PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1431563

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1431563

UK Mutual Funds - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

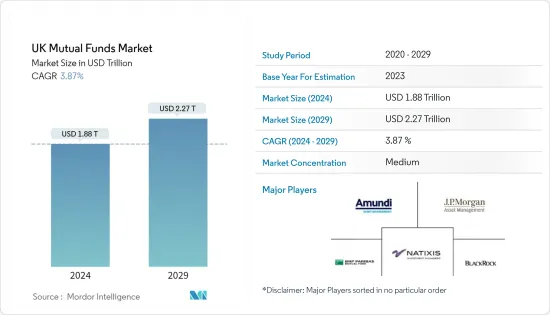

The UK Mutual Funds Market size is estimated at USD 1.88 trillion in 2024, and is expected to reach USD 2.27 trillion by 2029, growing at a CAGR of 3.87% during the forecast period (2024-2029).

Large financial institutions provide mutual funds. They permit individual and business investors to contribute funds to the mutual fund, which will buy and sell shares on your behalf. The Financial Conduct Authority (FCA) regulates the UK mutual funds market, which sets guidelines and rules to protect investors and ensure market integrity. Many UK mutual funds focus on stocks and shares listed on global markets. The market offers mutual funds catering to different investment objectives and risk profiles. Common types of funds include equity, fixed-income, money market, balanced, index, and sector-specific funds.

Many investors concentrate on the NASDAQ and the New York Stock Exchange, resulting in portfolios that include companies like Disney, Apple, Facebook, IBM, and Amazon. The roughly 600 companies that make up the FTSE All-Shares Index are increasingly attracting the interest of mutual funds looking to increase their exposure to the UK economy.

As the virus swept across the UK, stock prices in UK financial markets decreased, and volatility rose. UK equities markets began to rise after reaching low troughs in late March. The COVID-19 crisis sparked widespread panic and a rush for cash. Both money market funds and long-term funds saw outflows among UCITS.

UK Mutual Funds Market Trends

Growing Personal Finance Sector is Driving the Market

The growing personal finance sector in the UK drives the mutual fund market. Personal finance encompasses various financial services aimed at individuals, such as banking, insurance, investments, and retirement planning. People of the UK are becoming more aware of the importance of saving and investing for their future financial well-being, which has increased the demand for investment products such as mutual funds.

Retirement planning has become a major concern for many people in the UK due to an aging population and changes in pension regulations. People want personalized retirement solutions that go beyond traditional pensions. This has expanded services such as self-invested personal pensions (SIPPs) and individual savings accounts (ISAs), which provide tax benefits and greater control over retirement savings. Individuals have turned to alternative investment options in response to the low-interest-rate environment and volatility in other asset classes for ways to grow their wealth through investment vehicles such as stocks, bonds, mutual funds, and exchange-traded funds (ETFs).

Potential for Capital Appreciation is Driving the Market

Capital appreciation refers to growth in the market value of assets or investments. Capital appreciation in equity shares is passive and gradual. It can occur due to macroeconomic and microeconomic factors. In the mutual fund industry, 'growth funds' often invest in capital appreciation funds. These funds invest in young stocks that can grow and increase in value based on the company's improved fundamental metrics.

Mutual funds give investors access to a diverse portfolio of securities by pooling money from multiple investors. Mutual funds can invest in a wide range of assets, including stocks, bonds, and other financial instruments, reducing risks and increasing the potential for capital appreciation.

UK Mutual Funds Industry Overview

The UK Mutual Funds Market report includes an overview of mutual fund companies operating across the UK. The report presents detailed profiling of a few major companies, including product offerings, regulations governing them, their headquarters, and financial performance. Some major players dominating the market are BlackRock Funds, Van Guard, Charles Schwab, JP Morgan, and Barclay Hedge.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Personal Wealth is Driving the Market

- 4.2.2 Retirement Plannings are Driving the Market

- 4.3 Market Restraints

- 4.3.1 Market Volatility and Economic Uncertainties are Restraining the Market

- 4.4 Market Opportunities

- 4.4.1 Niche Investment Strategies and Investments in ESG's Create Opportunities for New Entrants in the Market

- 4.5 Industry Attractiveness: Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Insights on Industry Policies and Government Regulations

- 4.7 Insights on Various Types of Schemes or Funds Offered in UK Mutual Fund Industry

- 4.8 Insights on Technological Innovations Shaping the Industry

- 4.9 Impact of COVID 19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Fund Type

- 5.1.1 Equity

- 5.1.2 Debt

- 5.1.3 Multi-Asset

- 5.1.4 Money Market

- 5.1.5 Other Fund Types

- 5.2 By Investor Type

- 5.2.1 Households

- 5.2.2 Monetary Financial Institutions

- 5.2.3 General Government

- 5.2.4 Non-Financial Corporations

- 5.2.5 Insurers & Pension Funds

- 5.2.6 Other Financial Intermediaries

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 BlackRock Funds

- 6.2.2 Natixis Investment Managers

- 6.2.3 Charles Schwab

- 6.2.4 JP Morgan

- 6.2.5 BNP Paribas Asset Management

- 6.2.6 Fidelity Investments

- 6.2.7 State Street Global Advisors

- 6.2.8 Capital Group

- 6.2.9 BNY Mellon

- 6.2.10 Amundi Asset Management

- 6.2.11 PIMCO/Allianz

- 6.2.12 Legal and General Investments*

7 MARKET FUTURE TRENDS

8 DISCLAIMER AND ABOUT US