Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693945

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693945

Satellite Parts and Components - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 169 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

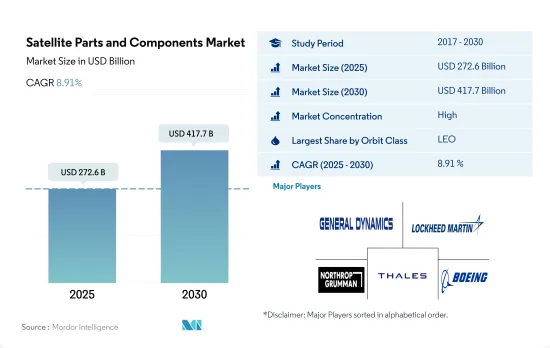

The Satellite Parts and Components Market size is estimated at 272.6 billion USD in 2025, and is expected to reach 417.7 billion USD by 2030, growing at a CAGR of 8.91% during the forecast period (2025-2030).

The adaptation of new satellite manufacturing techniques is expected to open new scope of opportunities

- The global satellite parts and components industry has been experiencing several trends in recent years. With the advancements in technology, small satellites have become more capable and cost-effective, making them an attractive option for various applications. The trend of satellite miniaturization resulted in an increasing demand for small satellite components, such as propulsion systems, power systems, and antennas.

- Additive manufacturing, or 3D printing, has been gaining popularity in the satellite industry due to its ability to produce complex parts and reduce manufacturing costs. This technology is being used to produce satellite components such as antennas, brackets, and engine parts. The major space agencies such as NASA and the European Space Agency have emphasized that. One of the major players in the global space industry, the United States, is a trendsetter in the development of advanced technologies for satellite communications, remote sensing, and space exploration. These innovative technologies include high-performance electronics, advanced sensors, lightweight materials, and propulsion systems. Another trend is the increasing use of pre-existing components and subsystems commercial-off-the-shelf (COTS) in satellite design and development. COTS components can significantly reduce development time and costs while improving reliability and performance.

- Between 2017 and May 2022, around 4300+ satellites were manufactured and launched globally. Overall, these trends are shaping the future of the global satellite parts and components industry as companies work to meet the demands of an ever-changing market while also driving innovation in the field. The global satellite parts and components market is expected to grow by 40% between 2023 and 2029.

Global Satellite Parts and Components Market Trends

The increased importance of satellite miniaturization is expected to affect the satellite mass

- Satellites are getting smaller nowadays, and a small satellite can do almost everything that a conventional satellite can at a fraction of the cost of the conventional satellite, which has made the building, launching, and operation of small satellite constellations increasingly viable. Correspondingly, reliance on them has been growing exponentially. Small satellites typically have shorter development cycles, smaller development teams, and cost much less for launch.

- The major classification types according to mass are large satellites that are more than 1,000 kg. During 2017-2022, around 44 large satellites launched were owned by North American organizations. A medium-sized satellite has a mass between 500 and 1000 kg. Globally, organizations operated more than 320 satellites launched. Satellites are classified according to mass. Satellites with a mass of less than 500 kg are considered small satellites, and around 3800+ small satellites were launched globally.

- There is a growing trend toward small satellites in the region because of their shorter development time, which can reduce overall mission costs. They have made it possible to significantly reduce the time required to obtain scientific and technological results. Small spacecraft missions tend to be flexible and can, therefore, be more responsive to new technological opportunities or needs. The small satellite industry in the United States is supported by a robust framework for designing and manufacturing small satellites tailored to serve specific application profiles. The demand for satellite parts and components in the North American region is expected to surge during 2023-2029 due to increasing demand in the commercial and military space sector.

The increasing expenditures of different space agencies is expected to positively impact the satellite industry

- The increasing use of satellite technology in various applications, including communication, navigation, and earth observation, has created a need for new and innovative satellite components. Companies are investing in R&D to develop components that meet the specific requirements of these applications. Technological advancements, such as the use of AI and machine learning, additive manufacturing, and advanced materials, are driving the need for R&D investment in the satellite parts and components industry. These advancements are creating new opportunities for the development of innovative components.

- In November 2022, ESA announced that it proposed a 25% boost in space funding over the next three years designed to maintain Europe's lead in Earth observation, expand navigation services, and remain a partner in exploration with the United States. The European Space Agency (ESA) is asking its 22 nations to back a budget of some EUR 18.5 billion for 2023-2025. Likewise, in September 2022, France announced that it is expecting to increase spending on national and European space programs.

- In North America, global government expenditure for space programs hit a record of approximately 103 billion in 2021. The region is the epicenter of space innovation and research, with the presence of NASA, the world's biggest space agency. In 2022, the US government spent nearly USD 62 billion on its space programs, making it the highest spender on space in the world. In the United States, federal agencies receive aid from the government every year, known as funding, USD 32.33 billion for its subsidiaries. The spending on space and research grants is expected to surge in the region, growing the sector's importance in every domain of the global economy.

Satellite Parts and Components Industry Overview

The Satellite Parts and Components Market is fairly consolidated, with the top five companies occupying 90.12%. The major players in this market are General Dynamics, Lockheed Martin Corporation, Northrop Grumman Corporation, Thales and The Boeing Company (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50001258

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Satellite Miniaturization

- 4.2 Satellite Mass

- 4.3 Spending On Space Programs

- 4.4 Regulatory Framework

- 4.4.1 Global

- 4.4.2 Australia

- 4.4.3 Brazil

- 4.4.4 Canada

- 4.4.5 China

- 4.4.6 France

- 4.4.7 Germany

- 4.4.8 India

- 4.4.9 Iran

- 4.4.10 Japan

- 4.4.11 New Zealand

- 4.4.12 Russia

- 4.4.13 Singapore

- 4.4.14 South Korea

- 4.4.15 United Arab Emirates

- 4.4.16 United Kingdom

- 4.4.17 United States

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Region

- 5.1.1 Asia-Pacific

- 5.1.2 Europe

- 5.1.3 North America

- 5.1.4 Rest of World

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 AAC Clyde Space

- 6.4.2 BAE Systems

- 6.4.3 General Dynamics

- 6.4.4 Innovative Solutions in Space BV

- 6.4.5 Jena-Optronik

- 6.4.6 Lockheed Martin Corporation

- 6.4.7 Northrop Grumman Corporation

- 6.4.8 OHB SE

- 6.4.9 SENER Group

- 6.4.10 Sitael S.p.A.

- 6.4.11 Thales

- 6.4.12 The Boeing Company

7 KEY STRATEGIC QUESTIONS FOR SATELLITE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.