Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693833

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693833

Middle East Fluoropolymer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

PUBLISHED:

PAGES: 163 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

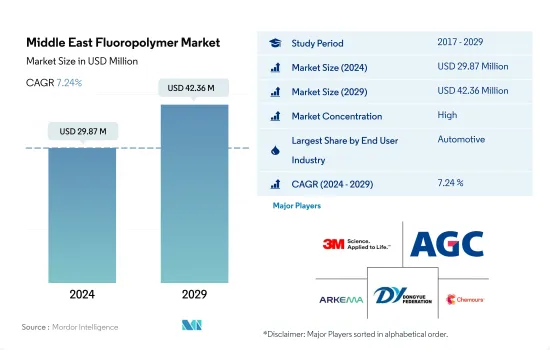

The Middle East Fluoropolymer Market size is estimated at 29.87 million USD in 2024, and is expected to reach 42.36 million USD by 2029, growing at a CAGR of 7.24% during the forecast period (2024-2029).

Aerospace and automotive industries to create opportunities for the market

- Fluoropolymers have applications in oil and gas, semiconductor and electronic, chemical processing, automotive, wire and cable, building, aerospace, and pharmaceutical sectors. The Middle Eastern fluoropolymer market is led by the building and construction and automotive industries, accounting for 9.75% and 39.96% shares in 2021 in terms of revenue.

- The building and construction industry is the largest consumer of fluoropolymers in the region. It held a share of 11.4% of the Middle Eastern fluoropolymer market in 2022 by volume. The region's new floor area is expected to reach 4.9 billion sq. ft by 2029 from 4.2 billion sq. ft in 2022, which is expected to drive the demand for fluoropolymers in the coming years.

- The automotive industry is the second-largest consumer of fluoropolymers in the region, accounting for 25.58% of the consumption share in 2022 by volume. The industry witnessed a 32.8% increase in the production of vehicles by volume in 2022 compared to 2021. The increased consumption of fluoropolymers in lithium-ion batteries, the main components of an EV, is expected to drive the market during the forecast period.

- The aerospace industry is expected to be the fastest-growing industry in the region in terms of revenue, with a CAGR of 8.42% during the forecast period (2023-2029). This growth can be attributed to the fluoropolymer component's ability to withstand the aggressive etching process and provide the necessary purity required to produce microchips and other electronics used in the aerospace industry. It is also used in the coatings of various aerospace components as it can withstand extreme temperatures and resist corrosion.

Investments in UAE to boost the demand for fluoropolymer

- Fluoropolymers are used in the Middle East for applications such as coatings and liners for industrial machinery, automotive, and many others. The fluoropolymers market in the region is dominated by Saudi Arabia and the United Arab Emirates, with a share of 0.83% of the revenue of the global overall fluoropolymers market.

- Saudi Arabia is the largest consumer in the regional fluoropolymer market, with a share of 25.69% by a value in major applications in the aerospace, automotive, and industrial machinery sectors due to increasing demand. The rise in the production of automobiles drives the fluoropolymer market in Saudi Arabia, which contributed a 1.13% share of the overall region in 2022.

- The United Arab Emirates is the second-largest consumer in the Middle Eastern fluoropolymer market, with a share of 6.06% of the revenue in 2022. With a CAGR of 8.71% in terms of revenue from electronics production in the country, the demand for fluoropolymers in the United Arab Emirates is likely to increase during the forecast period.

- The Rest of the Middle East segment is one of the largest markets in the Middle East, with a share of 58.8% by value of the fluoropolymer market due to the rise in automotive production. Automotive production in the Rest of Middle East has a share of 98.4% in the overall Middle Eastern region.

- The United Arab Emirates is the fastest-growing country in the region, with an expected CAGR of around 7.06% by revenue during the forecast period. This growth is expected to be a result of the plans for investment in the United Arab Emirates' financial hub to double the size of its economy by 2033, accounting for USD 8.7 trillion in economic development technology sectors through innovation.

Middle East Fluoropolymer Market Trends

Growing investments from the government and private players

- In the Middle East, Saudi Arabia is quickly emerging as one of the key markets for the electrical and electronics industry. Aside from the oil and gas industry, the country has a sizable consumer base and a broad range of industrial pursuits, contributing to the rapid annual increase in production for the electrical and electronics industry. Thus, electrical and electronics production in the region registered a CAGR of 18% from 2017 to 2019 in revenue terms.

- In 2020, the demand for consumer electronics for remote working and home entertainment increased due to the COVID-19 pandemic. In 2020, Saudi Arabia registered the highest smartphone penetration rate, around 97%, in the world, which enabled approximately 60% of Saudi customers to discover new sellers through social networks. Saudi Arabia faced a higher rate of e-commerce growth, nearly 60% (between 2019 and 2020), mainly due to the pandemic. The revenue from electrical and electronics production increased by 1.8% compared to the previous year.

- Electrical and electronic production is expected to witness a CAGR of 8.51% in value during the forecast period (2023-2029). The major driving component behind the growth is likely to be the growing investments from the government and the manufacturers like Samsung. Samsung has also been pitching its 5G wireless technology to the Middle East. Saudi Arabia implemented a 5G network in line with the Vision 2030 initiative. All such factors are expected to boost electronics production over the forecast period in the region.

Middle East Fluoropolymer Industry Overview

The Middle East Fluoropolymer Market is fairly consolidated, with the top five companies occupying 75.30%. The major players in this market are 3M, AGC Inc., Arkema, Dongyue Group and The Chemours Company (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 5000171

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Electrical and Electronics

- 4.1.5 Packaging

- 4.2 Import And Export Trends

- 4.2.1 Fluoropolymer Trade

- 4.3 Regulatory Framework

- 4.3.1 Saudi Arabia

- 4.3.2 United Arab Emirates

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Electrical and Electronics

- 5.1.5 Industrial and Machinery

- 5.1.6 Other End-user Industries

- 5.2 Sub Resin Type

- 5.2.1 Ethylenetetrafluoroethylene (ETFE)

- 5.2.2 Fluorinated Ethylene-propylene (FEP)

- 5.2.3 Polytetrafluoroethylene (PTFE)

- 5.2.4 Polyvinylfluoride (PVF)

- 5.2.5 Polyvinylidene Fluoride (PVDF)

- 5.2.6 Other Sub Resin Types

- 5.3 Country

- 5.3.1 Saudi Arabia

- 5.3.2 United Arab Emirates

- 5.3.3 Rest of Middle East

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 AGC Inc.

- 6.4.3 Arkema

- 6.4.4 Dongyue Group

- 6.4.5 Solvay

- 6.4.6 The Chemours Company

7 KEY STRATEGIC QUESTIONS FOR ENGINEERING PLASTICS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.