Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693873

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693873

Europe Non-Dairy Milk - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 213 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

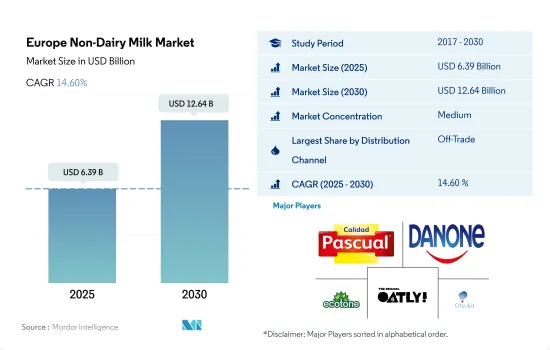

The Europe Non-Dairy Milk Market size is estimated at 6.39 billion USD in 2025, and is expected to reach 12.64 billion USD by 2030, growing at a CAGR of 14.60% during the forecast period (2025-2030).

Easy availability of plant-based milk through wide retail sector is boosting the growth

- Plant-based milk is the innovation leader in the milk category, supported by key advancements in ingredient diversification and product development that seek to replicate the sensory experience and nutritional value of cow's milk. The sales value of plant-based milk through the overall distribution channel is anticipated to grow by 70.3% in 2026 from 2022.

- Among overall distribution channels, the off-trade segment dominates the distribution channels of the Europe plant-based milk market. Hypermarkets and supermarkets primarily drive the high market share of off-trade channels. The sales value of plant-based milk in supermarkets and hypermarkets registered a growth of 72.57% from 2018 to 2022. These retail channels have a strong position due to the wide selection of brands offered, considerable shelf space, and frequent price promotions.

- Compared to other plant-based milk, soy milk is the most consumed through off-trade channels, with a market share of 38.17% in 2022.

- The region does not have a considerable market for the on-trade channels and is at a nascent stage. Consumers prefer plant-based milk at home and are less likely to drink from a restaurant or food service outlet. On-trade channels acquired less than 3% of the value share in 2022 compared to off-trade channels.

- In Europe, plant-based milk alternatives have been gaining popularity compared to other plant-based products, such as cheese and meat, and many consumers are already familiar with milk alternatives like soy, oat, almond, and coconut milk. In Germany, 93% of consumers already buy plant-based milk alternatives, which is higher than in any other plant-based product category.

Germany plays a major role in the consumption of plant-based milk in the region

- The plant-based milk in the Europe region witnessed a growth of 14.1% in 2022 compared to the previous year, 2021. The growth is attributed to many consumers drawn toward the health and sustainability benefits of plant-based products. Plant-based beverages also claim other advantages, as they have a longer shelf life than dairy-based milk. Cow's milk usually lasts four to seven days, but plant-based milk lasts up to 10 days at room temperature.

- By country, Germany is the leading market for plant-based milk in the region, and it is anticipated to grow by 77.6% in 2024 compared to the year 2021. Compared to other plant-based products, many consumers in the country are familiar with milk alternatives. Milk is the most preferred plant-based product in the country, with 93% of consumers buying it already. In 2021, 75% of consumers in Germany consumed oat milk as their go-to alternative to conventional milk, 69.4% consumed almond milk, and almost 51% consumed soy milk. Milk is the most preferred plant-based product in the country, with a consumption rate of 93%.

- Spain is the second-leading market for plant-based milk in the region. In Spain, the number of vegans is growing, and more than half of the population wants to reduce meat consumption, considering themselves flexitarian. As of 2022, 30% of Spanish consumers identify as flexitarian, while 6% follow a plant-based diet. The total sales value of plant-based milk in Spain reported an increase from USD 650.7 million in 2021 to USD 706.4 million in 2022, which represented an increase of approximately 8.6%. Compared to other plant-based milk, soy milk is majorly consumed in Spain. In 2022, soy milk accounted for 31.5% of the value share.

Europe Non-Dairy Milk Market Trends

The consumption of plant-based milk products increased due to the health benefits they offer

- The consumption of plant milk in Europe is on the rise. The increasing inclusion of oat milk instead of conventional milk, especially in the daily diet, is strengthening consumption patterns across Europe. Compared to other plant-based products such as cheese and meat, plant-based milk leads the plant-based food market in the region. The European plant-based milk market is expected to hold a share of 66.8% in 2023. Many consumers are familiar with milk alternatives like soy and coconut milk. In Germany, 93% of consumers consume plant-based milk, which is higher than in any of the other plant-based product categories.

- The popularity of plant milk has increased over the past decade. Drinks like these have been consumed for centuries in various cultures. In Spain, tiger nut milk, known as horchata de chufa, is a popular national drink. Plant milk has become a household staple and is no longer consumed exclusively by vegans and vegetarians. Nearly 54% of European consumers prefer plant-based milk, and 43% purchase dairy and dairy alternatives.

- The domestic demand for plant-based milk is expected to be constant during the forecast period. This is due to the growing consumption of plant milk as a staple product. The per capita consumption of plant milk is anticipated to rise by 44% during 2024-2027. Bigger cities in European countries have strong plant-based consumer bases, but a gradual shift toward plant-based protein consumption is expected to spread to other parts of countries during the forecast period. Around 60% of UK consumers were interested in plant-based proteins in 2022.

Europe Non-Dairy Milk Industry Overview

The Europe Non-Dairy Milk Market is moderately consolidated, with the top five companies occupying 43.66%. The major players in this market are Calidad Pascual SAU, Danone SA, Ecotone, Oatly Group AB and Otsuka Holdings Co. Ltd (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50000739

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Per Capita Consumption

- 4.2 Raw Material/commodity Production

- 4.2.1 Dairy Alternative - Raw Material Production

- 4.3 Regulatory Framework

- 4.3.1 France

- 4.3.2 Germany

- 4.3.3 Italy

- 4.3.4 United Kingdom

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Product Type

- 5.1.1 Almond Milk

- 5.1.2 Cashew Milk

- 5.1.3 Coconut Milk

- 5.1.4 Hazelnut Milk

- 5.1.5 Hemp Milk

- 5.1.6 Oat Milk

- 5.1.7 Soy Milk

- 5.2 Distribution Channel

- 5.2.1 Off-Trade

- 5.2.1.1 By Sub Distribution Channels

- 5.2.1.1.1 Convenience Stores

- 5.2.1.1.2 Online Retail

- 5.2.1.1.3 Specialist Retailers

- 5.2.1.1.4 Supermarkets and Hypermarkets

- 5.2.1.1.5 Others (Warehouse clubs, gas stations, etc.)

- 5.2.2 On-Trade

- 5.2.1 Off-Trade

- 5.3 Country

- 5.3.1 Belgium

- 5.3.2 France

- 5.3.3 Germany

- 5.3.4 Italy

- 5.3.5 Netherlands

- 5.3.6 Russia

- 5.3.7 Spain

- 5.3.8 Turkey

- 5.3.9 United Kingdom

- 5.3.10 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Calidad Pascual SAU

- 6.4.2 Califia Farms LLC

- 6.4.3 Danone SA

- 6.4.4 Ecotone

- 6.4.5 International Food SRL

- 6.4.6 Minor Figures Limited

- 6.4.7 Oatly Group AB

- 6.4.8 Otsuka Holdings Co. Ltd

- 6.4.9 The Hain Celestial Group Inc.

- 6.4.10 Valsoia SpA

7 KEY STRATEGIC QUESTIONS FOR DAIRY AND DAIRY ALTERNATIVE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.