Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693847

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693847

North America Polyamide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

PUBLISHED:

PAGES: 185 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

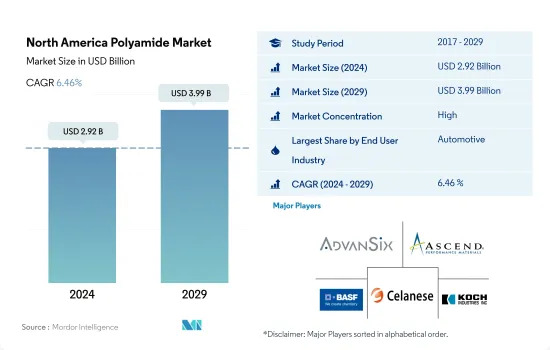

The North America Polyamide Market size is estimated at 2.92 billion USD in 2024, and is expected to reach 3.99 billion USD by 2029, growing at a CAGR of 6.46% during the forecast period (2024-2029).

Increasing demand from the automotive and electrical and electronics industries in Mexico may drive the market growth

- Polyamides are high-performance plastics that can withstand high temperatures and corrosive environments. Due to their non-adhesive and low friction properties, they are suitable for applications in various end-user industries like aerospace, electronics, automotive, and telecommunications.

- The automotive industry occupied the largest market share in terms of consumption of polyamides in 2022. This can be attributed to the United States-Mexico-Canada agreement, which enforces that 75% of the components manufactured in the United States, Mexico, or Canada will avail zero tariffs, subsequently driving the demand for vehicles and polyamides in the region. For instance, vehicle production reached 14.5 million units in 2022 compared to 14 million units in the previous year.

- The electrical and electronics industry occupied the second-largest market share in terms of consumption of polyamides in 2022, and it is expected to register a CAGR of 8.87% in terms of value during the forecast period, making it the fastest-growing industry.

- There was a significant shift of consumers toward consumer electronics items like laptops, mobiles, and smart devices, as companies began adopting work-from-home models and people began setting up home offices. This caused a surge in the demand for consumer electronics. For instance, the electrical and electronics industry generated a production revenue of USD 378 billion in 2022 compared to USD 371 million in 2021.

- Trends like using advanced materials, organic electronics, miniaturization, 5G, Artificial Intelligence (AI), and the Internet of Things (IoT) are expected to enable smart manufacturing practices. They are expected to work as growth drivers for the industry. The electrical and electronics production revenue is expected to reach USD 977 billion by 2029.

The United States is the largest consumer of polyamide resin in the region owing to its growing automotive and packaging industries

- North America accounted for 15.6% by value of the global consumption of polyamide resin in 2022. Polyamide is a key polymer in North America for various industries, including automotive, packaging, and electrical and electronics.

- The United States is the largest consumer of polyamide resin in the region, owing to its growing automotive and packaging industries. The automotive and electrical and electronics industries accounted for around 29.1% and 15.5%, respectively, by value of polyamide demand in the country in 2022. The rising automotive and electrical and electronics industries are projected to drive the demand for polyamide resin in the country during the forecast period. For instance, vehicle production in the country reached 9.6 million units in 2022 from 9.3 million units in 2021.

- Mexico's demand for polyamide resin is increasing significantly due to increased revenue from vehicle production, plastic packaging production, and electrical and electronics production. The country's demand for polyamide resin is expected to be driven by the growing automotive and electrical and electronics industries. For instance, vehicle production in the country is expected to reach 5.9 million units in 2029 from 4.0 million units in 2023.

- Mexico is expected to be the fastest-growing country in the North American polyamide market and is expected to register a CAGR of 8.39% by value during the forecast period (2023-2029). The country's consumer electronics market is also expanding at a rapid rate, and it is expected to reach USD 16.23 billion in 2027 from USD 10.36 billion in 2023. The growing US electrical and electronics industry is projected to drive the demand for polyamide resin in the country in the future.

North America Polyamide Market Trends

Strong growth of technological innovations to augment the overall growth of the industry

- Electrical and electronics production in North America witnessed a CAGR of over 1.4% between 2017 and 2019 owing to the advancement of technology, coupled with the increasing demand for consumer electronics products, such as smart TVs, refrigerators, air conditioners, and other products. The rapid pace of electronic technological innovation is driving the demand for newer and faster electronic products. As a result, it has also increased the electrical and electronics production in the region.

- Electronic device sales in North America fell by around 9% in 2020 compared to 2019, owing to the COVID-19 impact, because of the production facility shutdowns, supply chain disruptions, and various other constraints. As a result, revenue from electrical and electronics production in the region decreased by 4.7% in 2020 compared to the previous year.

- In 2021, the sales of consumer electronics in the region reached around USD 113 billion, 4% higher than in 2020. As a result, North America's electrical and electronics production grew by 13.8% in 2021 in terms of revenue compared to the previous year.

- By 2027, North America is projected to be the third-largest region for electrical and electronics production and account for a share of around 10.5% of the global market. The emergence of advanced technologies such as virtual reality, IoT solutions, and robotics into consumer electronic products to achieve efficiency and low cost has provided a significant advantage to the consumer electronics industry. The consumer electronics industry in the region is projected to reach a market volume of around USD 161.8 billion by 2027 from USD 127.6 billion in 2023. As a result, the demand for electrical and electronic products in the region is projected to increase.

North America Polyamide Industry Overview

The North America Polyamide Market is fairly consolidated, with the top five companies occupying 92.38%. The major players in this market are AdvanSix, Ascend Performance Materials, BASF SE, Celanese Corporation and Koch Industries, Inc. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 5000186

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Electrical and Electronics

- 4.1.5 Packaging

- 4.2 Import And Export Trends

- 4.2.1 Polyamide (PA) Trade

- 4.3 Price Trends

- 4.4 Recycling Overview

- 4.4.1 Polyamide (PA) Recycling Trends

- 4.5 Regulatory Framework

- 4.5.1 Canada

- 4.5.2 Mexico

- 4.5.3 United States

- 4.6 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Electrical and Electronics

- 5.1.5 Industrial and Machinery

- 5.1.6 Packaging

- 5.1.7 Other End-user Industries

- 5.2 Sub Resin Type

- 5.2.1 Aramid

- 5.2.2 Polyamide (PA) 6

- 5.2.3 Polyamide (PA) 66

- 5.2.4 Polyphthalamide

- 5.3 Country

- 5.3.1 Canada

- 5.3.2 Mexico

- 5.3.3 United States

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 AdvanSix

- 6.4.2 Arkema

- 6.4.3 Ascend Performance Materials

- 6.4.4 BASF SE

- 6.4.5 Celanese Corporation

- 6.4.6 Domo Chemicals

- 6.4.7 DSM

- 6.4.8 EMS-Chemie Holding AG

- 6.4.9 Koch Industries, Inc.

- 6.4.10 Polymeric Resources Corporation

7 KEY STRATEGIC QUESTIONS FOR ENGINEERING PLASTICS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.