Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693830

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693830

Asia-pacific Fluoropolymer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

PUBLISHED:

PAGES: 201 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

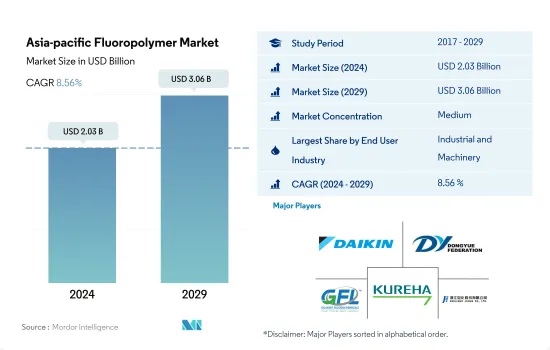

The Asia-pacific Fluoropolymer Market size is estimated at 2.03 billion USD in 2024, and is expected to reach 3.06 billion USD by 2029, growing at a CAGR of 8.56% during the forecast period (2024-2029).

Industrial machinery may lose its share to the electrical and electronics industry

- Fluoropolymers have applications ranging from oil and gas, semiconductor and electronic, chemical processing, automotive, wire and cable, building, aerospace, and pharmaceutical applications. The Asia-Pacific fluoropolymer market is led by industrial machinery, electrical and electronics, and automotive industries. Electrical and electronics accounted for around 27.28% of the revenue of the overall fluoropolymer market in 2022.

- Electrical and electronics is one of the largest industries in the region, especially in China. In China, the industry accounted for 39% of the GDP in 2021. The increasing demand for electrical and electronics empowered the onset of electric vehicles, autonomous robots, and top-secret defense technologies, which, in turn, has been boosting the demand for fluoropolymers in the region.

- Industrial machinery is the largest end-user industry in the region. In China, the industry is the largest consumer of fluoropolymers, with a share of 44.4%, owing to the increasing demand for chemical processing equipment, pumps, and engines. The abovementioned factors are expected to increase the demand for fluoropolymers in the region during the forecast period.

- Automotive is the fastest-growing industry in the region by revenue, with a CAGR of 14.16%. The application of fluoropolymers for plastic composites and lithium-ion batteries used in electric automobiles has increased. This, coupled with the growing electric vehicle production and demand in the region, is expected to drive the demand during the forecast period.

China and India to lead the booming Asia-Pacific fluoropolymer market

- Fluoropolymer is an important polymer in Asia-Pacific for various industries, including automotive, aerospace, and industrial and machinery. Asia-Pacific accounted for 53.64% of the global consumption of fluoropolymer resins in 2022.

- China is the largest consumer of fluoropolymers in the region owing to its rising aerospace, automotive, industrial, and machinery segments. Electrical and electronics and industrial and machinery held shares of 35.66% and 39.29%, respectively, in 2021 and are driving the increasing demand for fluoropolymer resins in the country. The rising automotive, industrial, and machinery production is expected to drive the demand for fluoropolymer resins in the country during the forecast period.

- Japan's demand for fluoropolymer resins is increasing significantly due to rising vehicle production, industrial and machinery, and others. Japan is Asia-Pacific's fourth-largest vehicle producer. In 2022, the country produced 9.4 million units, which is 3.4% more than in 2021. The country's industrial machinery segment is also expanding. In 2021, the order value for metal cutting machines (milling machines, etc.) at manufacturers in Japan amounted to approximately JPY 1.16 trillion, increasing from around JPY 697.39 billion in the previous year. These factors are expected to drive the demand for fluoropolymer resins in the country.

- India is expected to be the fastest-growing consumer of fluoropolymer resins, registering a CAGR of 10.13% by revenue during the forecast period 2023-2029. Vehicle production in the country is expected to reach 33 million units in 2029 from 27.4 million units in 2022.

Asia-pacific Fluoropolymer Market Trends

Rapid growth in ASEAN countries to foster electronics production

- The Asia-Pacific region saw an increase in electrical and electronics production revenue by 13.9% from 2020 to 2021. The electronics sector accounts for 20-50% of the total value of most Asian countries' exports. Consumer electronics such as televisions, radios, computers, and cellular phones are largely manufactured in the ASEAN region.

- ASEAN leads the production of hard drives, with over 80% of hard drives being manufactured in the region. Overall, the electrical and electronics (E&E) industry in ASEAN relies more on foreign inputs and technology than other industries, with 53% of E&E exports arising from foreign value added (FVA) or foreign inputs integrated into ASEAN's E&E exports.

- Countries like Thailand and Malaysia lead in the production of electronics in the region. Thailand, home to one of the largest electronics assembly bases in Southeast Asia, leads in the production of hard drives, integrated circuits, and semiconductors. It ranks second in manufacturing air conditioning units and fourth in the global refrigerators market.

- The electronics industry has greatly benefitted from ASEAN's integrated production networks, which foster improved trade with larger Asian economies like China and Japan.

- China held an 11.2% share of global exports in electrical products and registered a growth of 5.8% in the export of digital products from 2019 to 2020. According to the Asian Development Bank, China provides a large market for electronics in the region. Countries such as Thailand, Japan, China, Malaysia, India, and the Philippines continue to lead the region in the production of electronics.

Asia-pacific Fluoropolymer Industry Overview

The Asia-pacific Fluoropolymer Market is moderately consolidated, with the top five companies occupying 42.98%. The major players in this market are Daikin Industries, Ltd., Dongyue Group, Gujarat Fluorochemicals Limited (GFL), Kureha Corporation and Zhejiang Juhua Co., Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 5000168

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Electrical and Electronics

- 4.1.5 Packaging

- 4.2 Import And Export Trends

- 4.2.1 Fluoropolymer Trade

- 4.3 Regulatory Framework

- 4.3.1 Australia

- 4.3.2 China

- 4.3.3 India

- 4.3.4 Japan

- 4.3.5 Malaysia

- 4.3.6 South Korea

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Electrical and Electronics

- 5.1.5 Industrial and Machinery

- 5.1.6 Packaging

- 5.1.7 Other End-user Industries

- 5.2 Sub Resin Type

- 5.2.1 Ethylenetetrafluoroethylene (ETFE)

- 5.2.2 Fluorinated Ethylene-propylene (FEP)

- 5.2.3 Polytetrafluoroethylene (PTFE)

- 5.2.4 Polyvinylfluoride (PVF)

- 5.2.5 Polyvinylidene Fluoride (PVDF)

- 5.2.6 Other Sub Resin Types

- 5.3 Country

- 5.3.1 Australia

- 5.3.2 China

- 5.3.3 India

- 5.3.4 Japan

- 5.3.5 Malaysia

- 5.3.6 South Korea

- 5.3.7 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Arkema

- 6.4.2 Daikin Industries, Ltd.

- 6.4.3 Dongyue Group

- 6.4.4 Gujarat Fluorochemicals Limited (GFL)

- 6.4.5 Hubei Everflon Polymer Co., Ltd.

- 6.4.6 Kureha Corporation

- 6.4.7 Shanghai Huayi 3F New Materials Co., Ltd.

- 6.4.8 Sinochem

- 6.4.9 Solvay

- 6.4.10 Zhejiang Juhua Co., Ltd.

7 KEY STRATEGIC QUESTIONS FOR ENGINEERING PLASTICS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.