PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1431615

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1431615

Satellite Component - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

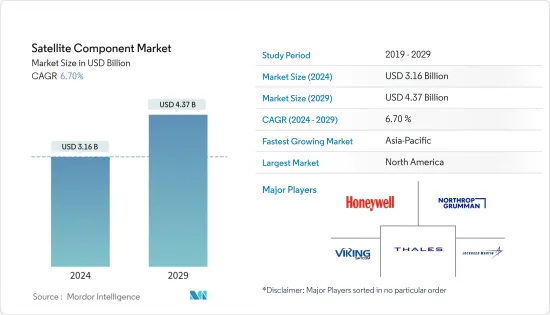

The Satellite Component Market size is estimated at USD 3.16 billion in 2024, and is expected to reach USD 4.37 billion by 2029, growing at a CAGR of 6.70% during the forecast period (2024-2029).

Key Highlights

- The global satellite component market has faced unprecedented challenges due to the COVID-19 pandemic. The space sector witnessed challenges such as shortages of raw materials, delayed satellite launch programs, and supply chain disruptions due to strict regulations imposed by governments. The market showcased a strong recovery after the pandemic. An increase in expenditure on the space sector and rising small satellite launches drive the market growth post-covid.

- The satellite components consist of the communications system, power systems, power systems, and others. The communication system includes antennas and transponders that receive and retransmit signals. The propulsion system consists of rockets that propel the satellite, and the power system includes solar panels that provide power. An increasing number of satellite launches and growing expenditure on the space sector drive the market growth. According to the United Nations Office for Outer Space Affairs (UNOOSA) index, in 2022, there were 8,261 individual satellites orbiting the Earth, with an increase of 11.84% compared to April 2021.

Satellite Component Market Trends

The Antenna Segment is Expected to Show Remarkable Growth During the Forecast Period

- The antenna segment is projected to show significant growth during the forecast period. The growth is due to increasing demand for advanced communication systems, rising number of satellite launches, and rising spending on the space sector. Satellite antennas are used to concentrate the satellite's transmitting power to the designated geographical region on Earth and avoid interference from undesired signals that will deteriorate the overall quality of the signal. Increasing satellite launches for various end-use applications such as communications, broadcasting, navigation, weather forecasting, and others drive the growth of the segment.

- The United Nations Office for Outer Space Affairs (UNOOSA) stated that 155 orbital and suborbital launches took place in November 2022. Moreover, in June 2022, the Satellite Industry Association (SIA) unveiled the 25th annual State of the Satellite Industry Report (SSIR). The report indicated a remarkable deployment of 1,713 commercial satellites in 2021, reflecting a notable surge of over 40 percent compared to 2020. This escalating demand for satellites is set to trigger a corresponding need for satellite components, thereby propelling market growth in the projected period. As an illustration, a significant development took place in July 2022 when MDA Ltd. entered into a contract with York Space Systems, a satellite manufacturer, to construct Ka-Band steerable antennas for satellites.

North America Held Highest Shares in the Market During the Forecast Period

- North America dominated the satellite components market and continued its domination during the forecast period. An increase in spending on space research and development and a rising number of satellite launches from the National Aeronautics and Space Administration (NASA) and SpaceX. In 2022, the United States government spent approximately USD 62 billion on its space programs and making the country with the highest space expenditure in the world. There were 180 successful rocket launches worldwide in 2022, out of which 76 were launched by the United States.

- For instance, in September 2021, Terran Orbital, a satellite manufacturing company in the United States, announced that it would open the world's largest satellite manufacturing and component facility on Florida's Space Coast at a cost of USD 300 million. Furthermore, in December 2021, Redwire Corporation signed a three-year supplier agreement with Terran Orbital, a satellite manufacturer, to provide a range of advanced components and solutions used in satellite manufacturing and service offerings.

Satellite Component Industry Overview

The satellite component market is moderately consolidated in nature, with a handful of players holding significant shares in the market. Some prominent market players are THALES, Viking Satcom, Lockheed Martin Corporation, Northrop Grumman Corporation, and Honeywell International Inc. With the growing competition, major original equipment manufacturers (OEMs) are focusing on the design and development of advanced satellite components and systems for space applications. Growing expenditure on research and development and design and development of next-generation satellite antennas, transponders, propulsion systems, and others will create better opportunities in the coming years.

For instance, in October 2021, the European Space Agency (ESA), French space agency CNES and Thales Alenia Space, a satellite manufacturer, announced it would jointly develop a cooling system that will maintain the temperature of big satellites in orbit. It will be the first mechanically pumped loop to be used on large commercial telecommunications satellites.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Component

- 5.1.1 Antennas

- 5.1.2 Power Systems

- 5.1.3 Propulsion Systems

- 5.1.4 Transponders

- 5.1.5 Other Components (Sensors, Thermal Control Systems, etc)

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 Germany

- 5.2.2.3 France

- 5.2.2.4 Russia

- 5.2.2.5 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 South Korea

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 Latin America

- 5.2.4.1 Brazil

- 5.2.4.2 Rest of Latin America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 United Arab Emirates

- 5.2.5.3 South Africa

- 5.2.5.4 Rest of Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Lockheed Martin Corporation

- 6.1.2 Viking Satcom

- 6.1.3 Sat- lite Technologies

- 6.1.4 Honeywell International Inc.

- 6.1.5 THALES

- 6.1.6 Northrop Grumman Corporation

- 6.1.7 IHI Corporation

- 6.1.8 BAE Systems plc

- 6.1.9 Challenger Communications

- 6.1.10 JONSA TECHNOLOGIES CO., LTD.

- 6.1.11 Accion Systems

7 MARKET OPPORTUNITIES AND FUTURE TRENDS