Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693848

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693848

Asia-Pacific Polyamide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

PUBLISHED:

PAGES: 196 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

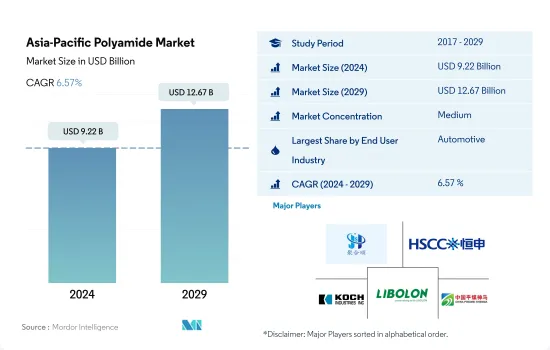

The Asia-Pacific Polyamide Market size is estimated at 9.22 billion USD in 2024, and is expected to reach 12.67 billion USD by 2029, growing at a CAGR of 6.57% during the forecast period (2024-2029).

The automotive industry to remain dominant during the forecast period

- Polyamides are high-performance plastics that can withstand high temperatures and corrosive environments. Due to their non-adhesive and low friction properties, they are suitable for applications in various end-user industries like aerospace, electronics, automotive, and telecommunications. Asia-Pacific accounted for 51% of the global consumption of polyamides in 2022, making it the largest consumer of polyamides in the world.

- The automotive industry holds the largest market share, accounting for 33% of the region's total polyamide consumption in 2022. China's automotive industry was the largest consumer of polyamides in the region in 2022. China is an emerging exporter of small- and medium-sized vehicles, with companies like Geely, Chery, and BYD setting up manufacturing plants to penetrate developing vehicle markets abroad. This is increasing the production of vehicles and the application of polyamides in the country. Vehicle production in the country is expected to reach 64.7 million units in 2029 compared to 46.6 million units in 2022.

- The packaging industry is expected to be the fastest-growing industry in terms of consumption of polyamides. It is predicted to register a CAGR of 8.22%, by value, during the forecast period [2023-2029]. Trends such as technology-enabled packaging, personalized packaging, and sustainable and environmentally friendly product-driven packaging, which aims to reduce carbon footprint, are expected to drive future demand for food and retail packaging. The packaging industry in countries like South Korea and China is among the fastest-growing in terms of polyamide consumption. These countries are projected to register CAGRs of 10.30% and 9.24%, respectively, by value, during the forecast period.

China to remain as a market leader in the region

- The Asia-Pacific region is the largest consumer of polyamides globally, holding a share of over 50.86% in 2022. In this region, polyamides are used extensively in a variety of applications, including electrical and electronics, automotive, consumer goods, and food packaging industries.

- In 2019, due to geopolitical tensions, global trade saw a minor decline. This decline was particularly pronounced in Malaysia, resulting in the country's first full-year drop in a decade. Consequently, the demand for polyamides in the country fell by 10.09% compared to 2018, whereas the regional demand experienced a Y-o-Y decrease of 2.53%. In 2020, various restrictive factors, such as worker unavailability and raw material shortages resulting from operational and trade restrictions during the pandemic, severely impacted various end-user industries. This factor, in turn, negatively affected the polyamide demand in the region.

- However, in 2021, as restrictions eased, polyamide demand returned to pre-pandemic levels. This resurgence was primarily driven by the rapid growth in industrial activities in countries like Australia and Malaysia. This growth trend is expected to continue throughout the forecast period, with China expected to witness the highest growth in polyamide demand among all countries. Overall, polyamide demand from the Asia-Pacific region is anticipated to register a CAGR of 4.81% in terms of volume during the forecast period.

Asia-Pacific Polyamide Market Trends

Rapid growth in ASEAN countries to foster electronics production

- The Asia-Pacific region saw an increase in electrical and electronics production revenue by 13.9% from 2020 to 2021. The electronics sector accounts for 20-50% of the total value of most Asian countries' exports. Consumer electronics such as televisions, radios, computers, and cellular phones are largely manufactured in the ASEAN region.

- ASEAN leads the production of hard drives, with over 80% of hard drives being manufactured in the region. Overall, the electrical and electronics (E&E) industry in ASEAN relies more on foreign inputs and technology than other industries, with 53% of E&E exports arising from foreign value added (FVA) or foreign inputs integrated into ASEAN's E&E exports.

- Countries like Thailand and Malaysia lead in the production of electronics in the region. Thailand, home to one of the largest electronics assembly bases in Southeast Asia, leads in the production of hard drives, integrated circuits, and semiconductors. It ranks second in manufacturing air conditioning units and fourth in the global refrigerators market.

- The electronics industry has greatly benefitted from ASEAN's integrated production networks, which foster improved trade with larger Asian economies like China and Japan.

- China held an 11.2% share of global exports in electrical products and registered a growth of 5.8% in the export of digital products from 2019 to 2020. According to the Asian Development Bank, China provides a large market for electronics in the region. Countries such as Thailand, Japan, China, Malaysia, India, and the Philippines continue to lead the region in the production of electronics.

Asia-Pacific Polyamide Industry Overview

The Asia-Pacific Polyamide Market is moderately consolidated, with the top five companies occupying 51.54%. The major players in this market are Hangzhou Juheshun New Materials Co., Ltd., Highsun Holding Group, Koch Industries, Inc., LIBOLON and Shenma Industrial Co., Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 5000187

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Electrical and Electronics

- 4.1.5 Packaging

- 4.2 Import And Export Trends

- 4.2.1 Polyamide (PA) Trade

- 4.3 Price Trends

- 4.4 Recycling Overview

- 4.4.1 Polyamide (PA) Recycling Trends

- 4.5 Regulatory Framework

- 4.5.1 Australia

- 4.5.2 China

- 4.5.3 India

- 4.5.4 Japan

- 4.5.5 Malaysia

- 4.5.6 South Korea

- 4.6 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Electrical and Electronics

- 5.1.5 Industrial and Machinery

- 5.1.6 Packaging

- 5.1.7 Other End-user Industries

- 5.2 Sub Resin Type

- 5.2.1 Aramid

- 5.2.2 Polyamide (PA) 6

- 5.2.3 Polyamide (PA) 66

- 5.2.4 Polyphthalamide

- 5.3 Country

- 5.3.1 Australia

- 5.3.2 China

- 5.3.3 India

- 5.3.4 Japan

- 5.3.5 Malaysia

- 5.3.6 South Korea

- 5.3.7 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 China Petrochemical Development Corporation

- 6.4.2 Guangdong Xinhui Meida Nylon Co.,Ltd

- 6.4.3 Hangzhou Juheshun New Materials Co., Ltd.

- 6.4.4 Highsun Holding Group

- 6.4.5 Koch Industries, Inc.

- 6.4.6 LIBOLON

- 6.4.7 Shenma Industrial Co., Ltd.

- 6.4.8 Sinolong

- 6.4.9 UBE Corporation

- 6.4.10 Zig Sheng Industrial Co., Ltd.

7 KEY STRATEGIC QUESTIONS FOR ENGINEERING PLASTICS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.