Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693839

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693839

Middle East Polyethylene Terephthalate (PET) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

PUBLISHED:

PAGES: 143 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

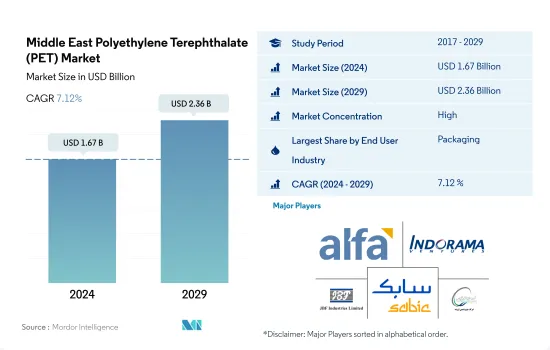

The Middle East Polyethylene Terephthalate (PET) Market size is estimated at 1.67 billion USD in 2024, and is expected to reach 2.36 billion USD by 2029, growing at a CAGR of 7.12% during the forecast period (2024-2029).

Packaging industry to dominate the market in the coming years

- PET has a wide range of applications in packaging and electronics, including packaging foods and beverages, particularly convenience-sized soft drinks and water, coil forms, electrical encapsulation, solenoids, and smart meters. In 2022, PET resin in the region accounted for around 6.07% by value of the global PET resin consumption.

- The packaging industry is the region's largest end-user industry for PET resin. The plastic packaging industry of the region is being driven by key factors such as a rising population, a significant increase in per capita income, and changing lifestyles. The demand for packaged food in the region is expected to reach 44 million tons by 2026. The region's plastic packaging production volume is expected to reach 6.7 million tons in 2029 from 5.0 million tons in 2023. As a result, the demand for PET resin is expected to drive during the forecast period.

- The electrical and electronics industry is the region's fastest-growing industry, with a CAGR of 9.78% in terms of value during the forecast period. The surge in demand for technologically advanced consumer electronics and appliances, such as smartphones, laptops, computers, cameras, and televisions, is expected to boost consumer electronics demand during the forecast period. The region's electrical and electronics production revenue is projected to reach USD 114.9 billion in 2029 from USD 69.7 billion in 2023. The consumer electronics industry in the United Arab Emirates is projected to reach a revenue of USD 2.2 billion in 2027 from USD 1.7 billion in 2023. The increase in electrical and electronics production in the region is projected to drive the demand for PET resin in the future.

Saudi Arabia to dominate the PET market

- PET has a wide range of applications in packaging and electrical and electronics, including food and beverage packaging, convenience-sized soft drinks, water, coil forms, electrical devices, and smart meters. In 2022, the Middle East accounted for 6.03% of the global consumption of PET resin in terms of value.

- Saudi Arabia is the largest consumer of PET resin in the region. It is expected to record the highest CAGR of 7.70% in terms of value during the forecast period due to its growing packaging, electrical and electronics, and industrial machinery industries. The preference for processed and packaged foods has propelled the food packaging market in the country due to the rapidly developing lifestyles and economic growth, along with a shift in population dynamics from rural to urban areas. Saudi Arabia has one of the largest e-commerce markets in the Middle East. With the increasing demand for packaging, the consumption of PET resins from end-user industries will likely increase in the region during the forecast period.

- The demand for PET resin from the United Arab Emirates is increasing significantly due to the growing packaging, electrical and electronics, and other end-user industries. The surging demand for technologically advanced consumer electronics and appliances, such as smartphones, laptops, computers, cameras, and televisions, is expected to boost the demand for PET resins in the country in the future. Consumer electronics in the country are projected to reach a market volume of around USD 2.5 billion in 2027 from USD 1.8 billion in 2023.

Middle East Polyethylene Terephthalate (PET) Market Trends

Growing investments from the government and private players

- In the Middle East, Saudi Arabia is quickly emerging as one of the key markets for the electrical and electronics industry. Aside from the oil and gas industry, the country has a sizable consumer base and a broad range of industrial pursuits, contributing to the rapid annual increase in production for the electrical and electronics industry. Thus, electrical and electronics production in the region registered a CAGR of 18% from 2017 to 2019 in revenue terms.

- In 2020, the demand for consumer electronics for remote working and home entertainment increased due to the COVID-19 pandemic. In 2020, Saudi Arabia registered the highest smartphone penetration rate, around 97%, in the world, which enabled approximately 60% of Saudi customers to discover new sellers through social networks. Saudi Arabia faced a higher rate of e-commerce growth, nearly 60% (between 2019 and 2020), mainly due to the pandemic. The revenue from electrical and electronics production increased by 1.8% compared to the previous year.

- Electrical and electronic production is expected to witness a CAGR of 8.51% in value during the forecast period (2023-2029). The major driving component behind the growth is likely to be the growing investments from the government and the manufacturers like Samsung. Samsung has also been pitching its 5G wireless technology to the Middle East. Saudi Arabia implemented a 5G network in line with the Vision 2030 initiative. All such factors are expected to boost electronics production over the forecast period in the region.

Middle East Polyethylene Terephthalate (PET) Industry Overview

The Middle East Polyethylene Terephthalate (PET) Market is fairly consolidated, with the top five companies occupying 100%. The major players in this market are Alfa S.A.B. de C.V., IVL Dhunseri Petrochem Industries Private Limited (IDPIPL), JBF Industries Ltd, SABIC and Shahid Tondgooyan Petrochemical Company (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 5000177

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Electrical and Electronics

- 4.1.5 Packaging

- 4.2 Import And Export Trends

- 4.2.1 Polyethylene Terephthalate (PET) Trade

- 4.3 Price Trends

- 4.4 Form Trends

- 4.5 Recycling Overview

- 4.5.1 Polyethylene Terephthalate (PET) Recycling Trends

- 4.6 Regulatory Framework

- 4.6.1 Saudi Arabia

- 4.6.2 United Arab Emirates

- 4.7 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Automotive

- 5.1.2 Building and Construction

- 5.1.3 Electrical and Electronics

- 5.1.4 Industrial and Machinery

- 5.1.5 Packaging

- 5.1.6 Other End-user Industries

- 5.2 Country

- 5.2.1 Saudi Arabia

- 5.2.2 United Arab Emirates

- 5.2.3 Rest of Middle East

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Alfa S.A.B. de C.V.

- 6.4.2 Far Eastern New Century Corporation

- 6.4.3 IVL Dhunseri Petrochem Industries Private Limited (IDPIPL)

- 6.4.4 JBF Industries Ltd

- 6.4.5 Reliance Industries Limited

- 6.4.6 SABIC

- 6.4.7 Shahid Tondgooyan Petrochemical Company

7 KEY STRATEGIC QUESTIONS FOR ENGINEERING PLASTICS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.