Although China's organic food sector is still quite small and falls far short of satisfying domestic and international consumer demand, it can be stated that organic food in China has enormous potential in both the domestic and foreign markets, considering the rise in domestic sales by 4.01% in 2021.

China Biopesticides Industry Overview

The China Biopesticides Market is fragmented, with the top five companies occupying 0.78%. The major players in this market are Andermatt Group AG, Biolchim SPA, Dora Agri-Tech, Koppert Biological Systems Inc. and Valent Biosciences LLC (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 500024

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Organic Cultivation

- 4.2 Per Capita Spending On Organic Products

- 4.3 Regulatory Framework

- 4.3.1 China

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Form

- 5.1.1 Biofungicides

- 5.1.2 Bioherbicides

- 5.1.3 Bioinsecticides

- 5.1.4 Other Biopesticides

- 5.2 Crop Type

- 5.2.1 Cash Crops

- 5.2.2 Horticultural Crops

- 5.2.3 Row Crops

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Andermatt Group AG

- 6.4.2 Biobest Group NV

- 6.4.3 Biolchim SPA

- 6.4.4 Dora Agri-Tech

- 6.4.5 Henan Jiyuan Baiyun Industry Co. Ltd

- 6.4.6 King Biotec Corp.

- 6.4.7 Koppert Biological Systems Inc.

- 6.4.8 Valent Biosciences LLC

- 6.4.9 Wuhan Taixin Biological Technology Co. Ltd

7 KEY STRATEGIC QUESTIONS FOR AGRICULTURAL BIOLOGICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.