PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1431452

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1431452

Aluminum Electrolytic Capacitors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

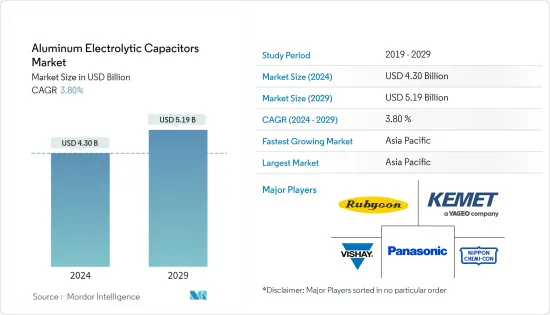

The Aluminum Electrolytic Capacitors Market size is estimated at USD 4.30 billion in 2024, and is expected to reach USD 5.19 billion by 2029, growing at a CAGR of 3.80% during the forecast period (2024-2029).

Key Highlights

- Aluminum Electrolytic capacitors have gained a reputation for being extremely reliable and stable passive components. They are extensively utilized in different sectors, such as commercial, industrial, and automotive, mainly due to their remarkable ability to withstand extreme temperatures. These capacitors are highly effective within a broad temperature range and can endure temperatures as high as 250°C. Moreover, they demonstrate outstanding stability and insulation resistance. In terms of leakage current-temperature characteristics, electrolytic capacitors outperform numerous other high-temperature capacitors currently available in the market.

- Aluminum electrolytic capacitors exist in multiple applications, such as power supplies and computer motherboards. These capacitors are mainly used when large capacitance is required, and leakage current is not essential. These capacitors are available in different sizes and shapes, primarily depending on properties such as working voltage, type of electrolyte, and applications.

- Various factors, such as the plate area and the thickness of the electrolyte, primarily determine the capacity of an aluminum electrolytic capacitor. This also means that a capacitor required for large capacitance can be bulky and more prominent in size.

- Moreover, according to HuanYu Future Technologies, the reliability selection of military electrolytic capacitors is directed toward tantalum capacitors and aluminum electrolytic capacitors. One of the significant advantages of aluminum electrolytic capacitors is their availability, as aluminum is widely distributed in China and is made available at lower prices for large production. In addition, the metal is preferred for electrolytic capacitors due to its characteristics, such as its lightweight and self-healing properties.

- However, the non-gas sealing element with the aluminum shell is generally used, which makes it unreliable. Also, its adaptation to the environment temperature range is considered narrow, especially regarding negative temperature characteristics, generally -20°C (individual military products can reach -40°C, and the military STANDARD CDK series is -55°C). Therefore, aluminum electrolytic capacitors are mostly suitable for general civilian electronic products with low environmental requirements. Some of the capacitors are also used in ground military electronic whole machines, which also require low reliability requirements.

- Additionally, it is mentioning that vendors in the market are broadening their product range by introducing new aluminum electrolytic capacitors. For instance, In 2023, Kypcera AVX, which features a radial-leaded selection consisting of the REH, REF, and REH Series wet aluminum electrolytic capacitors, the RPA and RPF Series conductive polymer aluminum electrolytic capacitors, and the RHA and RHD Series hybrid aluminum electrolytic capacitors. This expanded range offers a diverse array of part numbers, catering to both commercial and industrial reliability requirements, all while maintaining a competitive pricing structure.

- During the pandemic, new projects around the world were put on hold, which decreased the demand for analog semiconductors. However, in the post-pandemic situation, global factories that faced challenges during the pandemic are now gaining an advantage by incorporating new aluminum electrolytic capacitors. Furthermore, recovering economies and industries from the pandemic have triggered the revival of manufacturing activities across various sectors, thereby boosting the demand for the market under study.

- Although aluminum electrolytic capacitors have many benefits, they are hindered by certain limitations such as a short lifespan, equivalent series resistance, less value tolerance, and significant leakage currents. These factors prevent their widespread use in various industries, which is affecting the sales of aluminum electrolytic capacitors. Additionally, the increasing preference of customers for multilayered ceramic capacitors (MLCCs) in new cellphones, entertainment systems, and other computing solutions is reducing the demand for electrolytic capacitors.

Aluminum Electrolytic Capacitors Market Trends

Automotive is Expected to Hold Significant Market Share

- The new automotive features and functionality due to autonomous vehicle technologies, vehicle-to-vehicle (V2V) communications, advanced driver-assistance systems (ADAS), and other safety and sensing systems, like backup cameras and lane-departure detectors, are driving the demand for aluminum electrolytic capacitors in automotive applications.

- Electric vehicles, plug-in hybrids, and other motor vehicles deploy electric drive trains. These drive trains are creating a significant demand for capacitors and subsystems. In these vehicles, aluminum electrolytic capacitors are used in drive-train applications, including boost inverters, DC/DC converters, motor inverters, onboard chargers, and wall chargers.

- Aluminum electrolytic capacitors also play a crucial role in regenerative braking systems, a technology that was employed in the popular Toyota Prius hybrid. A regenerative braking system takes the kinetic energy lost as heat when a car decelerates and turns it into electricity. This electricity can be stored for a short period of time in a capacitor before it is recycled to make the vehicle accelerate again.

- Additionally, due to the rapidly expanding market for electrified vehicles (EVs), there is a growing demand for on-board chargers (OBCs). These OBCs offer the opportunity to conveniently charge the car not only at fast-charging DC stations but also with AC sources in a timely manner. Presently, these systems can reach up to 22 kW with operating voltages of up to 800 V. It is crucial to recognize that OBCs play a vital role in enhancing the appeal of EVs.

