Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693935

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693935

Europe Remote Sensing Satellites - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 169 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

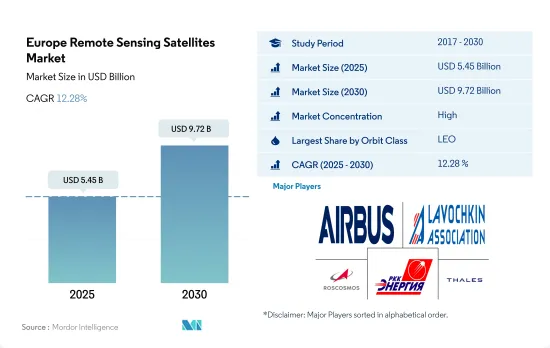

The Europe Remote Sensing Satellites Market size is estimated at 5.45 billion USD in 2025, and is expected to reach 9.72 billion USD by 2030, growing at a CAGR of 12.28% during the forecast period (2025-2030).

The surge in the number of LEO satellites is driving the growth in the forecast period

- Commercial companies have begun to combine advances in microelectronics, small satellites, and low costs to orbit to create growing low Earth orbit (LEO) sensing constellations: a large number of satellites in multiple orbital planes that facilitate quick review and provide a wide range of low to high-resolution images.

- These commercial advances, combined with the ability to detect outside the visible and infrared (IR) spectrum using synthetic aperture radar (SAR) and radio frequency (RF) mapping, generate new commercial and security applications, from moving target indication to fast jamming geolocation. These commitments are also utilized for other applications and not only for national security.

- Manufacturers have realized the potential of disaster response and have even increased their awareness of changing market conditions by observing the live movement of road freight, global rail, sea, and land.

- Many weather and communication satellites tend to have high Earth orbits farthest from the surface. Satellites in mid Earth orbit include navigational and specialized satellites, which are designed to monitor a specific area. The different satellites produced and launched in this region have different applications. For instance, from 2017 to 2022, of the 16 satellites launched into MEO orbit, most were built for global positioning/navigation purposes. Similarly, of the 15 satellites in GEO orbit, most were deployed for Earth observation and communication purposes. Approximately more than 500 LEO satellites produced and launched belong to European organizations. The market is expected to grow by 69% during the forecast period.

Europe Remote Sensing Satellites Market Trends

Global rising demand for satellite miniaturization is driving the market

- Miniature satellites leverage advances in computation, miniaturized electronics, and packaging to produce sophisticated mission capabilities. As microsatellites can share the ride to space with other missions, they offer a considerable reduction in launch costs. The demand in Europe is primarily driven by Germany, France, Russia, and the United Kingdom, which manufacture the largest number of small satellites each year. The ongoing investments in start-ups and nano and microsatellite development projects are also expected to boost the revenue growth of the region. On this note, during 2017-2022, more than 50 nano and microsatellites were placed into orbit by various players in the region.

- Companies are focusing on cost-effective approaches to produce these satellites on a large scale to meet the growing demand. The approach involves the use of low-cost industrial-rated passives at the development and design validation stages. The miniaturization and commercialization of electronic components and systems have driven market participation, resulting in the emergence of new market players who aim to capitalize on and enhance the current market scenario. For instance, a UK-based start-up, Open Cosmos, partnered with ESA to provide commercial nanosatellite launch services to end users while ensuring competitive cost-savings of around 90%. Similarly, in August 2021, France launched the BRO satellite into LEO orbit. This nanosatellite is able to locate and identify ships around the world, providing tracking services for maritime operators and helping security forces. The company plans to build a fleet of 20 to 25 nanosatellites by 2025.

Investment opportunities in the market

- European countries are recognizing the importance of various investments in the space domain and are increasing their spending in areas such as Earth observation, satellite navigation, connectivity, space research, and innovation to stay competitive and innovative in the global space industry. For instance, in November 2022, ESA announced that it had proposed a 25% boost in space funding over the following three years, designed to maintain Europe's lead in Earth observation, expand navigation services and remain a partner in exploration with the United States. The ESA asked its 22 nations to back a budget of around EUR 18.5 billion for 2023-2025. Similarly, in September 2022, the French government announced that it was planning to allocate more than USD 9 billion to space activities, an increase of about 25% over the previous three years. Additionally, in November 2022, Germany announced that about EUR 2.37 billion was allocated for ESA programs, including about EUR 669 million for Earth observation, about EUR 365 million for telecommunications, EUR 50 million for technology programs, EUR 155 million for space situational awareness and space security, and EUR 368 million for space transport and operations.

- The UK Space Agency announced that it would be funding EUR 6.5 million to support 18 projects to boost the UK space industry. The funding will stimulate growth in the UK space sector by supporting high-impact and locally-led schemes and space cluster development managers. These 18 projects are expected to pioneer a range of innovative space technologies to combat local issues, such as utilizing Earth observation data, to enhance public services. In April 2023, the UK government announced that it expects to allocate USD 3.1 billion for space-related activities.

Europe Remote Sensing Satellites Industry Overview

The Europe Remote Sensing Satellites Market is fairly consolidated, with the top five companies occupying 99.97%. The major players in this market are Airbus SE, NPO Lavochkin, ROSCOSMOS, RSC Energia and Thales (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50001247

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Satellite Mass

- 4.2 Satellite Miniaturization

- 4.3 Spending On Space Programs

- 4.4 Regulatory Framework

- 4.4.1 France

- 4.4.2 Germany

- 4.4.3 Russia

- 4.4.4 United Kingdom

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Satellite Mass

- 5.1.1 10-100kg

- 5.1.2 100-500kg

- 5.1.3 500-1000kg

- 5.1.4 Below 10 Kg

- 5.1.5 above 1000kg

- 5.2 Orbit Class

- 5.2.1 GEO

- 5.2.2 LEO

- 5.2.3 MEO

- 5.3 Satellite Subsystem

- 5.3.1 Propulsion Hardware and Propellant

- 5.3.2 Satellite Bus & Subsystems

- 5.3.3 Solar Array & Power Hardware

- 5.3.4 Structures, Harness & Mechanisms

- 5.4 End User

- 5.4.1 Commercial

- 5.4.2 Military & Government

- 5.4.3 Other

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Airbus SE

- 6.4.2 Esri

- 6.4.3 GomSpaceApS

- 6.4.4 ImageSat International

- 6.4.5 Lockheed Martin Corporation

- 6.4.6 Maxar Technologies Inc.

- 6.4.7 Northrop Grumman Corporation

- 6.4.8 NPO Lavochkin

- 6.4.9 Planet Labs Inc.

- 6.4.10 ROSCOSMOS

- 6.4.11 RSC Energia

- 6.4.12 Spire Global, Inc.

- 6.4.13 Thales

7 KEY STRATEGIC QUESTIONS FOR SATELLITE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.