Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1431588

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1431588

North America Almond Milk - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

PUBLISHED:

PAGES: 161 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

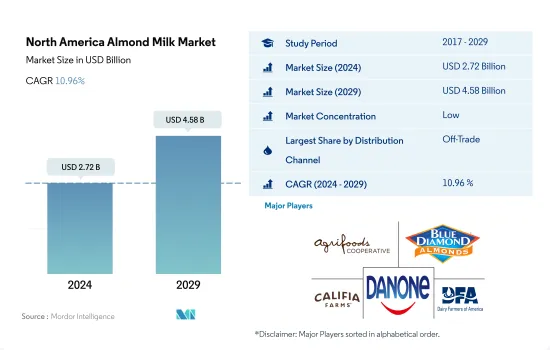

The North America Almond Milk Market size is estimated at USD 2.72 billion in 2024, and is expected to reach USD 4.58 billion by 2029, growing at a CAGR of 10.98% during the forecast period (2024-2029).

Easy availability of almond milk through wide retail sector is boosting the growth

- In North America, the rise in lactose intolerance and people's growing preferences for healthy foods are boosting the demand for almond milk sales through retail channels. Almond milk now serves as the leader of innovation in the milk category, supported by key advancements in ingredient diversification and product development that seeks to replicate both the sensory experience and nutritional value of cow's milk. In 2022, the sales value of almond milk through all the distribution channels in North America increased by 7.5% over 2021.

- The off-trade segment dominates the distribution channels of the North American almond milk market. In the off-trade segment, the supermarkets and hypermarkets sub-segment accounted for the majority of the share, amounting to 84.2% by value, in 2022.

- In North America, the United States recorded the highest sales of almond milk through retail channels. The United States is the leading market in North America for online shopping, and online retail stores as a sales channel are gaining popularity among the population. In 2022, the sales of almond milk through e-commerce reached a total of USD 36.86 million, rising from USD 33.22 million in 2021.

- The on-trade channel is the fastest-growing segment in the North American almond milk market, anticipated to grow by 19.3% in 2024 from 2021. Many leading restaurants in the region use plant-based milk, particularly as an optional ingredient in cocktails, smoothies, coffees, and espresso-based drinks. In 2022, there were more than 600,000 restaurants existing in the United States, and the average US household spent USD 2,375 annually on dining and takeout purchases.

Exhaustive production and consumption of almonds and almond milk led by United States remains the key factor

- North America dominated the global almond milk market due to the population's increasing intolerance for lactose, consumers' preferences shifting toward healthy foods, and also higher production of almonds, which rose by an average of 6.7% from 2017 to 2021. The market for plant-based milk accounts for around 10% of the North American milk market, and the increasing number of plant-based milk customers have more options than ever. Almond milk is currently the most preferred and consumed plant-based milk in North America, which accounts for almost two-thirds of the global market.

- The United States is the region's leading almond milk market and is projected to register the fastest Y-o-Y growth rate of 19% by value from 2023 to 2025. The country's higher demand is due to its accounting for the highest production volume of almonds globally, amounting to around 2,002,742 tons annually or 80% of the global almond production. This is resulting in increased production of almond milk every year. Constant product launches are a key factor promoting the sales of almond milk in the country because US consumers are highly keen on trying new products.

- Canada is the second-leading market for almond milk in North America. Governmental support is the primary factor boosting the sales of almond milk in the country. The Canadian government has identified plant-based foods as an important and growing industry and included the plant alternatives industry in its Supercluster Initiative while investing USD 150 million toward its development in 2018. In 2021, another investment of USD 173 million was made. Thus, the Canadian almond milk market is projected to record a Y-o-Y growth rate of 11.08% during the forecast period.

North America Almond Milk Market Trends

Consumer preferences shifting toward healthy foods and sustainable ingredient sourcing is largely driving the consumption of almond milk in North America

- Plant-based milk is the largest consumed category among all dairy alternative products across the region. Almond milk per capita consumption has been on the rise for the past few years due to the growing vegan population. Nearly half of the US population (47%) consumes plant-based milk regularly, a number that increases to 56% for the millennial demographic alone. Consumer preferences shifting toward healthy food and sustainable ingredient sourcing are significant factors influencing consumer choice. In the United States, 40% of Generation Z, followed by 38% of Millennials, 34% of Generation X, and 21% of Baby Boomers and Seniors demographics, consume plant-based milk due to sustainably sourced ingredients.

- One of the highest obesity rates globally is in the United States. As of November 2021, the United States had adult obesity rates of 30% or more, with 19 states having rates of 35% or more. The growing volume of lactose-intolerant consumers in the region has been another important aspect. In 2022, 30 to 50 million Americans were lactose intolerant. In order to counter these constraints, people are exploring ways to stay fit and opting for healthier lifestyles. This, in turn, has increased the consumption of various healthy drinks, including almond milk.

- Almond milk is perceived as a protein-rich nut-based milk that helps strengthen the bones. Almond milk has emerged as a good substitute for dairy milk owing to its flavor and amalgamation proficiency. It is also used as a base for smoothies since it effectively blends with hot and cold beverages such as tea or coffee and is considered a good substitute for milk, even for baking purposes. Thus, the consumption of almond milk is expected to grow significantly over the forecast period.

North America Almond Milk Industry Overview

The North America Almond Milk Market is moderately consolidated, with the top five companies occupying 42.12%. The major players in this market are Agrifoods International Cooperative Ltd, Blue Diamond Growers, Califia Farms LLC, Danone SA and Hiland Dairy Foods (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50000728

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Per Capita Consumption

- 4.2 Raw Material/Commodity Production

- 4.2.1 Almond

- 4.3 Regulatory Framework

- 4.3.1 Canada

- 4.3.2 Mexico

- 4.3.3 United States

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Distribution Channel

- 5.1.1 Off-Trade

- 5.1.1.1 By Sub Distribution Channels

- 5.1.1.1.1 Convenience Stores

- 5.1.1.1.2 Online Retail

- 5.1.1.1.3 Specialist Retailers

- 5.1.1.1.4 Supermarkets and Hypermarkets

- 5.1.1.1.5 Others (Warehouse clubs, gas stations, etc.)

- 5.1.2 On-Trade

- 5.1.1 Off-Trade

- 5.2 Country

- 5.2.1 Canada

- 5.2.2 Mexico

- 5.2.3 United States

- 5.2.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Agrifoods International Cooperative Ltd

- 6.4.2 Blue Diamond Growers

- 6.4.3 Califia Farms LLC

- 6.4.4 Campbell Soup Company

- 6.4.5 Danone SA

- 6.4.6 Elmhurst Milked LLC

- 6.4.7 Hiland Dairy Foods

- 6.4.8 Malk Organics LLC

- 6.4.9 SunOpta Inc.

- 6.4.10 The Hain Celestial Group Inc.

7 KEY STRATEGIC QUESTIONS FOR DAIRY AND DAIRY ALTERNATIVE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.