Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693939

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693939

Europe Satellite Bus - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 171 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

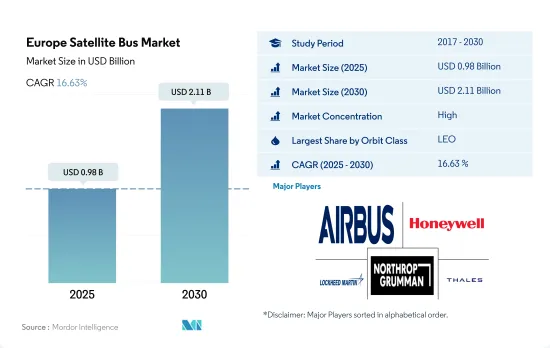

The Europe Satellite Bus Market size is estimated at 0.98 billion USD in 2025, and is expected to reach 2.11 billion USD by 2030, growing at a CAGR of 16.63% during the forecast period (2025-2030).

Increasing launches of satellites into LEO orbit for various satellite applications is driving the market demand

- LEO satellites are used for various applications, including weather monitoring, Earth observation, and remote sensing. In Europe, satellite buses such as the SSTL-150 bus developed by Surrey Satellite Technology Limited (SSTL) are used for LEO satellites. The SSTL-150 bus is a versatile platform that can support a range of payloads, including cameras, AIS (Automatic Identification System) receivers, and small satellites. Between 2017 and 2022, approximately 531 satellites were launched into LEO.

- GEO satellites are used for applications such as satellite-based television broadcasting, weather forecasting, and military communication systems. European satellite manufacturers use bus designs such as the Spacebus NEO developed by Thales Alenia Space for GEO satellites. The Spacebus NEO is a highly capable platform that can support a wide range of payloads, including large television broadcasting antennas and high-power amplifiers. Between 2017 and 2022, approximately 16 satellites were launched into GEO.

- MEO satellites are used for global navigation systems (GNSS) such as GPS and Galileo and satellite-based broadband services. European satellite manufacturers use a variety of bus designs for MEO applications, including the Eurostar E3000 bus developed by Airbus Defense and Space. The Eurostar E3000 bus is a reliable platform that has been used for numerous MEO applications. The standardized platform of the bus enables satellite manufacturers to build a range of MEO satellites for different applications with a high degree of reliability and cost-effectiveness. Between 2017 and 2022, approximately 16 satellites were launched into MEO. And the overall market is expected to grow by 19.43% during 2023-2029.

Europe Satellite Bus Market Trends

Europe's satellite industry benefits from a strong architecture for satellite design and manufacture, designed to meet specific application needs

- Classifying spacecraft by mass is one of the main metrics for determining launch vehicle size and the cost of launching satellites into orbit. The success of a satellite mission depends heavily on the accuracy of its pre-flight mass measurement and the proper balance of the satellite to generate mass within limits.

- Satellites are classified according to their mass, and the main mass classifications are large satellites over 1,000 kg. Between 2017 and 2022, more than 35+ large satellites owned by European organizations were launched. A medium-sized satellite has a mass between 500 kg and 1,000 kg. European organizations operated more than 15+ satellites that were launched during the historical period. Satellites with a mass of less than 500 kg are considered small satellites, and about 460+ small satellites were launched in the region.

- There is a growing trend toward smaller satellites in the region due to their shorter development times, which can reduce overall mission costs. These satellites have made it possible to significantly reduce the time required to obtain scientific and technological results. Small spacecraft missions tend to be flexible and can better respond to new technological opportunities or needs. The small satellite industry in Europe is supported by the presence of a robust framework for designing and manufacturing small satellites tailored to serve specific application profiles. The number of operations in the European region is expected to increase during 2023-2029, driven by the growing demand in the commercial and military space sectors.

Increasing space expenditures of different space agencies are expected to positively impact the European satellite industry

- Increased demand for satellites from the civil/government, commercial, and military sectors has been witnessed over recent years. Currently, some European countries, such as France and Germany, have adequate capabilities in the field of satellite bus manufacturing. However, due to the growing shift toward manufacturing smaller satellites, the manufacturing base of satellite buses is expected to expand across Europe.

- European countries are recognizing the importance of various investments in the space domain and increasing their spending in areas such as Earth observation, satellite navigation, connectivity, space research, and innovation to stay competitive and innovative in the global space industry.

- On this note, in November 2022, ESA announced that it had proposed a 25% boost in space funding over the next three years designed to maintain Europe's lead in Earth observation, expand navigation services, and remain a partner in exploration with the United States. The European Space Agency (ESA) has asked its 22 nations to back a budget of EUR 18.5 billion for 2023-2025. In September 2022, France announced its plans to increase spending on national and European space programs as the ESA works to secure commitments for its own significant budget increase. The government announced its plans to allocate more than USD 9 billion to space activities, an increase of about 25% over the past three years.

Europe Satellite Bus Industry Overview

The Europe Satellite Bus Market is fairly consolidated, with the top five companies occupying 71%. The major players in this market are Airbus SE, Honeywell International Inc., Lockheed Martin Corporation, Northrop Grumman Corporation and Thales (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50001251

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Satellite Miniaturization

- 4.2 Satellite Mass

- 4.3 Spending On Space Programs

- 4.4 Regulatory Framework

- 4.4.1 France

- 4.4.2 Germany

- 4.4.3 Russia

- 4.4.4 United Kingdom

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Application

- 5.1.1 Communication

- 5.1.2 Earth Observation

- 5.1.3 Navigation

- 5.1.4 Space Observation

- 5.1.5 Others

- 5.2 Satellite Mass

- 5.2.1 10-100kg

- 5.2.2 100-500kg

- 5.2.3 500-1000kg

- 5.2.4 Below 10 Kg

- 5.2.5 above 1000kg

- 5.3 Orbit Class

- 5.3.1 GEO

- 5.3.2 LEO

- 5.3.3 MEO

- 5.4 End User

- 5.4.1 Commercial

- 5.4.2 Military & Government

- 5.4.3 Other

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Airbus SE

- 6.4.2 Ball Corporation

- 6.4.3 Honeywell International Inc.

- 6.4.4 Lockheed Martin Corporation

- 6.4.5 Nano Avionics

- 6.4.6 NEC

- 6.4.7 Northrop Grumman Corporation

- 6.4.8 OHB SE

- 6.4.9 Sierra Nevada Corporation

- 6.4.10 Thales

7 KEY STRATEGIC QUESTIONS FOR SATELLITE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.