- Considering the intricate nature of these systems, it is necessary for the OBC to have a specific amount of bulk capacitance in order to ensure stability of the DC voltage used for battery charging. Aluminum electrolytic capacitors present themselves as a favorable option in this regard, as they are capable of meeting important criteria such as having high voltage ratings of up to 500 V, offering a large capacitance of up to 820 µF, and demonstrating excellent ripple current capabilities within an operating temperature range of -40 °C to 105 °C.

- Therefore, TDK Corporation announced the new EPCOS aluminum electrolytic capacitor series B43548* with snap-in terminals. The series B43548 capacitors feature a suitable maximum ripple current capability of 9.80 A (400 V, 100 Hz, 60 °C).

Asia-Pacific is Expected to Hold Significant Market Share

- The region is also witnessing increasing investments in the market. For instance, in January 2022, Exxelia announced that it had completed the majority acquisition of Alcon Electronics. Alcon Electronics is an Indian designer and manufacturer of catalog and aluminum electrolytic capacitors, mainly serving the renewable energy, medical imaging, induction heating equipment, power generation, and railway end markets. Alcon Electronics provides a wide range of film and screw-terminal aluminum electrolytic capacitors for use in power electronic applications.

- The vendors in the region are expanding their production footprint in the region. For instance, during the pandemic, Keltron, India's first and largest electronic corporation in the state sector, announced its plan to set up a production facility for manufacturing capacitors at its center in Kannur. The facility would use the most advanced technology developed by VSSC and ISRO in aluminum electrolytic capacitor production.

- For instance, Nippon Paper Industries developed a new technology that could eventually render lithium-ion batteries useless in electric vehicles. The company hopes to develop aluminum electrolytic capacitors to store and release electrical energy more efficiently than conventional battery technology by refining wood pulp to microscopic dimensions.

- Players in the regional market have followed investment deals, including mergers and acquisitions. For instance, in March 2022, KYOCERA AVX agreed with ROHM Semiconductor to transfer all of ROHM's capacitor manufacturing units and relevant intellectual property to KYOCERA AVX, effective August, 2022.

- Further, the Japanese government aims to have all the new cars sold in Japan, be they electric or hybrid vehicles, by the year 2050. The country also plans to offer subsidies to accelerate the private sector's development of batteries and motors for electricity-powered vehicles. Japan is one of the countries that were early adopters of electric vehicles, with the launch of the Nissan LEAF and Mitsubishi i-MIEV more than a decade ago.

- During the first half of 2023, the sales of imported electric vehicles (EVs) accounted for 9% of all domestically imported vehicles sold. According to the JAIA, the total number of EVs sold during this period was 10,968, indicating a significant year-on-year increase of 94.5%.

Aluminum Electrolytic Capacitors Industry Overview

The aluminum electrolytic capacitors market is fragmented and has several major players. These major players with prominent shares in the market are focusing on expanding their customer base across foreign countries. Some leading players offering aluminum electrolytic capacitors are KEMET Corporation, Panasonic Corporation, Vishay Intertechnology Inc., Rubycon Corporation, Nippon Chemi-Con Corporation, and many others. Additionally, these companies leverage strategic collaborative initiatives to increase their market shares and profitability.

- August 2023: TDK Corporation announced the release of the new EPCOS B43657 aluminum electrolytic capacitor series with snap-in terminals. These capacitors have a service life of at least 2000 hours at a maximum operating temperature of 105 °C. They are specifically designed to cover a rated voltage range from 450 V DC to 475 V DC, with capacitance values ranging from 120 µF to 1250 μF. One key feature of these capacitors is their impressive high ripple current capability, reaching up to 8.54 A (120 Hz, 60 °C). Furthermore, the AlCap Tool easily allows for accurate lifetime calculation under specific application conditions.

- February 2023: KYOCERA AVX, a manufacturer of advanced electronic components, has launched a comprehensive range of radial-leaded aluminum electrolytic capacitors specifically designed for various applications in industrial, communications, and consumer electronics sectors. These capacitors are readily available with a lead time of 24 weeks, which is currently one of the shortest lead times compared to other competing capacitors in the market. The newly introduced radial-leaded range consists of REH, REF, and REH Series wet aluminum electrolytic capacitors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Miniaturized Design Preferences

- 5.1.2 Rising Demand for Renewable Energy Solutions

- 5.2 Market Restraints

- 5.2.1 Rising Metal Prices Impacting Component Production Costs

6 MARKET SEGMENTATION

- 6.1 Voltage

- 6.1.1 High Voltage

- 6.1.2 Low Voltage

- 6.2 Applications

- 6.2.1 Industrial

- 6.2.2 Telecommunications

- 6.2.3 Consumer Electronics

- 6.2.4 Automotive

- 6.2.5 Energy & Power

- 6.2.6 Other Applications

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 KEMET Corporation (Yageo company)

- 7.1.2 Panasonic Corporation

- 7.1.3 Vishay Intertechnology Inc.

- 7.1.4 Rubycon Corporation

- 7.1.5 Nippon Chemi-Con Corporation

- 7.1.6 Lelon Electronics Corp.

- 7.1.7 Samwha Capacitor Group

- 7.1.8 Nantong Jianghai Capacitor Co., Ltd.

- 7.1.9 NIC Components Corp.

- 7.1.10 Hitano Enterprise Corp.

- 7.1.11 Samyoung Electronics Co., Ltd.

- 7.1.12 Taiwan Chinsan Electronics Industrial Co., Ltd.

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET