Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644988

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644988

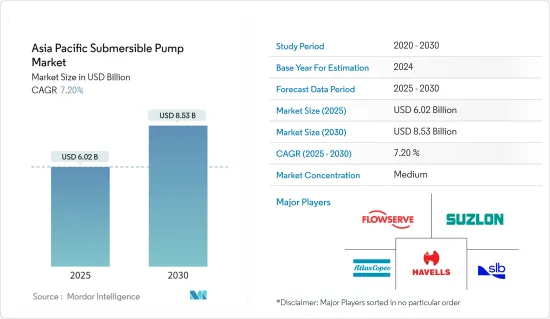

Asia Pacific Submersible Pump - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 110 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

The Asia Pacific Submersible Pump Market size is estimated at USD 6.02 billion in 2025, and is expected to reach USD 8.53 billion by 2030, at a CAGR of 7.2% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, increasing investments in end-user industries are expected to drive the market's growth.

- On the other hand, high maintenance and operation costs and volatility in oil and gas prices are expected to hamper the Asia-Pacific submersible pump market growth during the forecast period.

- Nevertheless, retrofitting, upgrading aging, existing infrastructure, and new technology innovations will likely create lucrative growth opportunities for the Asia-Pacific submersible pump market in the forecast period.

- China dominates the market, and it is also likely to witness the highest CAGR during the forecast period. This growth is attributed to the increasing investments and supportive government policies in the end-user industries.

Asia Pacific Submersible Pump Market Trends

Oil and Gas Industry to Witness Significant Demand

- In the oil and gas upstream industry, submersible pumps are used to move spent drilling mud in and out of the reserve pits, maximizing oil and gas production through the artificial lift and treating the produced wastewater.

- The demand for submersible pumps has been volatile in the past few years, mainly due to the downturn in the industry. However, the recovery in crude oil price and the low breakeven price drive the production activity in the market during the forecast period.

- In the year 2022, China was the largest producer of natural gas in the Asia-Pacific region with a production of 7.99 exajoules. In the same year, Australia produced around 5.5 exajoules of natural gas, making it the second biggest producer in the region.

- The oil and gas industry in the Asia Pacific region has witnessed numerous developments, such as production efficiency improvements and new fields startup, the natural gas production increased by 1.6% in 2021 compared to the previous year. Also, unit operating costs are expected to decline in the coming years.

- In June 2021, CNOOC's deepwater gas field commenced production capacity of 10 million cubic meters daily. The gas field, also named Lingshui 17-2, sits 1,500 meters below the sea surface in the South China Sea. The field will be able to supply 3 billion cubic meters of gas a year, or roughly 1% of China's gas demand.

- In September 2021, CNOOC Limited announced the discovery of Kenli 10-2 oilfield in Bohai Bay. The Kenli 10-2 oilfield is located in Laizhou Bay Sag in Southern Bohai Bay, with an average water depth of about 50 feet.

- As of 2022, India has 77 active rigs. The country's oil production has been falling for almost a decade due to aging fields and the absence of major discoveries. Both state-owned and private players have been working on investment plans to raise recovery from older fields.

- Therefore, based on the factors and projects mentioned above, the oil and gas industry is expected to witness significant demand for the submersible pump market in the Asia Pacific over the forecast period.

China to Dominate the Market

- China has been an essential factor in the growth of the manufacturing sector worldwide. The country is the leader in the mining and construction industries and is a top oil and gas player. Despite the outbreak of COVID-19, the industrial sector in the country has been registering a growth of over 3% since April 2020, reaching an all-time high of 35.1% in January 2021. As per the National Bureau of Statistics of China, in 2021, China's industrial production increased by 9.6% compared to the previous year.

- In 2022, Crude oil production in China was approximately 204 million tons. Crude oil production has witnessed a 2.5% increase compared to the previous year.

- China is committed to expanding the infrastructure required for these urban and rural areas, which is expected to positively impact the demand for submersible pumps in the coming years. The submersible pump market is expected to be driven by growth in oil and gas, wastewater treatment, mining and construction, and other industries.

- China is witnessing an increase in industrial activities, thereby inducing growth in demand for crude oil and chemicals, among others. China is expected to account for significant crude oil refining capacity growth between 2019 and 2025 in Asia-Pacific (APAC). The country is expected to account for 26.8% of the total refining expansion capacity in the region by 2025. This will likely contribute to the region's market demand for submersible pumps.

- China targets to boost domestic production of unconventional sources like shale gas. It is also estimated that China's shale gas production may reach around 280 billion cubic meters (bcm) by 2035. Thus, the plans to boost its shale gas production are expected to create an opportunity in the coming years.

- In February 2021, CNOOC announced total capital expenditure in the range of USD 13.91 billion to USD 15.46 billion, with targeted net production of 545-555 million barrels of oil equivalent (Mboe).

- In March 2021, Sinopec announced to invest USD 9.28 billion in upstream exploration, focusing on shale gas development in southwest China and the construction of liquefied natural gas (LNG) terminals in coastal areas.

- Therefore, based on such developments, China is expected to dominate the Asia Pacific submersible pump market during the forecast period.

Asia Pacific Submersible Pump Industry Overview

The Asia-Pacific submersible pump market is semi-fragmented. Some of the major players in the market (in no particular order) include Schlumberger Limited, Sulzer AG, Flowserve Corporation, Atlas Copco AB, and Havells India Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 5000238

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Borewell Submersible Pump

- 5.1.2 Openwell Submersible Pump

- 5.1.3 Non-clog Submersible Pump

- 5.2 Drive Type

- 5.2.1 Truck

- 5.2.2 Electric

- 5.2.3 Hydraulic

- 5.2.4 Other Drive Types

- 5.3 Head

- 5.3.1 Below 50 m

- 5.3.2 Between 50 m to 100 m

- 5.3.3 Above 100 m

- 5.4 End User

- 5.4.1 Water and Wastewater

- 5.4.2 Oil and Gas Industry

- 5.4.3 Mining and Construction Industry

- 5.4.4 Other End Users

- 5.5 Geography

- 5.5.1 China

- 5.5.2 India

- 5.5.3 Japan

- 5.5.4 South Korea

- 5.5.5 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Baker Hughes Co.

- 6.3.2 Schlumberger Limited

- 6.3.3 Halliburton Co.

- 6.3.4 Weir Group PLC

- 6.3.5 Sulzer AG

- 6.3.6 Flowserve Corporation

- 6.3.7 Atlas Copco AB

- 6.3.8 Crompton Greaves Consumer Electricals Limited

- 6.3.9 Havells India Ltd.

- 6.3.10 Falcon Pumps Pvt. Ltd.

- 6.3.11 Shimge Pump Industry Group Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.